When talking about corporate responsibility, people often use the terms ESG and sustainability interchangeably. It’s an easy mistake to make, considering the ‘E’ in ESG stands for ‘environmental’, which is often paired with sustainability, and both ESG and sustainability support similar business goals.

While they are complementary, the two are not synonymous, and it’s important to understand the distinction. Because of increased corporate interest and commitment to these do-good strategies, businesses should know the difference between ESG and sustainability in order to make better, more informed decisions.

At a high level, sustainability is a broad term to describe how a company operates to support their continued existence, usually in relation to the environment. On the other hand, ESG, or Environmental, Social, and Governance, is a more specific framework used to measure a company’s commitment to sustainable operations, financial transparency, and workplace safety practices, among other things.

In this post, we’ll dive deeper into the differences between ESG and sustainability, and explain why focusing on ESG can help provide businesses with a specific and measurable path to achieve long-term goals.

What is ESG?

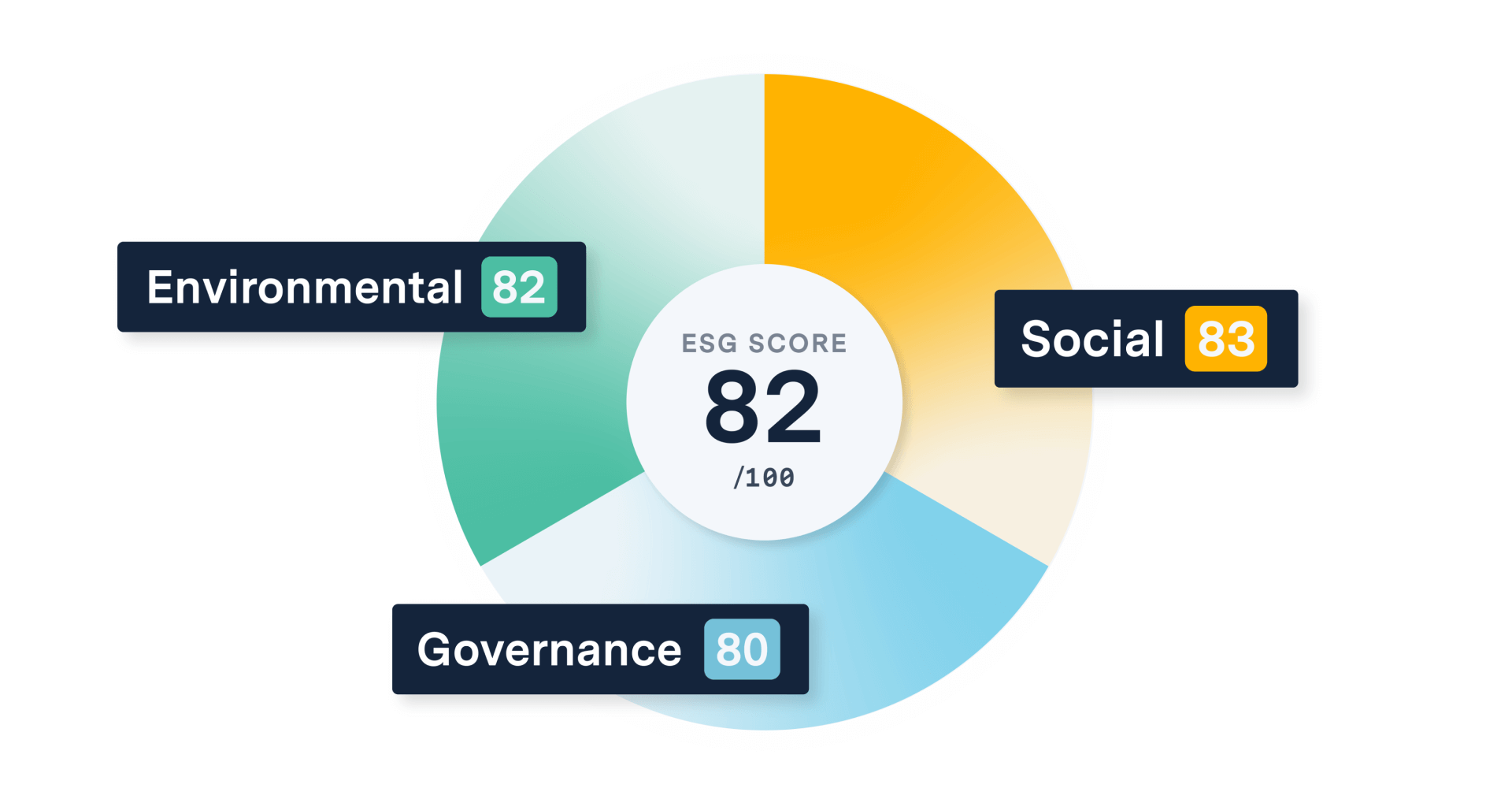

ESG is defined as a set of criteria to measure a company’s practices and values and it relates to sustainability and other conscious business operations. Businesses use ESG benchmarks to help inform strategic decision-making, prioritization, and planning, while investors look at ESG scores to evaluate a company’s investment value and risk.

