In collaboration with Ian Carlton and Kate Macfarlane (MapCraft); Mike Wilkerson and Marley Buchman (ECONorthwest)

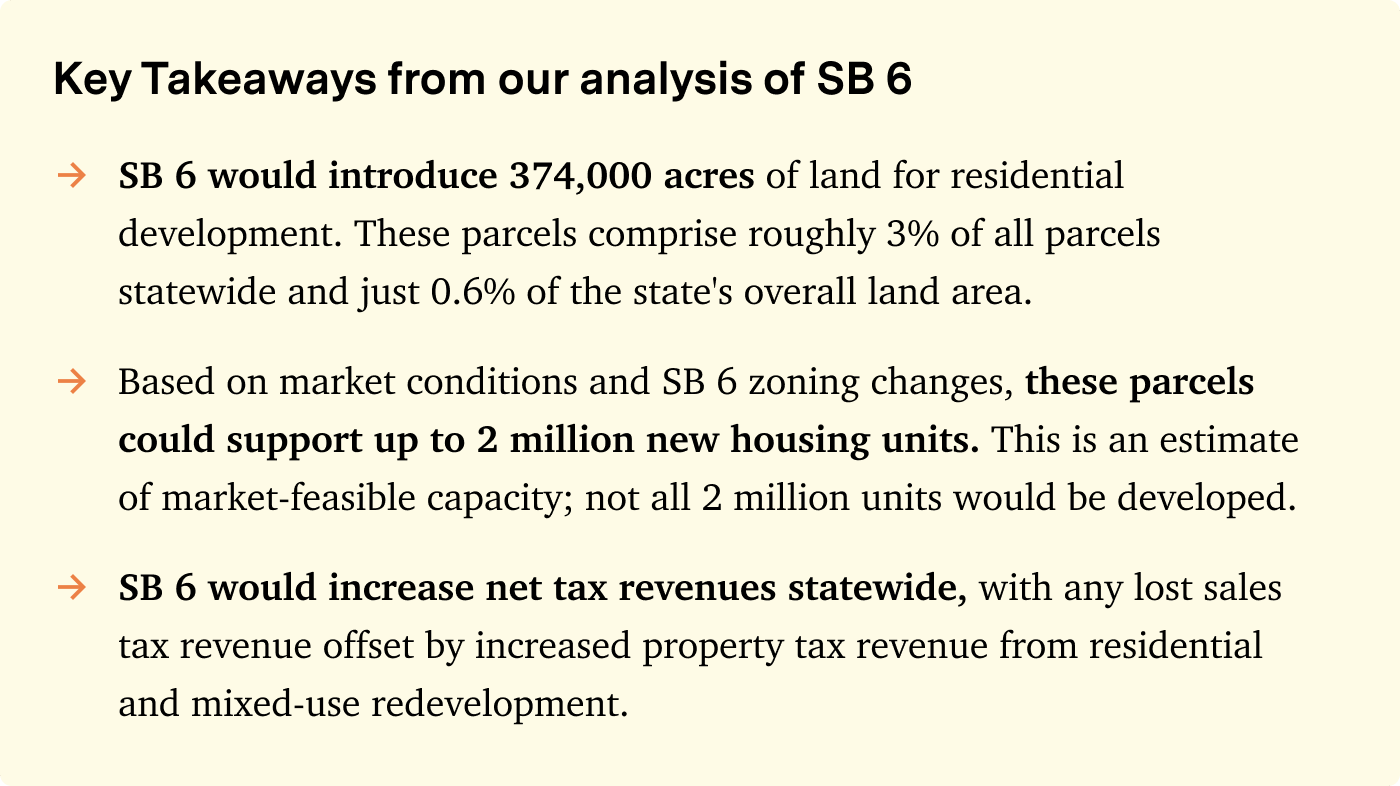

A new wave of proposed policies seeks to address California’s epic housing affordability crisis by redeveloping commercial properties into new residential developments. While the realities of complex markets, extensive land development processes, and labor shortages pose substantial hurdles, our analysis of a leading bill estimates that commercial properties could increase market-feasible capacity by as much as 2 million new homes while generating substantial fiscal benefits to cities.

Introduction

Despite record jobless claims and the challenges of more than a year of shifting stay-at-home orders, the California housing market continues to defy gravity. Median home prices rose more than 24% (to $758,990) between March 2020, when the COVID-19 economic shutdowns began, and March 2021. And despite an ever-worsening housing crisis, attempts to increase housing production via legislation in Sacramento have thus far largely fallen flat. Attention-grabbing bills such as SB 50 and SB 827, focused on upzoning areas around transit, have been tabled. Others such as AB 3040, which focused on incentivizing the production of 4-plexes and ‘missing-middle’ housing in areas zoned for single-family residences, also failed to make it to the governor’s desk.

