This analysis is a collaboration with MapCraft Labs

Amidst a global pandemic and national reckoning on race and equality, California’s acute housing crisis persists. The impacts of COVID-19 have exacerbated and exposed long standing inequities across the United States, including access to healthy food, medical care, housing, and more. As California faces a shortfall of 2 to 3 million homes, policy makers are under increasing pressure to develop interventions that effectively deliver more housing supply. One of the latest bills to emerge at the state legislature is Assembly Bill 3040.

Unlike other bills such as 2019’s Senate Bill 50, which aimed to override local zoning regulations to spur increased development, AB3040 seeks to incentivize cities to modify single-family zoning by giving credits toward satisfying mandated housing allocations under the Regional Housing Needs Allocation (RHNA) program. As an incentive, the bill would give additional RHNA credits to cities that upzone detached single-family areas to allow fourplexes.

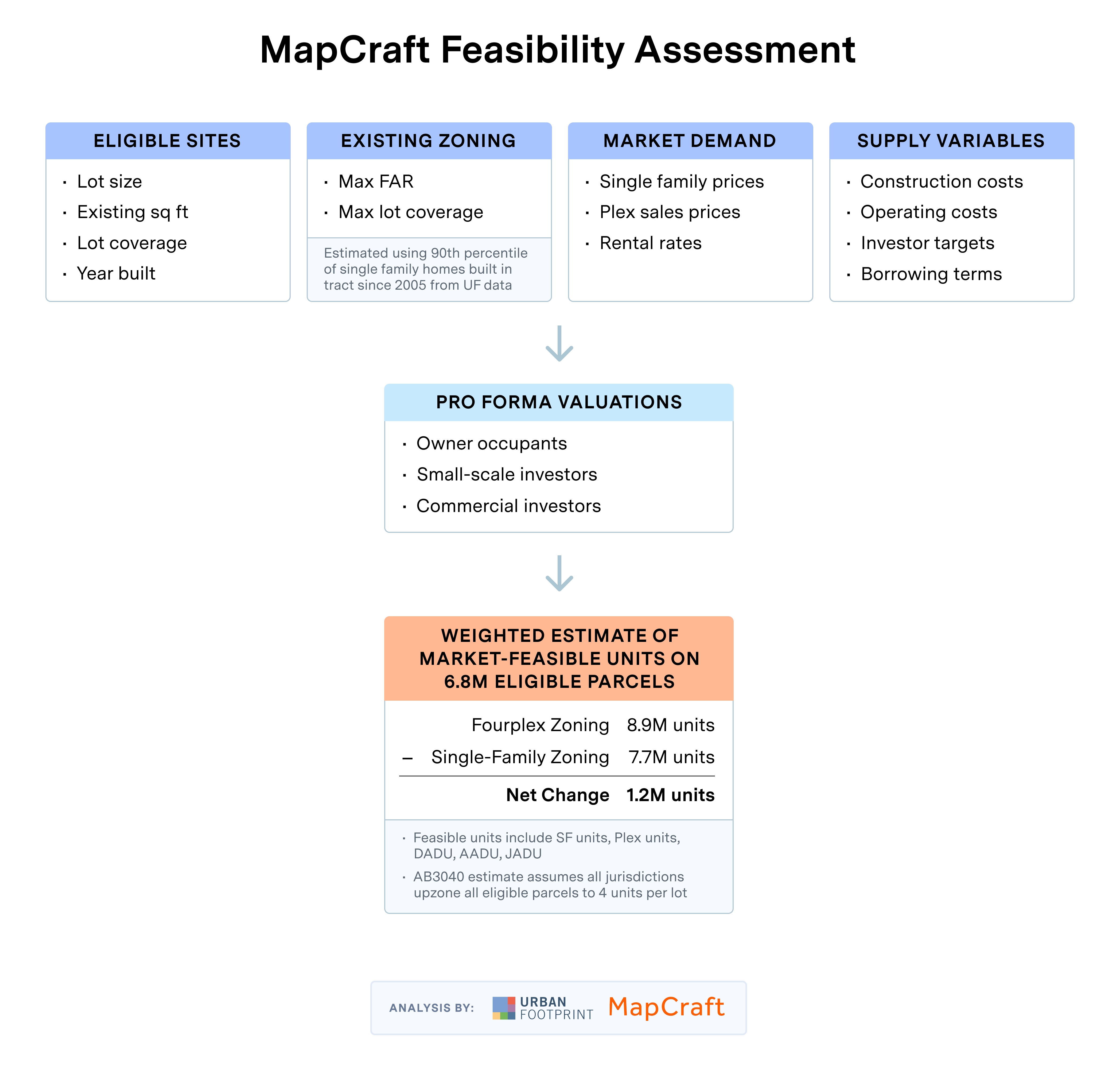

One big question surrounding this bill, and many other ‘production’ bills, is whether they would actually lead to the development of new housing. To help address this question, UrbanFootprint partnered with our colleagues at MapCraft to assess both the overall capacity for new units in the bill, as well as how many units could actually be built when considering market dynamics.

How would AB3040 update California’s Regional Housing Needs Allocation (RHNA) program?

AB3040 aims to update the RHNA program to encourage more housing production. Under the current RHNA process, cities and counties are allocated a certain number of units they need to accommodate as ‘inventory’ in their land use planning. These numbers are based on projections for population growth in each region of the state, and what each city’s ‘fair-share’ would be to meet that total.

AB3040 proposes a new inventory crediting process to give cities 0.1 credits for every detached single-family house that is upzoned to allow for a fourplex. The bill allows cities to account for up to 25 percent of their total RHNA housing requirements via these means.

The bill also specifies a few criteria for determining parcels, or lots, that are eligible for this process:

- A parcel must allow new residential dwellings as a use by right; and

- A parcel must include an existing home that received its first certificate of occupancy at least 15 years ago.

How many duplexes, triplexes, and fourplexes could be delivered?

