- Solutions

-

-

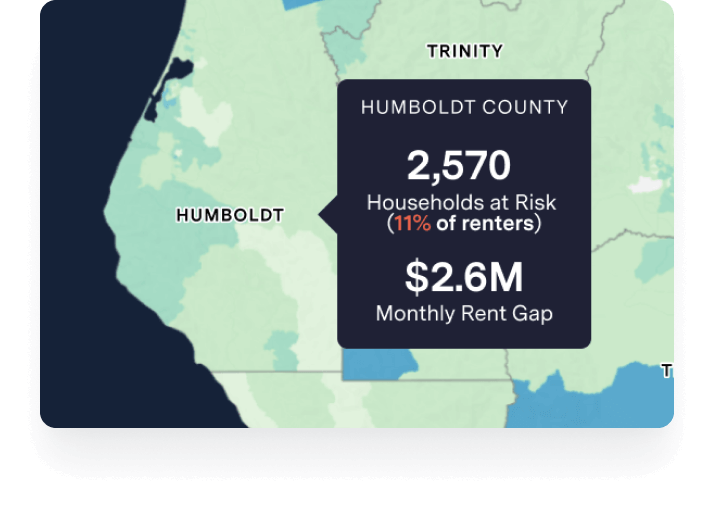

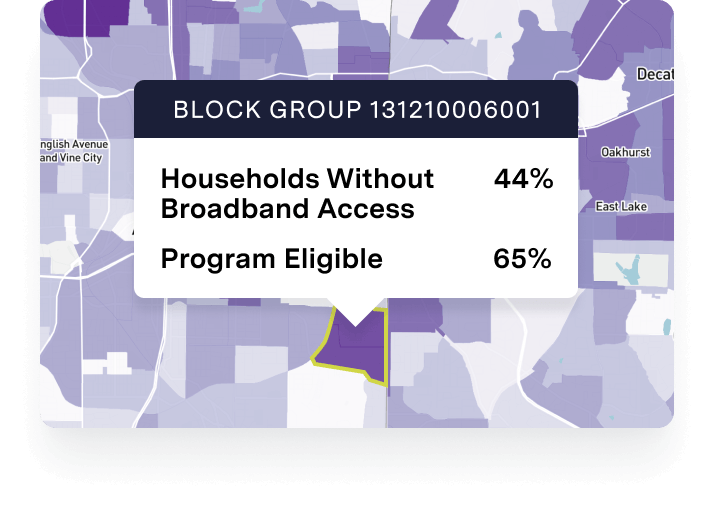