This year, a new wave of bills is taking on the housing crisis from a different angle. Rather than focus on existing residential areas, bills such as SB 6, AB 115, and SB 15 seek to unlock the potential for housing production on the state’s inventory of commercial lands. Commercial lands redevelopment is one of our favorite topics here at UrbanFootprint—our 2018 Grand Boulevards concept presents a proposal to renew California’s strip commercial corridors and address housing and climate challenges. This time we’ve partnered with industry experts at MapCraft and ECONorthwest to do a deep dive into the housing production potential of commercial lands across California, with a specific focus on Senate Bill 6, one of the bills currently winding its way through the halls of Sacramento.

Our analysis estimates that, if SB 6 were to become the law of the land, California commercial lands could increase market-feasible capacity by as many as 2 million new homes, similar to upzoning all of California’s single family homes to allow fourplex development as proposed by 2020’s AB 3040. We applied SB 6’s criteria to all commercial properties in the state, evaluated the bill’s impact on zoned capacity, and applied a market-based analysis to understand where housing redevelopment would be financially feasible. We also evaluated the potential fiscal impacts of the bill and found that housing development on commercial sites generally had a positive fiscal benefit to jurisdictions. If all of the 2 million market-feasible units were built on eligible commercial sites, the upper bound of potential SB 6 impacts, the net fiscal benefit to the state’s jurisdictions could be $6 billion in annual revenues generated.

We performed this analysis to shed more light on a growing crisis and the options being presented by policy makers to solve it. We unpack our analysis below and hope that it serves as a valuable source of information for those working to design and refine the complex policy prescription needed to tackle our state’s housing affordability crisis.

How can a state policy turn an old mall into a new apartment building?

Several bills being discussed in Sacramento are focused on housing production on ‘underutilized’ commercial lands. Each of these bills specifies its own nuanced set of criteria for what constitutes an eligible commercial property, what rules are in place for what can be built, who it is built for, and even the nature of the labor force that will build the new homes. We’ve focused on SB 6 for this analysis, but the takeaways and lessons learned can also be applied to other bills (SB 15 and AB 115). Here are the most salient characteristics and criteria embedded in Senate Bill 6:

- Allows residential uses on parcels in commercial and office zones: SB 6 allows for residential redevelopment on all properties zoned for commercial retail and office uses, as long as they are not adjacent to an industrial property. For this study, we used existing commercial and office land use as a proxy for zoning, as consistent statewide zoning data is not currently available.

- Applies local zoning standards, subject to minimum zoned residential densities: SB 6 redevelopments would be subject to local zoning requirements for the nearest zone that meets the bill’s minimum residential density requirements. The density minimums specified in SB 6 range from 30 units per acre in urban metro areas to 10 units per acre in rural/exurban areas.

- Requires affordable housing: SB 6 notes that affordable housing will be required as part of all redevelopment, but does not specify specific criteria. For this analysis, we assumed that SB 6 would require that new residential developments provide 20% of units for low-income households (those making 80% of Area Median Income or less).

- Includes labor type and rate requirements: SB 6 includes a requirement that all redevelopment projects pay prevailing wages and utilize a ‘skilled and trained’ workforce per the bill’s definition.

- Makes residential redevelopments in commercial zones eligible for streamlined, ministerial approval process: Projects enabled by SB 6 may apply for streamlined, ministerial review as enabled by SB 35. However, additional eligibility criteria apply, including additional geographic filters and a requirement that the commercial property must have been at least 50% unoccupied by tenants for at least three years. Our analysis did not consider the impact of this ministerial review provision of SB 6.