When evaluating ESG, analysts look at three categories:

- Environment. What kind of impact does a company have on the environment?

- Social. How does the company improve its social impact, both within the company and in the broader community?

- Governance. How does the company’s board and management drive positive change?

Examples of ESG practices

Companies with strong ESG scores may prioritize programs to reduce carbon emissions (environmental), prevent sexual harassment in the workplace (social), and ensure transparent accounting methods (governance). Companies with high ESG scores are typically more resilient to challenges and are viewed as less risky by investors due to their conscious business practices.

In fact, investors are recognizing the value conscientious business practices bring to consumers, and the role responsible companies can play in solving the climate crisis. In the span of one year from 2020 to 2021, investments in ESG funds doubled and there is no sign of this trend stopping. ESG investing is expected to grow into a $30 trillion industry by 2030.

What is sustainability?

Often, businesses report on their corporate sustainability efforts by measuring these criteria:

- Risk of biodiversity loss

- Climate-related risk and carbon reduction

- UN Sustainable Development Goals (SDGs)

Examples of corporate sustainability practices

Businesses practicing corporate sustainability may minimize waste by using recyclable packaging, or implement lean manufacturing to reduce excess processing and overproduction. Others may focus their corporate sustainability efforts on stakeholder engagement to educate consumers on reducing waste, or measure their carbon footprint and work to reduce emissions. Depending on the business, there are any number of ways to practice corporate sustainability.