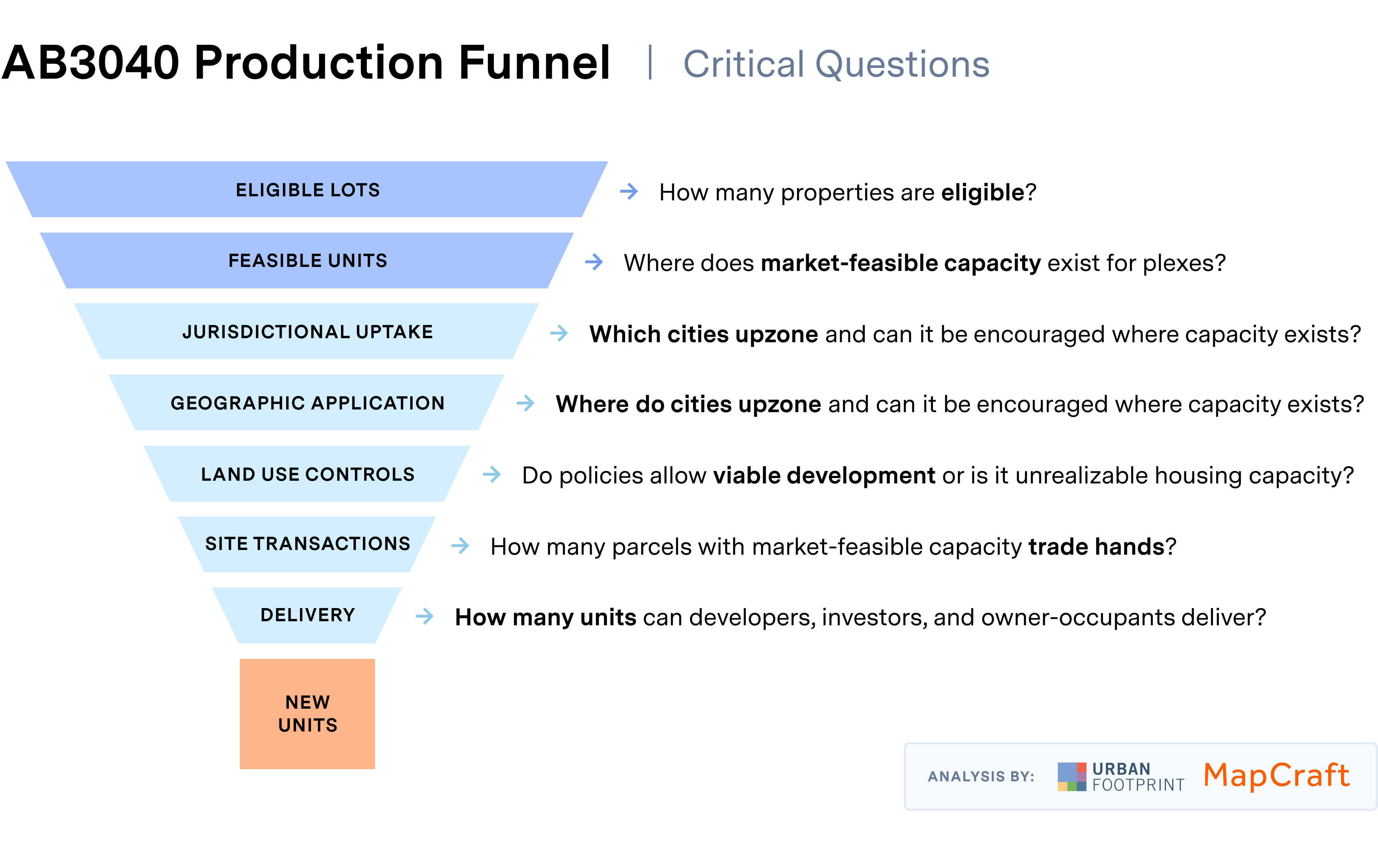

For a new home or redevelopment to make its way from idea, to plan, to constructed reality, it often takes a long and meandering path through drawings, zoning, approvals, public discourse, and ultimately construction. Development starts with an assessment of what can be done on a parcel (eligibility, usually designated via zoning or official mandate), then moves onto the market feasibility of a project, and then courses through the local and public nuances of political and administrative processes.

Our analysis of AB3040 focuses on the first two levels in the development funnel: eligible lots and market feasibility. Our goal is to arrive at a first-order understanding of how many new housing units AB3040 could enable if every jurisdiction followed through on rezoning all eligible single family lots to fourplexes, allowing single family, duplexes, triplexes, and fourplexes on those lots. While universal rezoning is unlikely to happen, it’s important to first assess how big the total housing opportunity might be. In this analysis, we set out to answer the following questions:

- How many lots in California are eligible for upzoning under the bill?

- On those lots, what scale of development, if any, could be market feasible?

These two questions address the first two levels of the production funnel in the figure below. Of course, many other factors constrain the delivery of units, not least of which will be the number of jurisdictions that choose to voluntarily take advantage of the opportunity provided by AB3040.

How many lots would be eligible for AB3040 upzoning in California?

Using the UrbanFootprint Base Canvas as our source of existing parcel-based land use data, we first identified all parcels matching the eligibility criteria defined by AB3040. We found that of the 7.4 million detached single-family parcels in California, 6.8 million have homes that were built before 2005, and therefore would be eligible for RHNA upzoning credit under AB3040. This puts the overall maximum capacity for new units, assuming every single parcel becomes a fourplex, at 27.2 million units, or 20.4 million more units than currently exist. Obviously, not all parcels will become fourplexes, which is why we next evaluate actual market feasibility.

Of those eligible lots, how many are market feasible?