Expanding the Housing Production Funnel

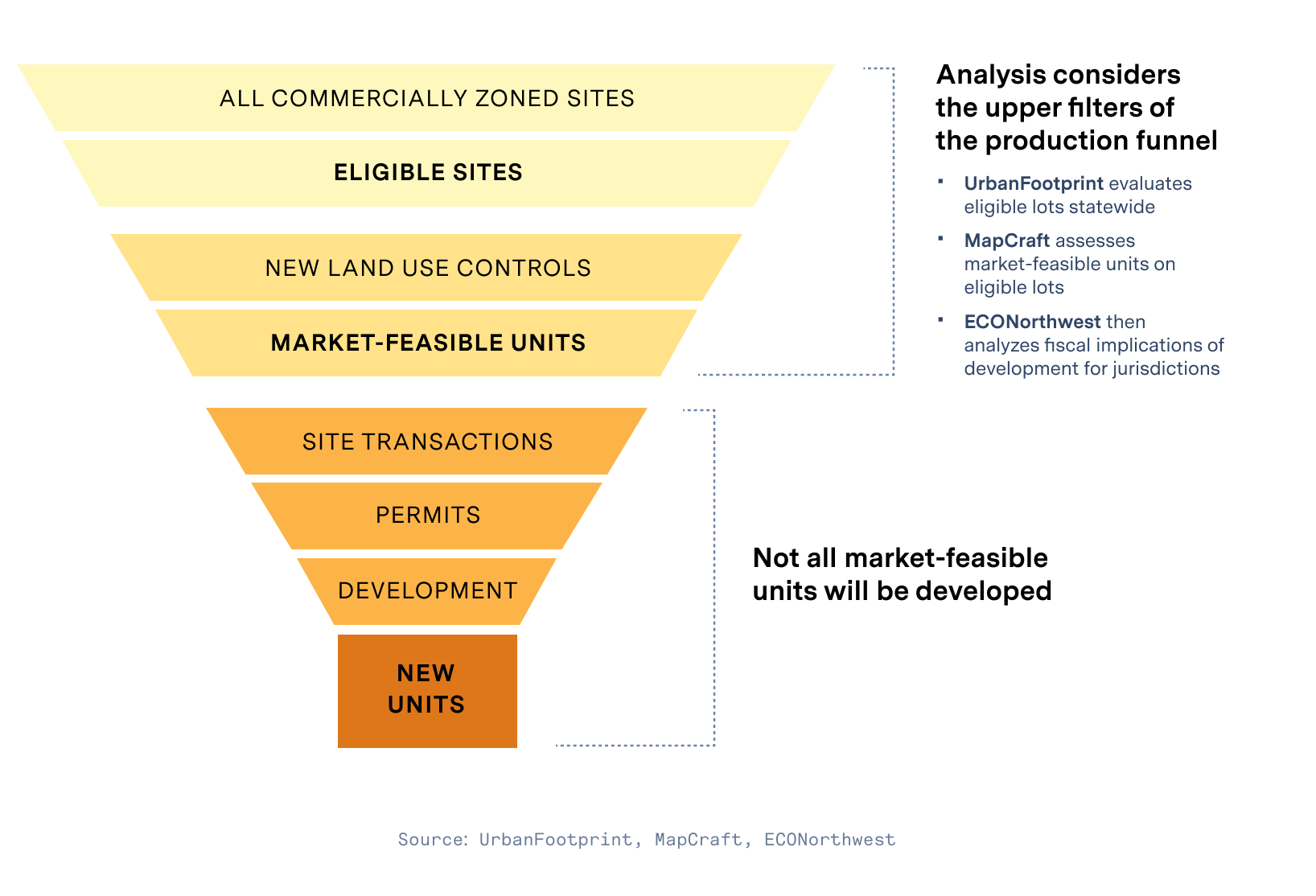

As we described in our analysis of 2020 housing bill contender AB 3040, there are many steps involved in getting a home built. Builders and developers must navigate a proposal through a complex process before a foundation is laid and a home is ultimately leased or sold to the public. The process includes evaluating site eligibility (whether the local jurisdiction permits residential development on a given parcel), determining whether the development would be profitable, purchasing the property from the existing owner, obtaining necessary permits, and ultimately breaking ground for construction. A project could be derailed at any point along this path.

Housing bills such as SB 6, AB 115, and SB 15 seek to increase housing production by including more land eligible for residential development—in this case, commercially zoned land. For these bills, the ‘top of the funnel’ is all the land in the state currently zoned for retail commercial and office uses. Because of the lack of statewide zoning data, we use existing commercial land use as a proxy for zoning.

Our analysis focuses on the top two sections of the development funnel: site eligibility and market feasibility. We seek to first establish a general understanding of the number of new sites on which housing could be permitted—locations that previously allowed only commercial or office uses. Second, we assess each newly eligible property to determine the likelihood that a developer would attempt to build housing based on the size and land use constraints of the site (affecting the size and type of building that could be constructed), the cost of land acquisition and construction, and the market conditions of the area. This results in an estimate of the number of market-feasible units that would be enabled by SB 6, after taking into account zoning and development feasibility.

From there, we assess the potential fiscal implications of this type of redevelopment on city budgets.

How Many Homes Could be Produced under SB 6?

