Now that the federal eviction moratorium has expired, and state and local eviction moratoriums are coming to an end across the country, the Emergency Rental Assistance (ERA) program is the one thing standing between many Americans and homelessness.

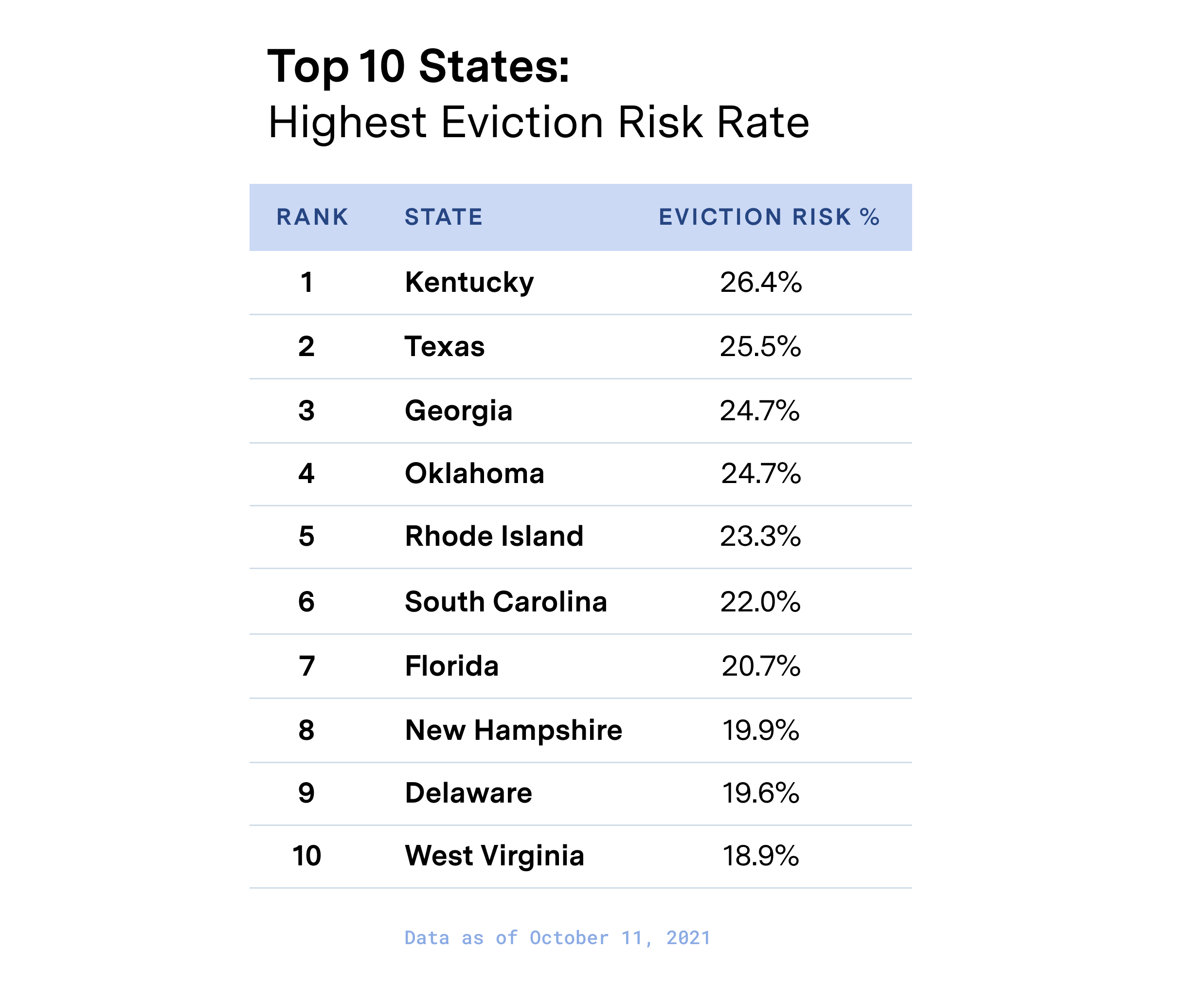

Unfortunately, the distribution of ERA funds has been difficult, and most of the benefits have not yet ended up in the hands of those in need. In fact, we estimate that there are 6.5 million households at risk of eviction right now — roughly 15% of renter households. The situation is even more dire in some states.