The MapCraft team ran market simulations on each of the 6.8 million eligible parcels to assess the likelihood that a fourplex, triplex, or duplex could actually be built when accounting for factors such as the value of the existing home, construction costs, market demand, lot constraints, and investment return. This analysis found that development was viable on many sites and, on average, allowing four units would increase the number of potential market-feasible units by 15% across eligible single-family lots.

Across California, allowing four units per lot would create the potential for an additional 1.2 million market-feasible units compared to single family zoning, which could accommodate 7.7 million housing units based on the financial feasibility of adding ADUs to the 6.8 million existing single family homes. This is far less than the 400% increase in zoned capacity that would occur if all eligible sites were upzoned from single family to fourplex zoning, largely because replacing existing single family homes with a fourplex is seldom a viable financial opportunity. However the possibility of adding 1.2 million additional market-feasible units, a 15% increase, suggests AB3040 presents a substantial opportunity to increase housing options in California communities.

If one assumes that only a small portion of the state’s jurisdictions take advantage of the provisions proposed by AB3040 and rezone just 10% of the state’s single family-zoned homes to fourplex, that is still nearly 700,000 upzoned lots. And if we assume just a small proportion of those rezoned parcels were to redevelop into duplexes, triplexes, or fourplexes over the next eight years (one RHNA cycle), then AB3040 could still amount to tens of thousands of new California homes.

Where would new housing be distributed across California?

Now that we’ve established how many lots could accommodate more housing under AB3040, it’s important to understand where these new homes are most likely to be built and the associated impacts. How might these homes be distributed across cities and neighborhoods and how might they impact gentrification and displacement in disadvantaged areas? Will new homes be built in wealthier areas?