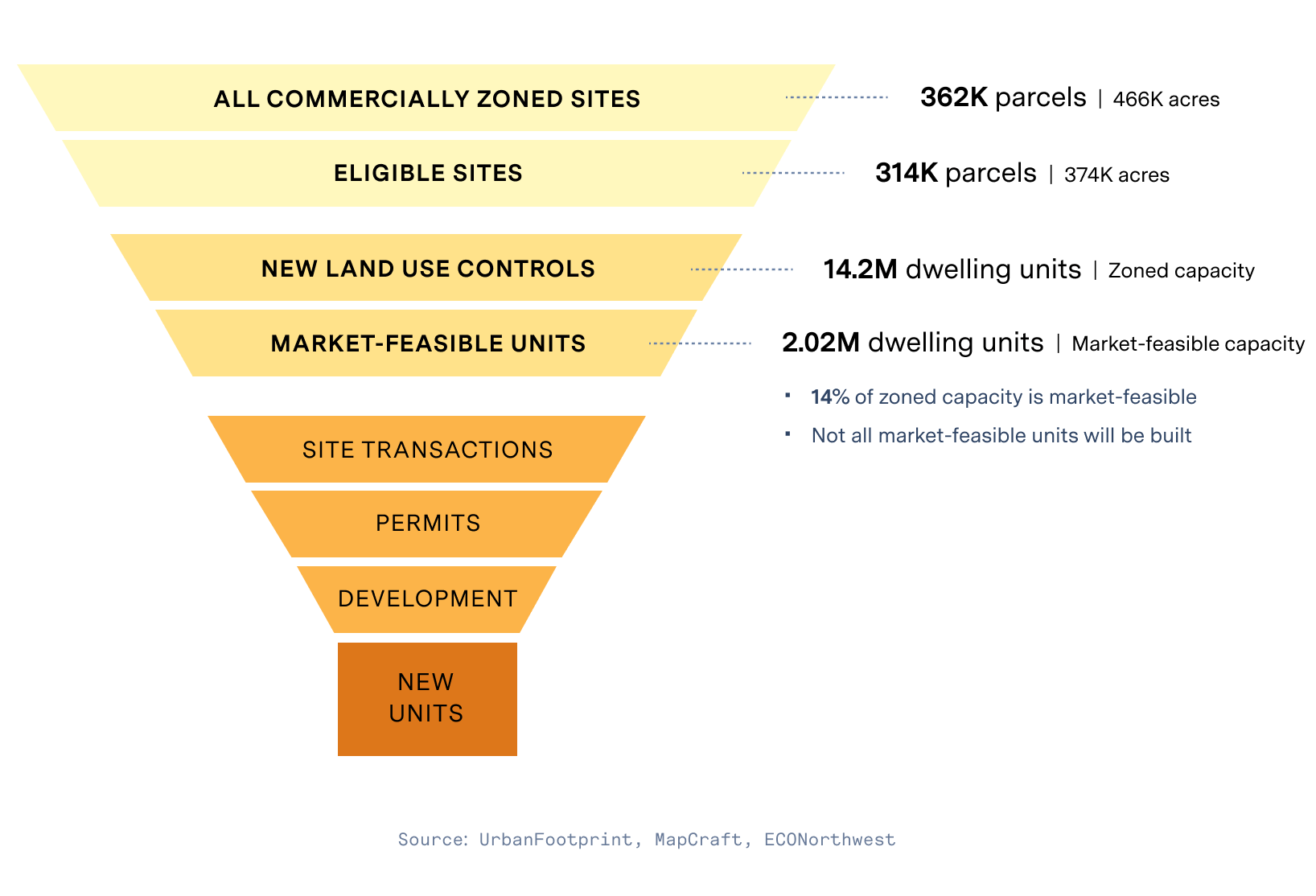

Let’s set the context for the top of the development funnel—how much commercial land is there to be redeveloped for housing. Using the UrbanFootprint Base Canvas as our source of parcel-based existing land use data, we identified 362,000 commercial properties across the state, spanning 466,000 acres. This includes main street properties in small towns, strip commercial corridors, large big-box sites on the edges of town, high rises and skyscrapers in downtown San Francisco and Los Angeles, and more. To put these figures into perspective, these parcels comprise roughly 3% of all parcels statewide and just 0.6% of the state’s overall land area.

With this superset of commercial parcels identified, the next step in our analysis was to apply the specific eligibility criteria laid out in SB 6 to assess the proportion eligible for residential development. We excluded commercial parcels adjacent to industrial uses (as specified in SB 6) and parcels of more than 100 acres (to prevent properties like SeaWorld from skewing the results). Of the overall 362,000 commercial parcels statewide, we found that 87% (314,000 parcels) met the SB 6 eligibility criteria. These properties would introduce 374,000 acres of land for residential development.

Next, we estimated future residential zoned capacity on those 314,000 parcels under SB 6. We assumed that these properties do not permit residential development under existing zoning constraints, so the current zoned capacity of these properties for residential development is zero. The bill specifies a layered set of criteria, including dwelling unit per acre minimums (as specified by the California Department of Housing and Community Development) that are subject to increases where neighboring residential zones permit higher densities. By assigning these new dwelling unit density maximums to each eligible parcel, the bill could support a maximum of 14.2 million new dwelling units statewide. To put this figure into context, this is roughly equivalent to the number of homes in California today. It is worth stressing again that this figure is just the zoned capacity for new units—not how many could feasibly be built.