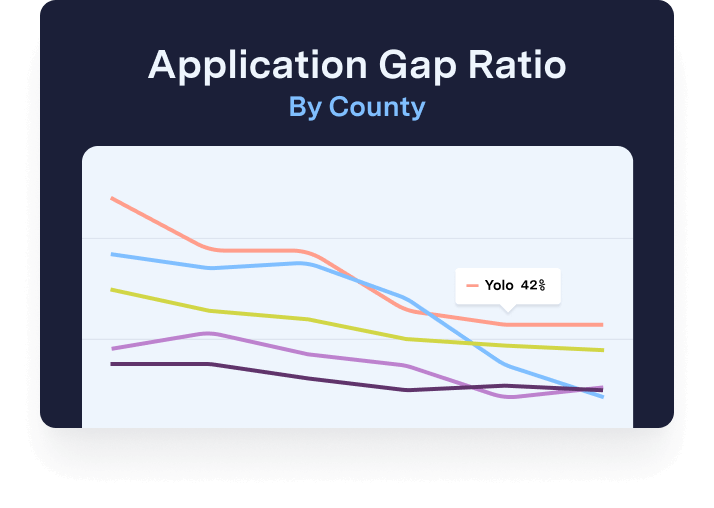

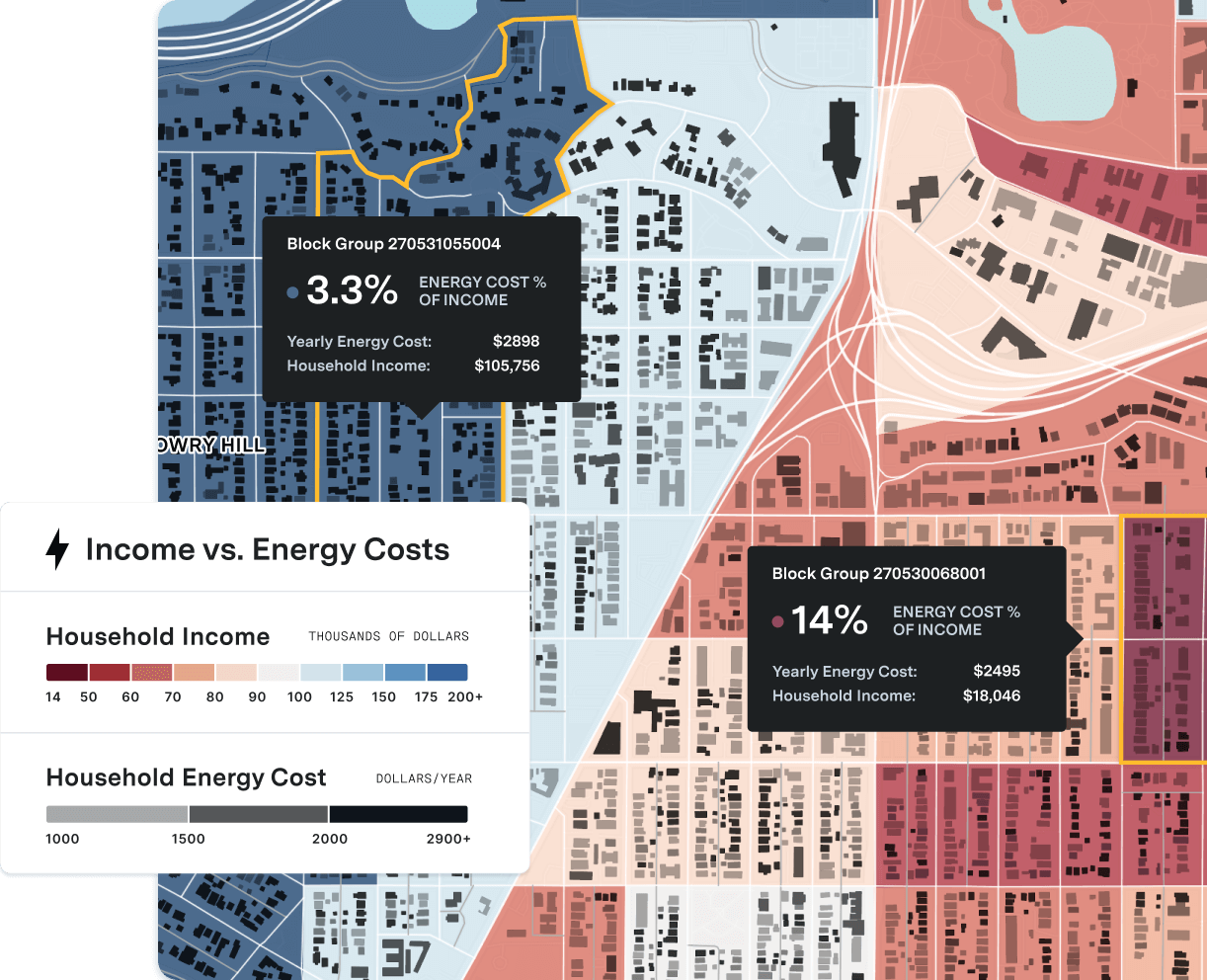

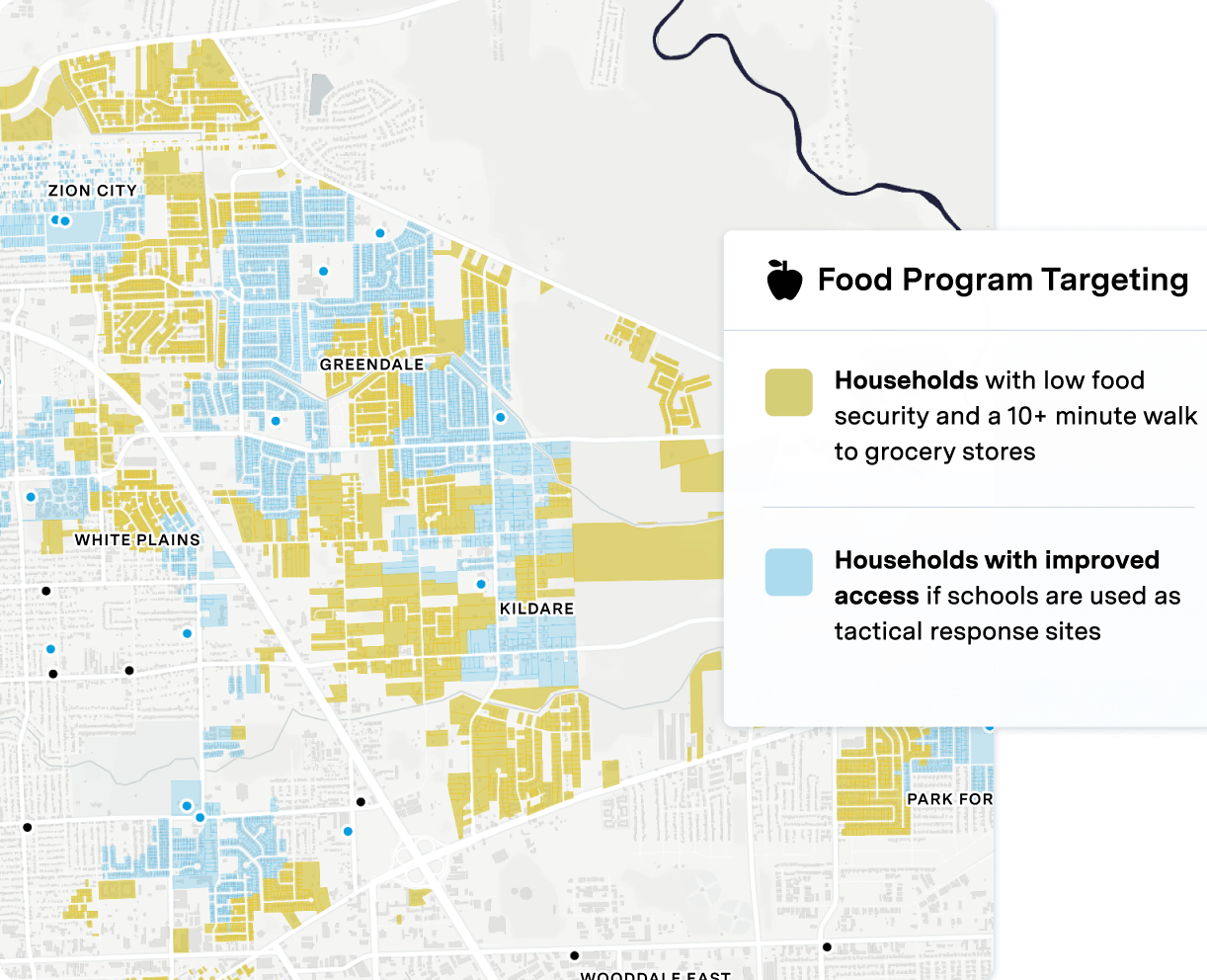