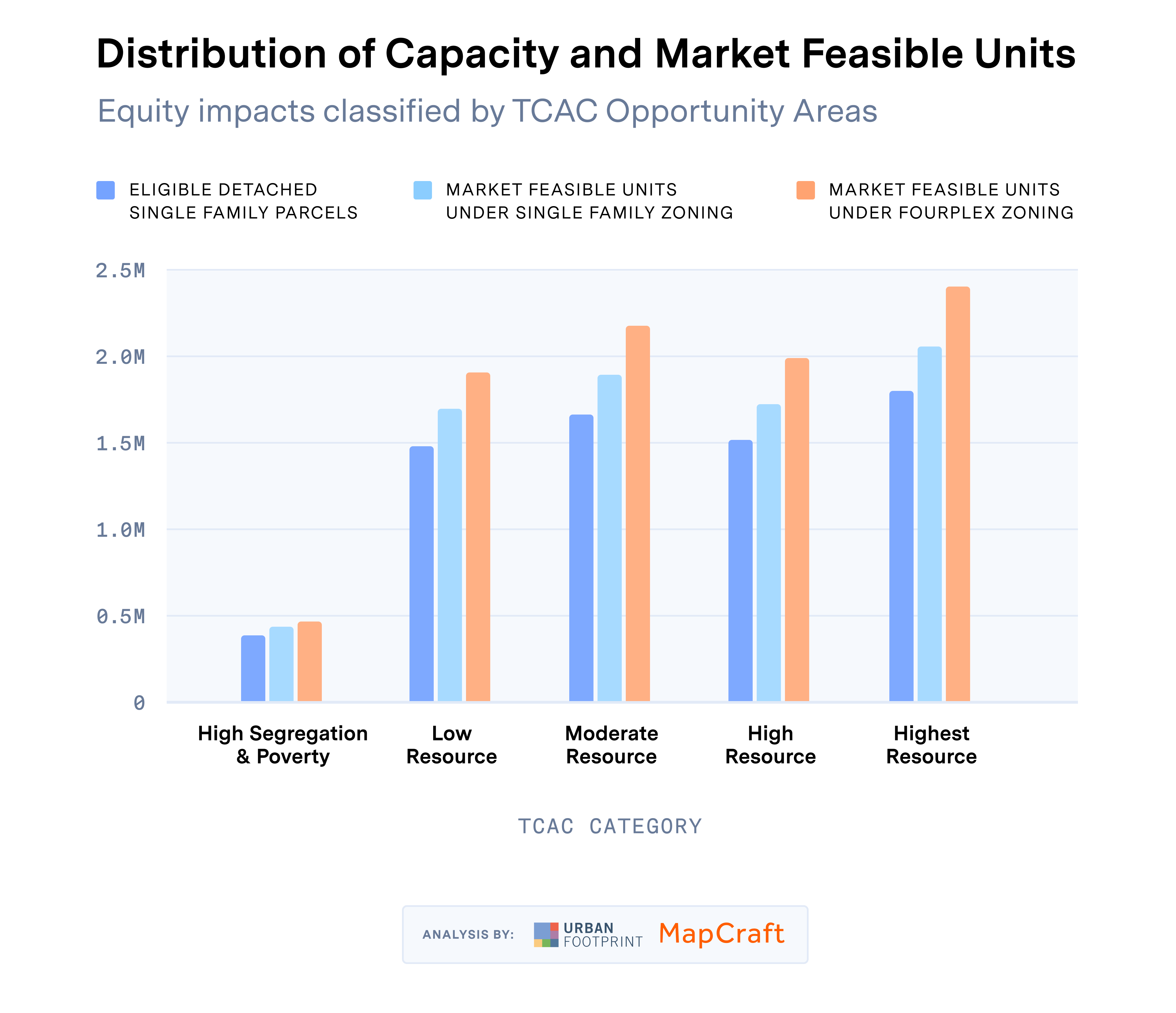

To answer some of these questions, we aggregated the eligible parcels by the California Department of Housing and Community Development Tax Credit Allocation Committee (TCAC) Opportunity Areas, which classifies census tracts across the state on a spectrum from highest resource to high segregation and poverty. Our analysis finds there were fewer eligible parcels in low resource areas. This is likely due to there being higher concentrations of multi-family homes, rather than detached single family homes, in lower resource areas.

We also found that, potentially due to stronger underlying market factors, higher resource areas would have a modestly greater likelihood of seeing market-feasible development than lower resource areas. In general, the market feasibility of developing fourplexes where single family exists is driven by the local differential between the values of single family and rental units, which does not perfectly correlate with high resource areas or places with high housing costs. In highest resource areas the analysis found a 17 percent increase in market feasible unit potential on eligible detached single-family parcels, whereas high segregation and poverty areas had an 8 percent increase in unit potential.

How likely are cities to follow the AB3040 incentive?