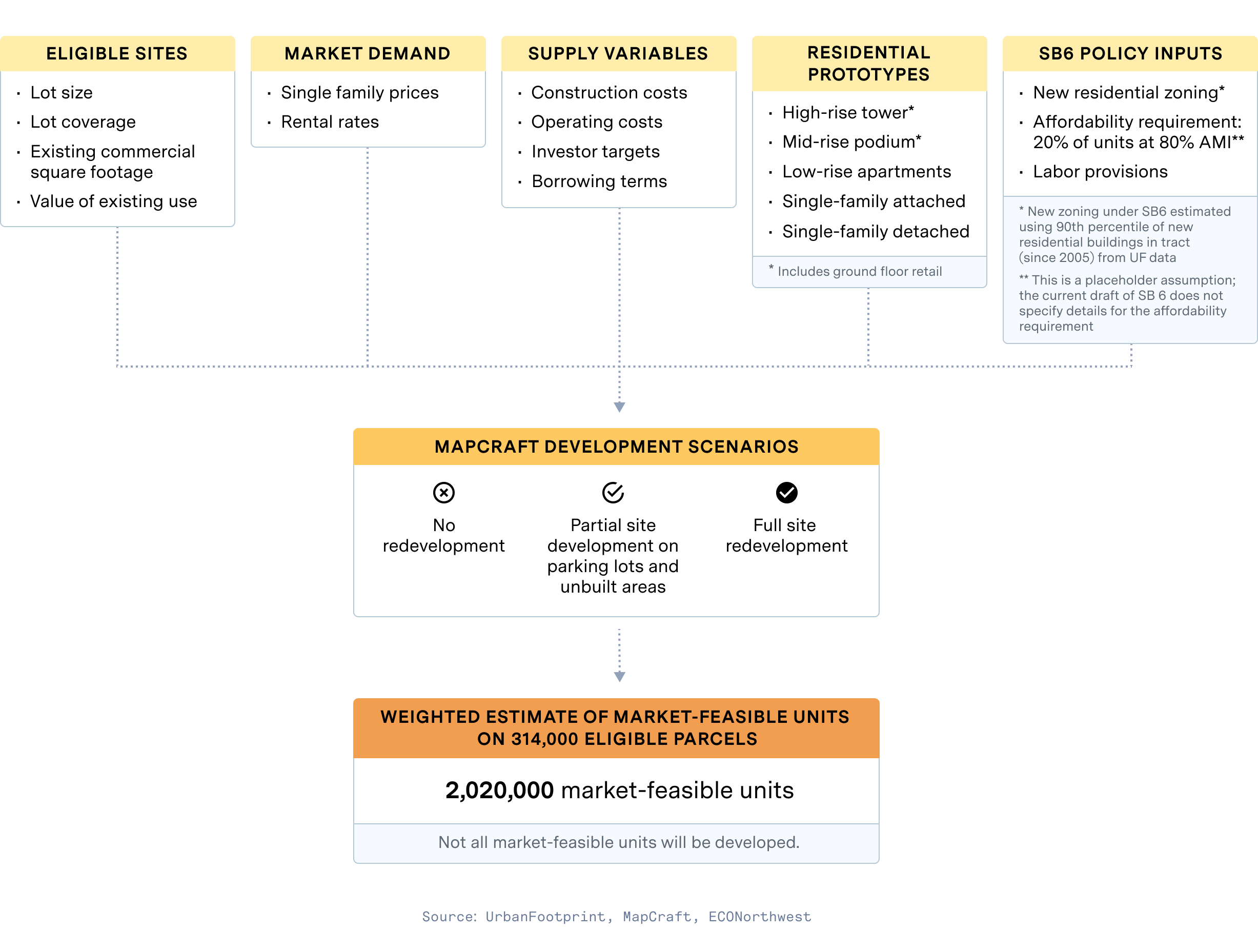

The next step in the funnel is the market feasibility assessment—that is, how much of the zoned capacity might be built given market conditions. Even if a zoning code allowed skyscrapers, market-rate developers may only build more financially viable townhomes. Real estate professionals use pro forma financial feasibility assessments to determine if a potential development investment is a worthwhile use of their resources. MapCraft used the same technique to analyze housing redevelopment potential on each of the 314,000 parcels eligible for SB 6 and estimate the most financially viable outcomes. This approach accounts for factors such as the value of the existing commercial use, construction costs, market local demand, lot size, and expected investment return.