In an effort to speed up the process, the U.S. Treasury Department recently issued guidelines for the reallocation of ERA funds if cities and states do not meet certain requirements. Essentially, the guidelines amount to a “use it or lose it” mandate, further increasing the sense of urgency among jurisdictions to distribute the funds.

In this blog post, we’ll look at the federal government’s new rules, the challenges involved with outreach and disbursement of rental aid funds, and what municipalities and state agencies can do to avoid losing ERA money.

What is Emergency Rental Assistance?

Emergency rental assistance is a rental subsidy available to those at risk of being evicted from rental housing as a result of being unemployed, receiving public assistance, or being a victim of domestic violence.

The ERA program was created in 1985 by the United States Department of Housing and Urban Development (HUD) as a rental assistance program for families and individuals at-risk of homelessness.

The program has become increasingly important as a result of the COVID-19 pandemic, which caused drastic increases in the number of people vulnerable to eviction.

Approximately 35 million rental assistance applications were approved in the U.S. last year. The majority of the assistance was distributed through state and city agencies, with a smaller portion going to private non-profits.

What are the new guidelines issued by the U.S. Treasury?

On October 4, 2021 the U.S. Treasury provided a new framework for re-allocating ERA funds from cities and states with low distribution rates to those with high distribution rates.

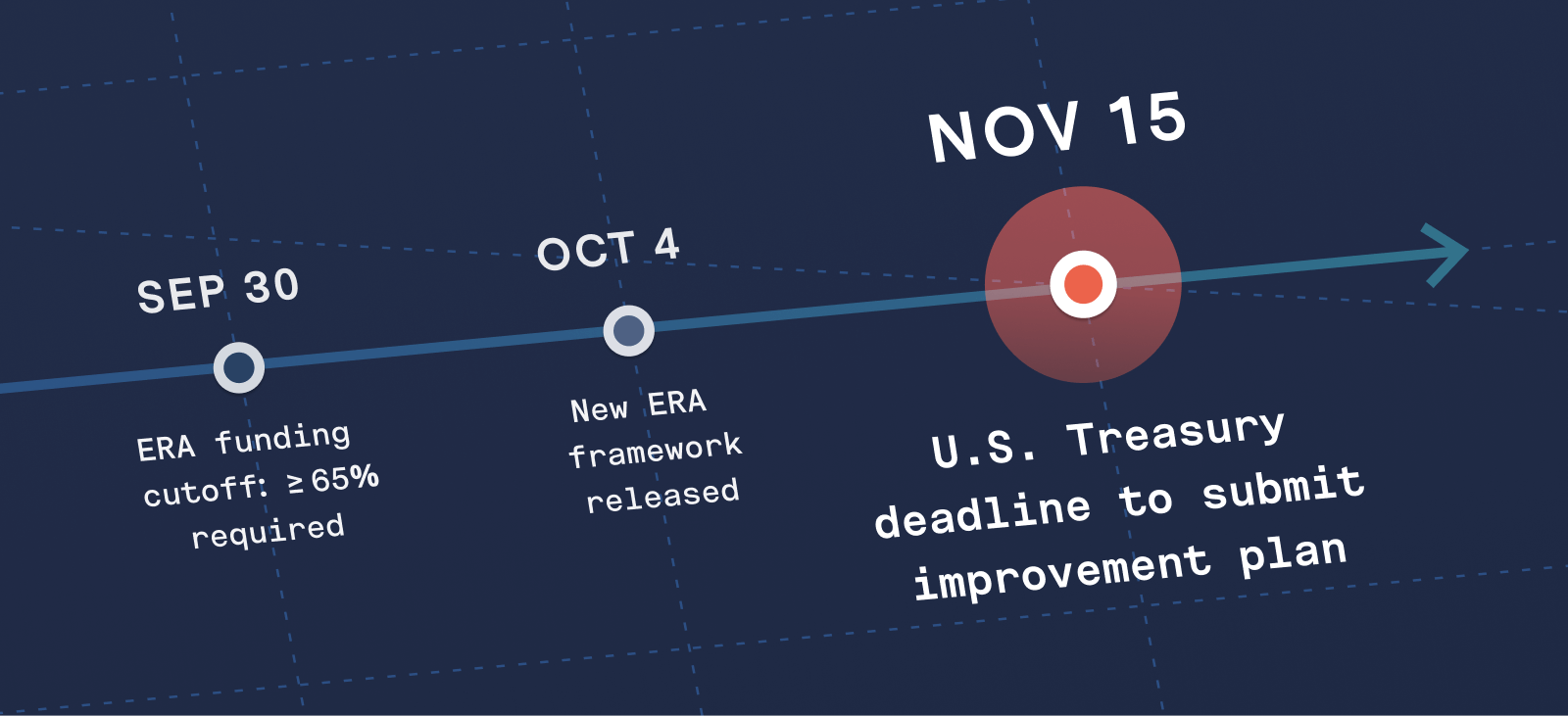

As part of the framework, cities and states were required to specify how much of their funding they had obligated as of September 30, 2021. Funds are defined as “obligated” if they have been spent to provide financial assistance to prevent evictions; are needed to pay for an eligible household to enter into an agreement with a landlord; or fulfill a contractual obligation between the grantee and a third party, such as a bulk payment to a landlord or utility company.

The Treasury will evaluate the expenditure ratios — the amount obligated compared to total funding — of city and state agencies every two months, with the requirement that the ratios increase by a minimum of 5% each month. If it is determined that there are excess funds, the Treasury may recapture the funding and allocate it elsewhere.

If the amount obligated by September 30 was less than 65 percent of the allocation, agencies are also required to submit a program self-assessment and improvement plan for Treasury’s approval by November 15, 2021.

States failing to submit an improvement plan are required to return all unused funds allocated for rental assistance to the U.S. Treasury Department.

What is in the “improvement plan?”

To avoid losing funding, cities and state agencies will need to submit a plan for distributing funds more quickly and efficiently.

The action plan includes identifying policies and practices recommended by the Treasury that the agency has already implemented, key obstacles in the delivery of ERA, and planned actions for improving performance. If the action plan is approved, it will cap recapture at no more than 15% of the funds.