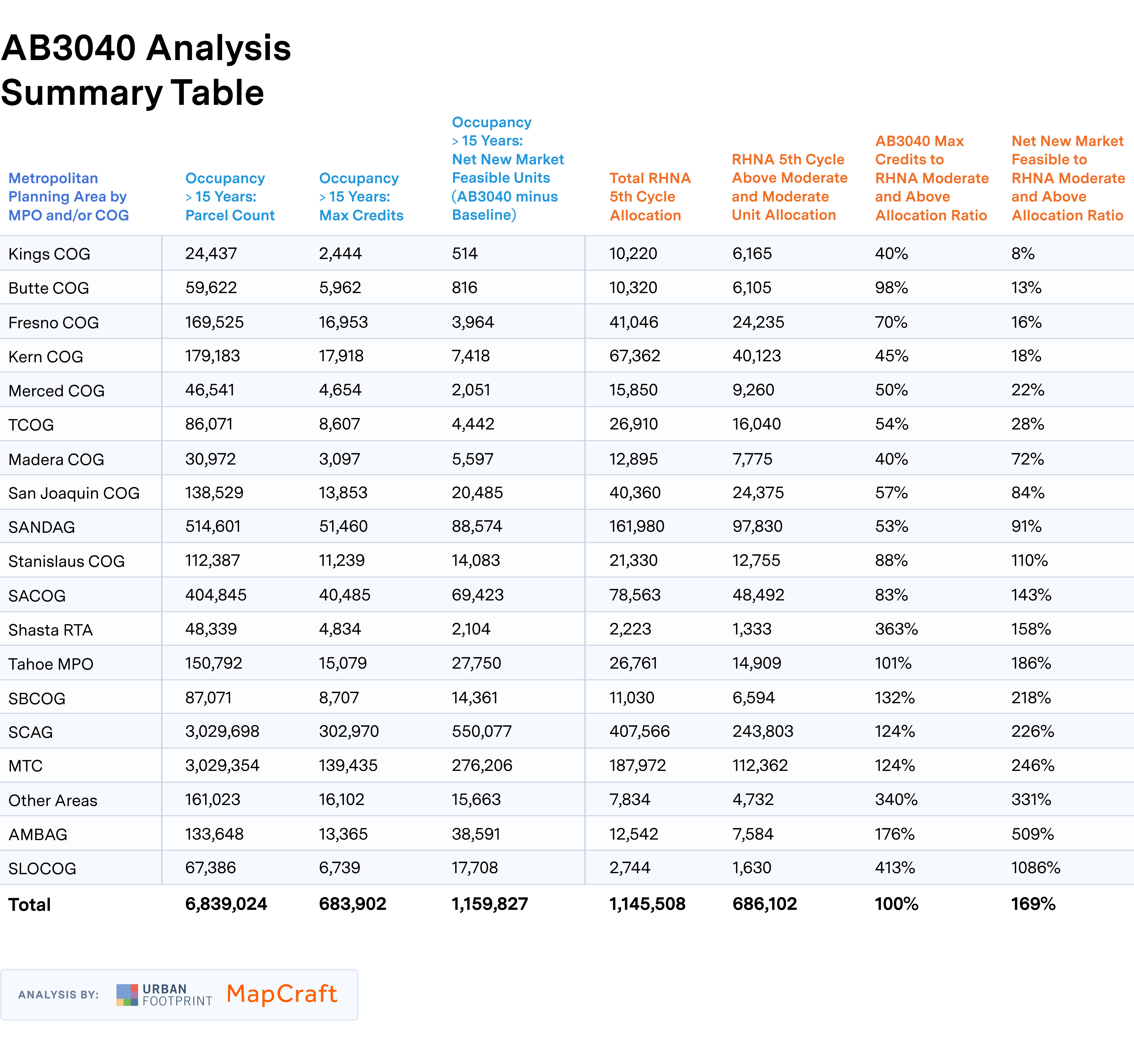

Our analysis has demonstrated the general capacity for higher density development to take place on detached single-family parcels throughout the state. However, this bill will only impact places where cities respond to the incentive and upzone single family areas to receive the credit. While we can’t model all the nuances that go into an individual jurisdiction’s decision to upzone an area, evaluating market feasibility numbers alongside available data on RHNA allocations does provide some insight into how different regions might respond. The table below shows a summary of overall capacity, potential credits, net new market feasible units, and 5th Cycle RHNA allocation numbers for different regions of the state.

In summary, even modest upzoning proposed by bills like AB3040 could serve as an important stepping stone in addressing California’s housing crisis

Addressing California’s dire housing deficit will require a variety of interventions and incentives to make a dent in the 2 to 3 million unit shortfall. Given the scale of the housing and affordability challenge, the bulk of new housing will need to take on more dense formats in urban centers and along major corridors – ideally organized around transit in more energy and resource efficient locations in sync with state and regional climate and hazard mitigation goals.

With so much land and development potential locked up in single family zoning, fully resolving California’s housing shortage looms as a daunting task. But bills such as AB3040 that look to create incentives for the incremental addition of new units in existing single family neighborhoods may serve as an important stepping stone in reaching this goal. Our analysis shows that the potential for new development is not insubstantial and that modest upzoning could be an important arrow in the housing quiver.