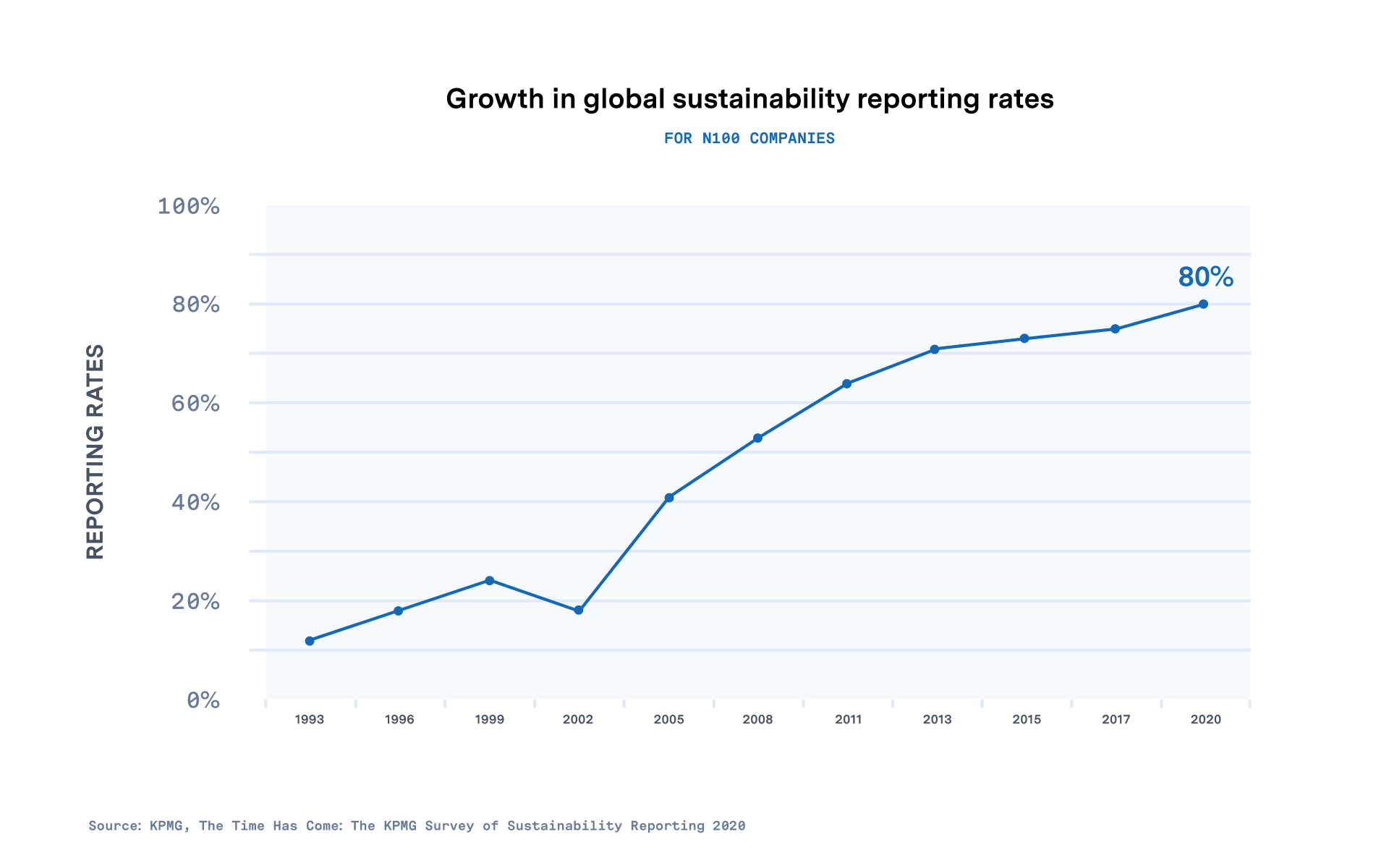

Over the past decade, corporate sustainability reporting has become a widely accepted and adopted business practice. Considered mainstream, corporate sustainability reporting has reached an all time high, with over 80% of companies worldwide now reporting on sustainability.

Most companies report setting targets to reduce their carbon emissions, representing a growing trend to link corporate goals with climate change. Unfortunately, the majority of reports tend to favor a company’s positive impacts to the environment, omitting transparent data on any negative impacts. Companies also tend to ignore biodiversity when reporting corporate sustainability efforts, which makes it challenging to determine true impact.

The differences between ESG and sustainability

| ESG | Sustainability | |

| Scope | ESG looks at all aspects of a company’s make-up and performance, from fiscal policies and safe worker practices to energy use and board diversity. Corporate identity is often reflected in ESG scores in order to appeal to both consumers and investors alike. | Sustainability focuses more on the relationship between a company and the environment, and the impact a company has on the environment around it. |

| Uses | ESG is used as a framework for external investors to evaluate the long-term value of a business and risk of an investment. Internally, ESG criteria can help businesses make decisions that can impact shareholder value. | Corporate sustainability is an approach that can help guide internal decision-making and to support environmentally conscious business practices. |

| Measurement | ESG measurement is based on scoring criteria set by lawmakers, investors, third-party companies, and ESG reporting organizations. While there is no standard for how to score ESG, there are agreed upon practices within industries. | Depending on how it’s defined, there are numerous ways to measure sustainability. Some even claim that sustainability is immeasurable. To measure corporate sustainability, some may use the UN Human Development Index, Triple Bottom Line accounting, Complex Performance Indicators, UN Sustainable Development Goals, and others. Some businesses may opt to simply measure emission levels or their carbon footprint. |

| Shortcomings | ESG criteria can be broad and difficult to quantify. Without a standard framework to score ESG, sometimes it can be challenging to know how a score is determined. Knowing a business’s ESG score can be helpful, but it shouldn’t be the only metric to make investment decisions or determine a company’s long-term prospects. | Sustainability is sometimes easier to measure, depending on what is being evaluated, but these factors often don’t tell the complete story about a company’s operations. Just because a business has sustainable operations doesn’t mean it is doing right by its employees or the communities it serves. |

Benefits of focusing on ESG rather than strictly sustainability

ESG provides stakeholders a more measurable view of a company’s practices, values, and long-term goals. Scoring high in ESG can lead to better relationships with consumers, better outcomes for the community, more equitable governance and leadership, and a more satisfied and happy workforce. All of this can result in more investment in the company and higher shareholder value.

While there is nothing wrong with a company choosing to implement corporate sustainability practices, focusing only on sustainability omits entire aspects of a business that are equally important to consumers and investors. Because sustainability is widely considered a valuable business practice, stakeholders are more aware of any gaps in corporate sustainability reports, and are more keen to accuse companies of ‘greenwashing’.

Because ESG is data-driven and designed around a scoring framework, stakeholders can more easily verify and trust claims of conscious business practices. From an investors perspective, ESG is the standard for determining a company’s value and risk, because ESG scores give them a glimpse into an entire company, not just their sustainability efforts.

How data can help you improve your ESG practices

To improve your ESG score, or to get a better understanding of your risk, you need access to the right data. In addition to improving ESG ratings, the right data can provide a foundation for measuring your ESG impact and facilitate reporting performance to stakeholders – helping to build credibility and trust with investors, customers, and the community.