While many cities and states have obligated enough funding and will not be required to submit an improvement plan, it is still in everyone’s best interest for ERA programs to run as efficiently as possible. This means everyone should be addressing the challenges of allocating and distributing relief.

Challenges of disbursing benefits

One of the challenges that have hindered rental assistance disbursement is making sure those at risk of eviction are enrolling in the program. Agencies have limited visibility into where those at the highest risk of eviction live. Additionally, COVID-19 is causing conditions to change more rapidly than before, including an increase in unemployment and other factors that might lead to eviction. That makes it difficult to target outreach to those most in need.

Underserved and disadvantaged communities are by definition the hardest to reach, and policy makers are putting increasing emphasis on the importance of re-thinking outreach. But the challenges don’t stop there.

Once people enroll, it can be difficult to verify eligibility for rental assistance. Rules and procedures have often not been in place to handle the flood of requests coming in, slowing down the pace at which applications are processed.

The third issue is that monitoring progress is difficult. Agencies are aware of the number of applications they are processing and how much money is being distributed, but they are unable to determine which forms of outreach lead applicants to apply for the program. It is also very difficult to accurately quantify the difference between need and assistance provided because the data is often outdated.

Luckily, up to 10% of funding can be used for administrative expenses. This may be applied to investments in program rollout improvements to help solve some of these challenges.

How to improve the delivery of ERA

The first step is to better understand the scope of the problem your community is facing when it comes to eviction risk. Knowing how many people are at risk of eviction right now will give you an idea of how much funding you need, and from there you can come up with an action plan for outreach to the vulnerable population. To accomplish that, you’ll need up-to-date information on community eviction risk.

You also need to know exactly where the risk is. The more granular your data is, the clearer your picture of the problem will be. This will improve efficiency by allowing you to prioritize resources in areas with more high-risk individuals. It will also help you more quickly enroll people who need aid the most. It can also help you make decisions to better process applications and disburse benefits.

The Treasury has recently provided some more guidance to help speed up the processing of applications, including:

- Relying on self-attestation when documentation isn’t readily available.

- Distributing funds to eligible landlords and utility providers based on estimates of what they’re owed.

- Providing tools based on successful aid-disbursement programs, giving states and cities templates to follow distributing aid.

Putting data into action with Eviction Risk Insights

How can you efficiently reach the most vulnerable in your community?

You must be able to see where they are. Mapping and AI can help you visualize the risk of eviction across your community so you can make better decisions and improve performance.