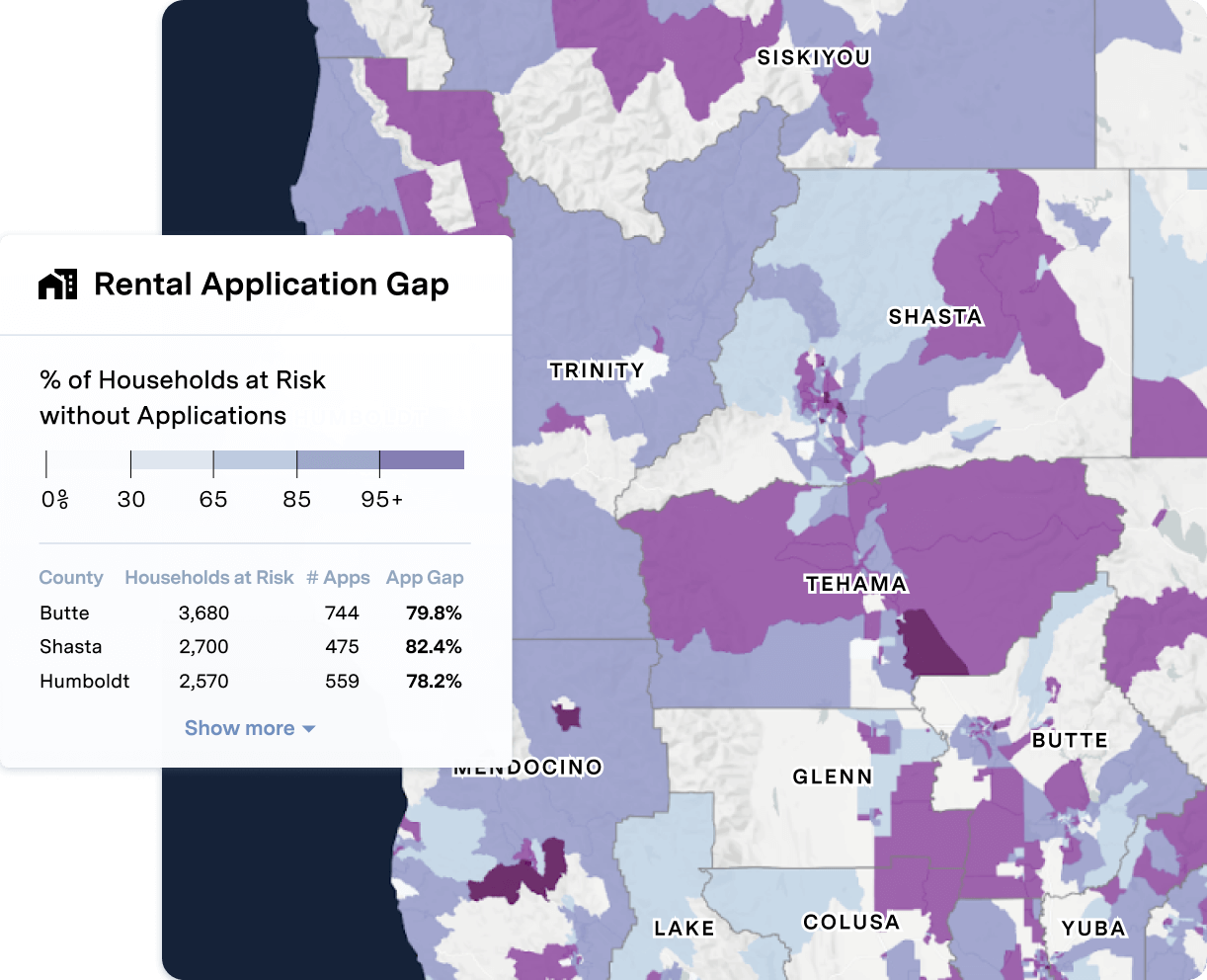

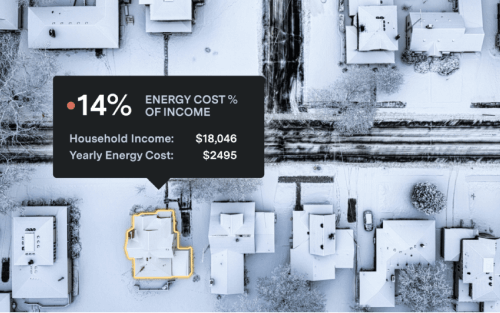

Resilience Insights

Power decision making with curated data and models assembled and intersected to surface insight