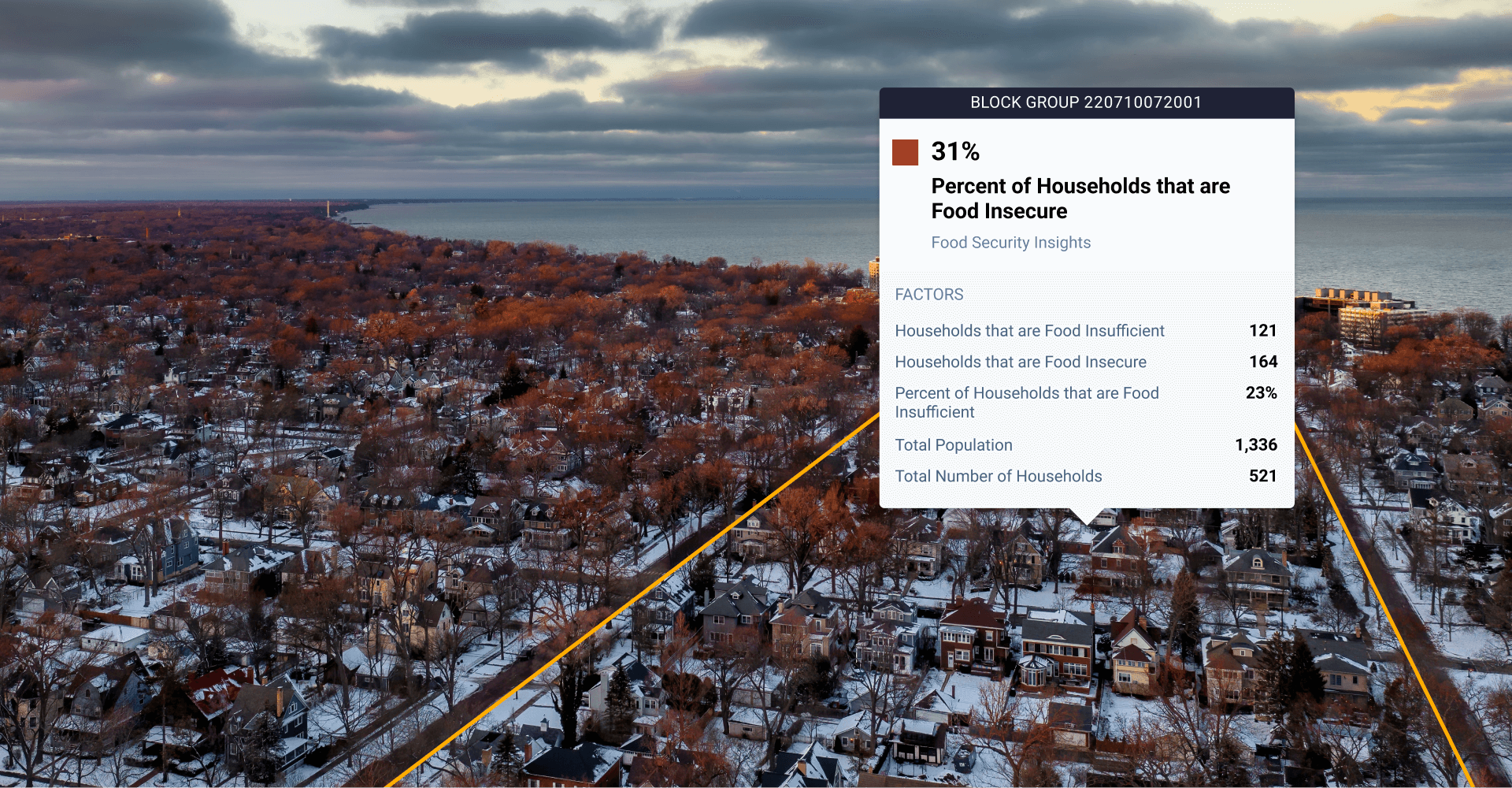

The problem is, most of the data related to ESG criteria exists in siloes. Siloed data in turn leads to siloed and suboptimal decision making. For example, climate and environmental data are rarely used in conjunction with community data when it comes to making decisions about hardening infrastructure against extreme weather threats – leading to decisions that can leave vulnerable populations unprotected.

UrbanFootprint addresses this by unifying and normalizing previously siloed data on climate, environmental, urban, and socio-economic factors to surface powerful, holistic, and actionable data insights. Helping you measure and improve your ESG impact and build Resilient Decision Intelligence.

With UrbanFooprint, you can not only get a better grasp of communities and conditions, but also gain a true understanding of how these are interrelated and impact your company’s ESG score. By analyzing the intersections of this data you’ll be able to make better “where” decisions —where to invest, where to deploy resources, and where to take action—that are aligned with your ESG goals.

Want to learn more? Join our community to stay up to date with the latest on how you can make corporate decisions that have a positive and sustainable impact, all while improving your ESG score.