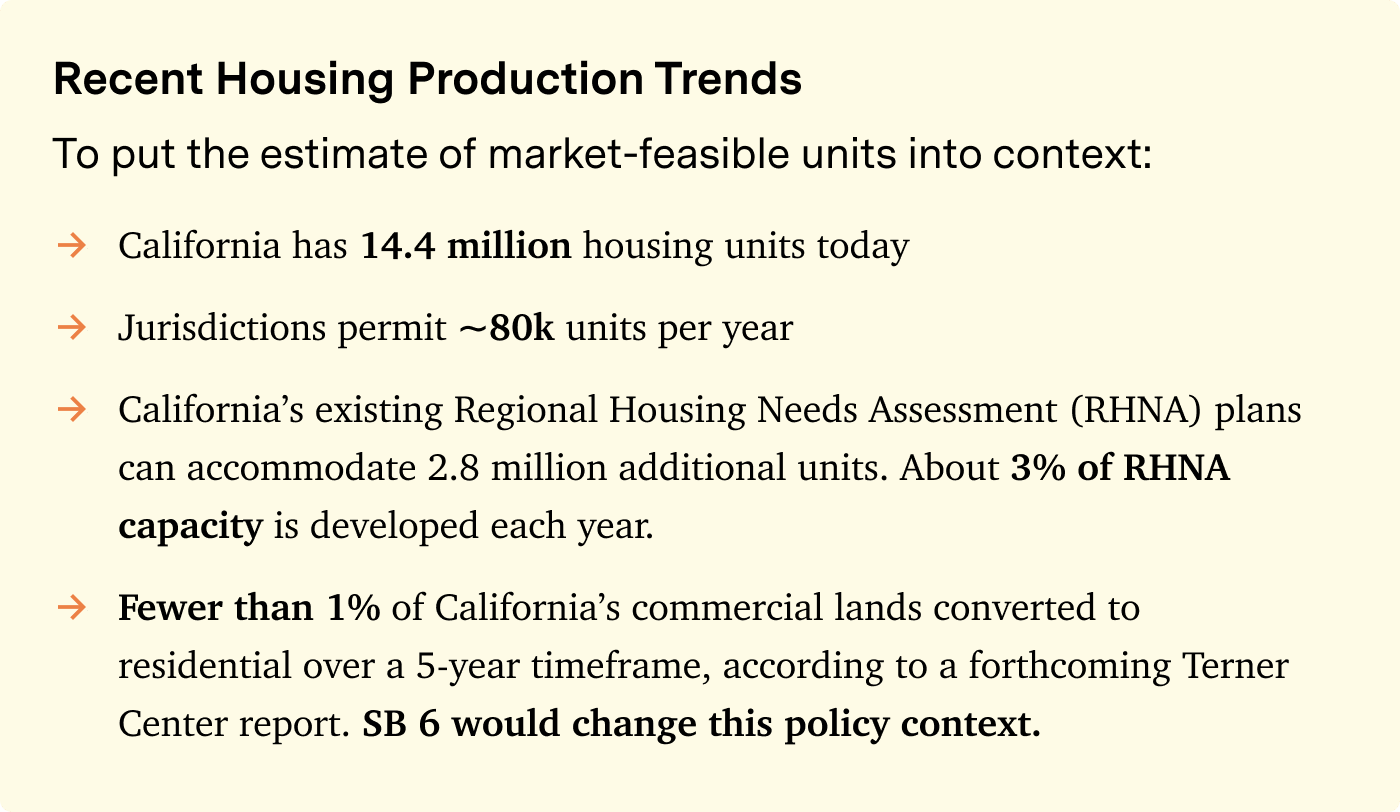

This analysis found that of the 14.2 million units of zoned capacity, 14% (2,020,000 units) would be market-feasible. Yet, we know that not all of the 2 million market-feasible units will be developed. After taking into account property transaction rates, absorption, permitting, site conditions, and other development factors, only a small portion of the market-feasible units would be expected to be built each year.