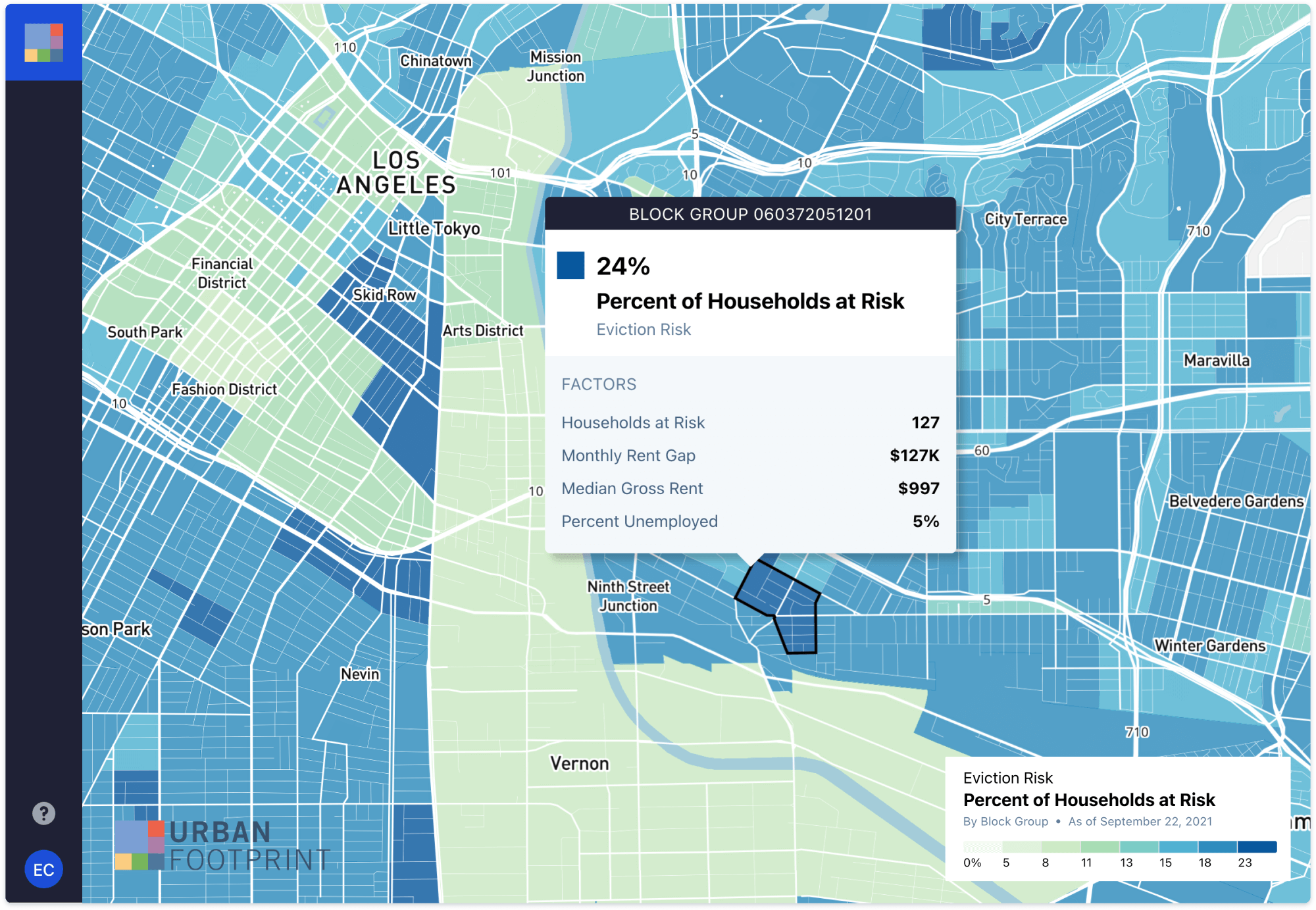

UrbanFootprint offers Eviction Risk Insights, providing frequently updated, dynamic data to pinpoint and measure the number of households at risk of eviction in any community, with precision down to the census block group level. For example, here is a map of the eviction risk in Los Angeles. In the highlighted census block group, you can quickly see that 24% of the households are at risk of eviction.

This leads to improvements in two key areas:

- Targeting – Identify zip codes or census tracts where eviction risk is highest based on income, unemployment rate, and other factors. Understand how and where eviction risk is changing over time.