-

-

- Technology

-

-

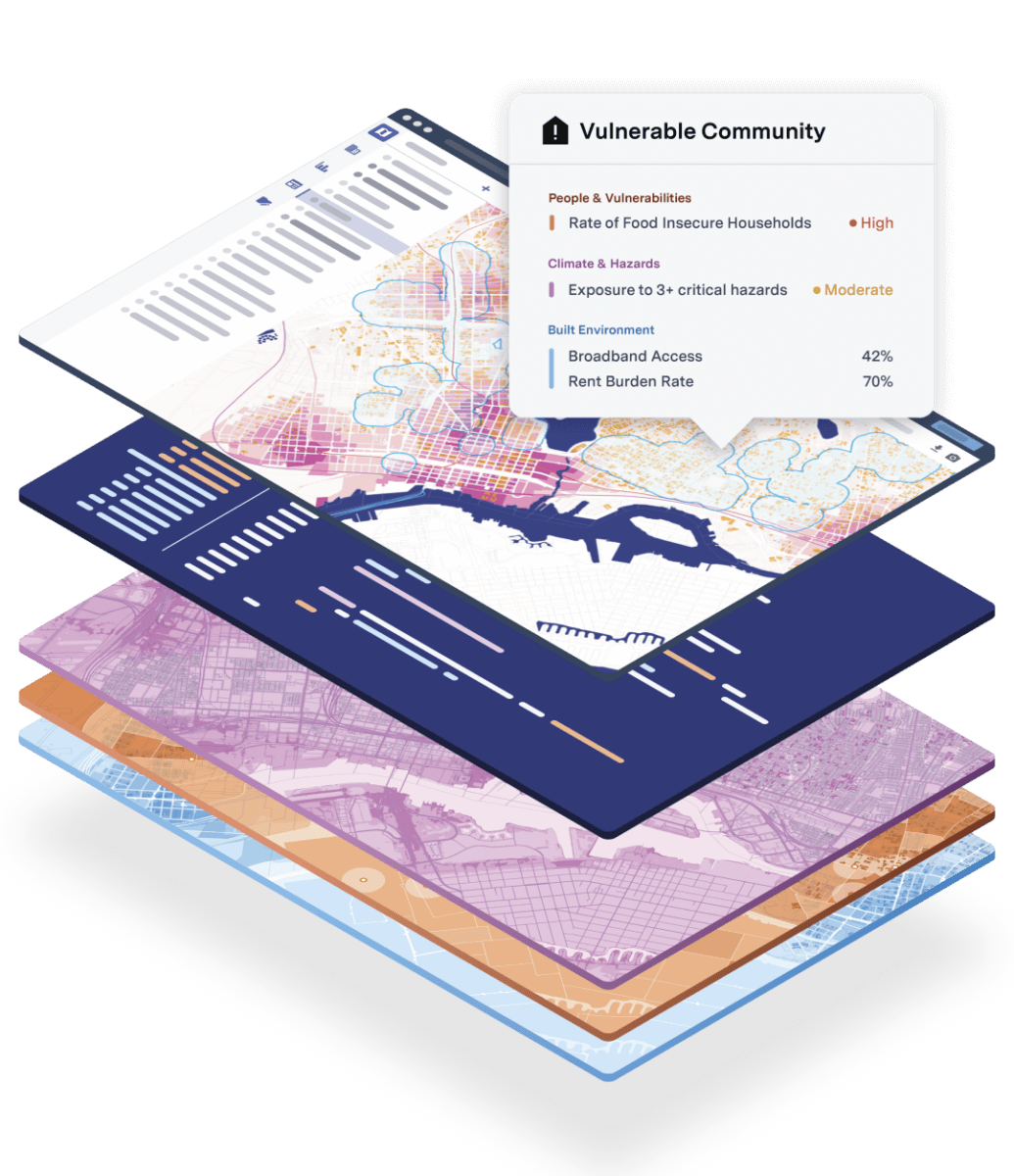

Our Technology

The UrbanFootprint platform curates components of our Data Foundations to build Resilience Insights and deliver them through one or more Data Experience

-

-

- Resources

-

-

-

RESOURCE TYPE

- Case Studies

- Solution Overviews, eBooks, and Whitepapers

-

-

-

TECHNICAL SUPPORT

- Product Documentation

- Contact Us

-

-

-

- Blog

-

- About

- Login

- Contact Us