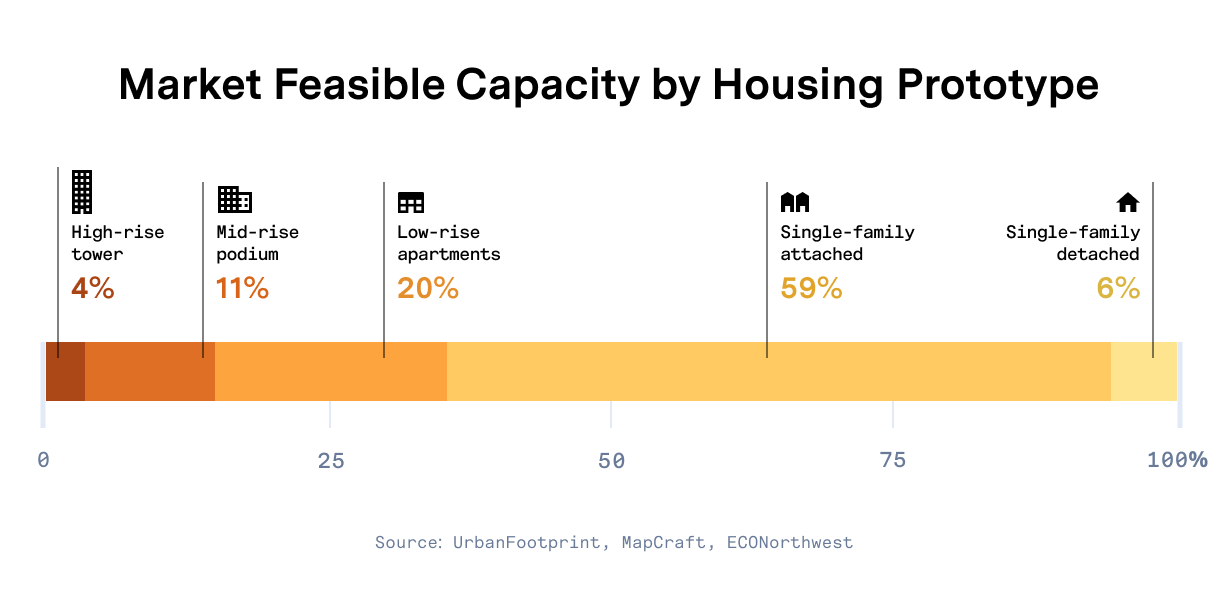

One finding of our analysis is that much of this market-feasible capacity is in relatively low intensity housing development, like townhomes and walk-up apartments. This is due in part to the relatively low minimum density requirements specified in SB 6. SB 6 requires zoning of at least 30 units per acre in the densest urban areas. In comparison, mid-rise multifamily developments can be 50-150 units per acre. This result also reflects current market conditions, including the relative profitability of townhomes as compared to other product types.

How would new housing be distributed across California?