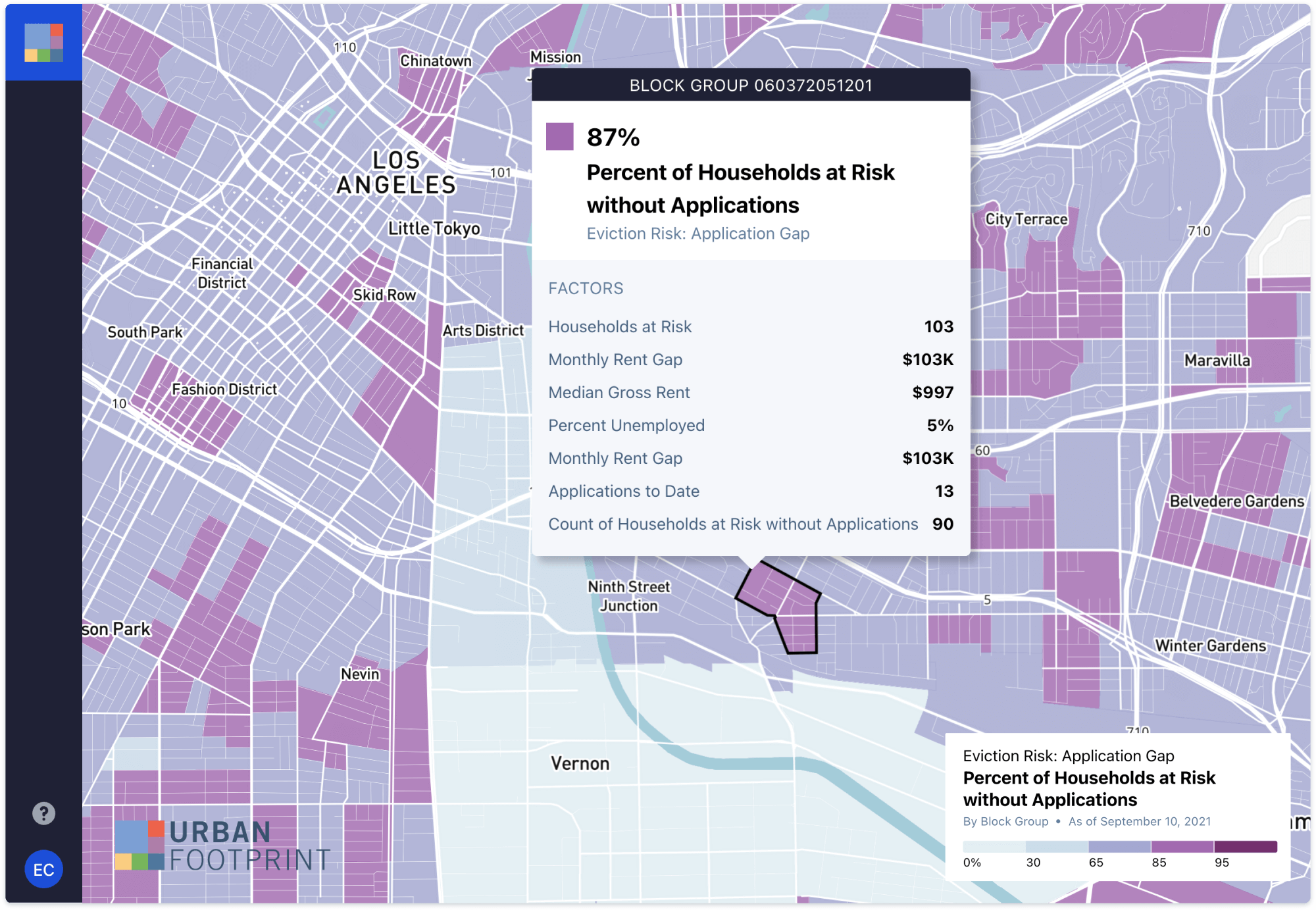

- Outreach & Performance Tracking – Identify local organizations such as CBOS, faith-based organizations, legislative and other partners to amplify outreach messaging, and engage PR firms to drive paid media into target communities. Visualize the application gap, track application intake and measure performance of different outreach tactics.

With Eviction Risk Insights you will be able to see the specific areas in greatest need of rental assistance right now, identify gaps in outreach and/or areas where processing improvements are needed, and then measure progress to drive better outcomes for rental assistance programs like ERA.

Conclusion

The U.S. Treasury’s new guidelines for the reallocation of ERA funding could be a major blow to cities and states that have not obligated enough funds. States or municipalities with insufficient relief obligations must submit an improvement plan to avoid having their funding reallocated.

There are many barriers to efficiently distributing rent relief funds. One of the most critical is not having visibility into where assistance is needed most — right now.

UrbanFootprint can help you see eviction risk data in a way never before possible. You will know exactly where to prioritize your resources. Learn more about Eviction Risk Insights.