Regional Distribution

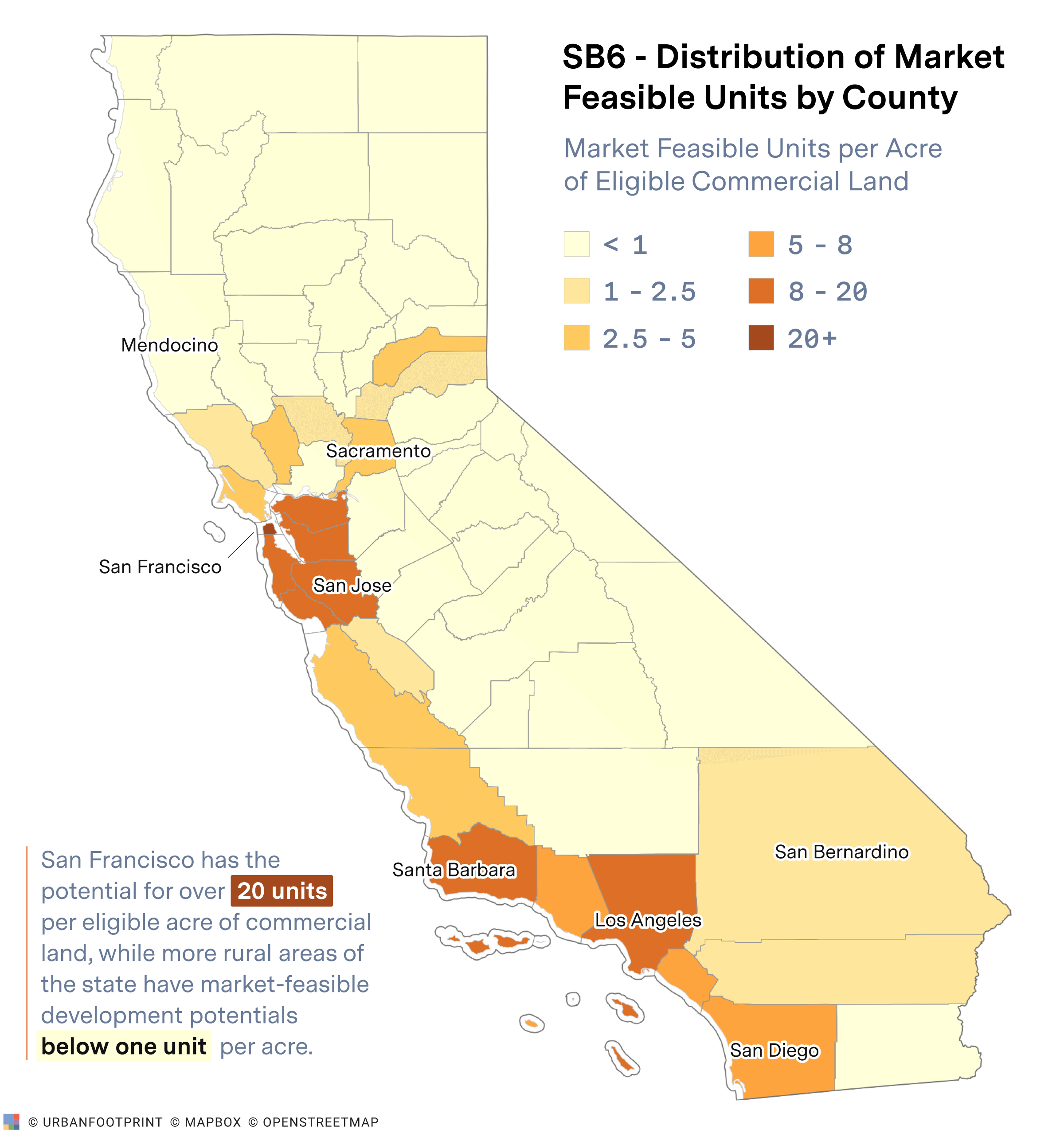

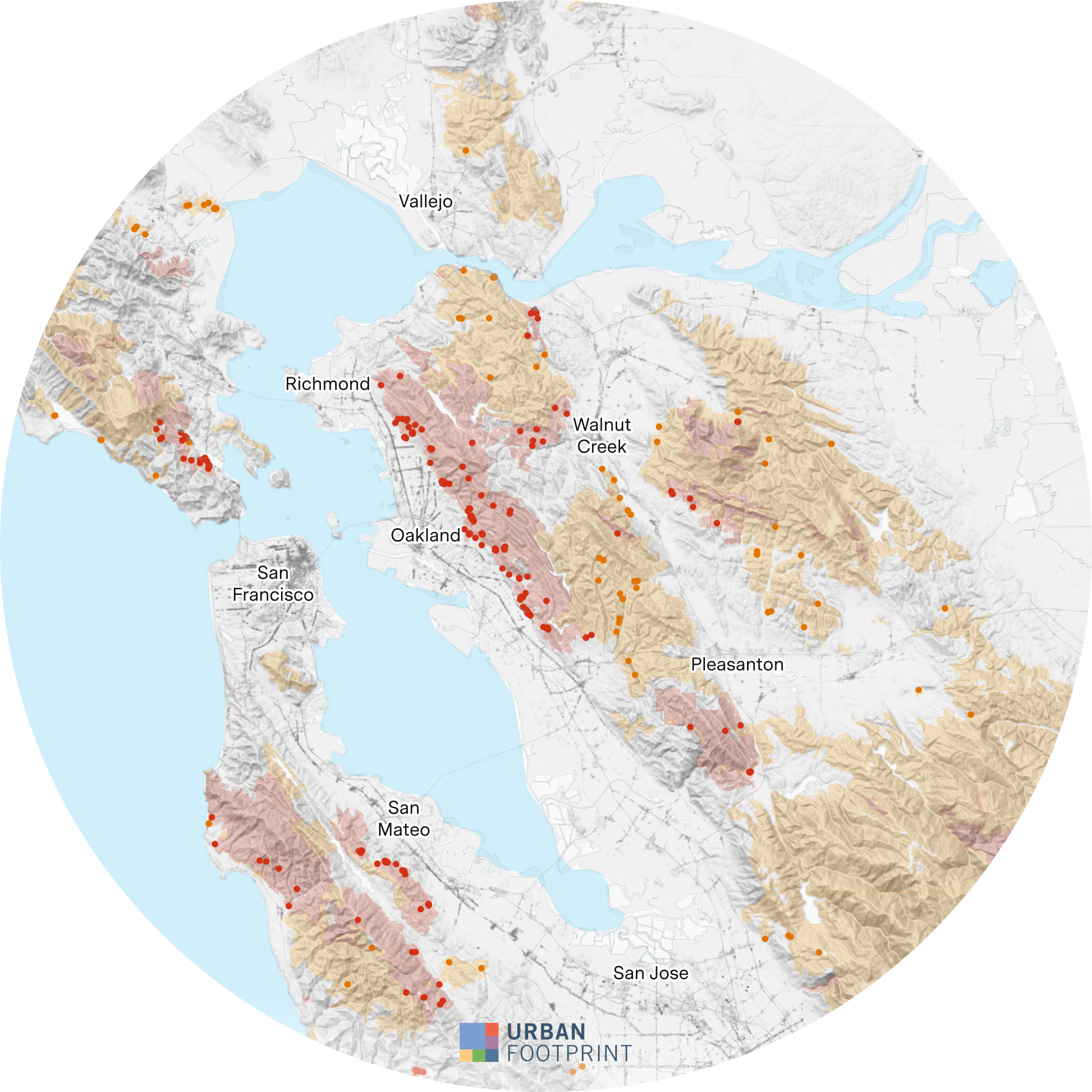

While this analysis identifies substantial market-feasible capacity on eligible commercial lands, the vast majority of new housing capacity enabled by SB 6 would be in existing metropolitan areas with strong housing markets that support the costs of redevelopment. More than 80 percent of market-feasible capacity under SB 6 is in the San Francisco Bay Area, Southern California, and San Diego. The map below shows market-feasible units per eligible acre of commercial land under SB 6. San Francisco has the potential for over 20 units per eligible acre of commercial land, while more rural areas of the state have market-feasible development potentials below one unit per acre.

To better understand the distribution of this capacity across California, we compared the number of market-feasible units to housing production targets set by the state through the 5th cycle Regional Housing Needs Assessment (RHNA) allocations. Each jurisdiction in California is required by law to designate lots that can support housing to address their ‘fair share’ of the housing deficit in the state. We found that 60% of jurisdictions could meet their 5th Cycle RHNA allocations using the new market-feasible commercial properties alone.

Equity and Socio-Economic Impacts

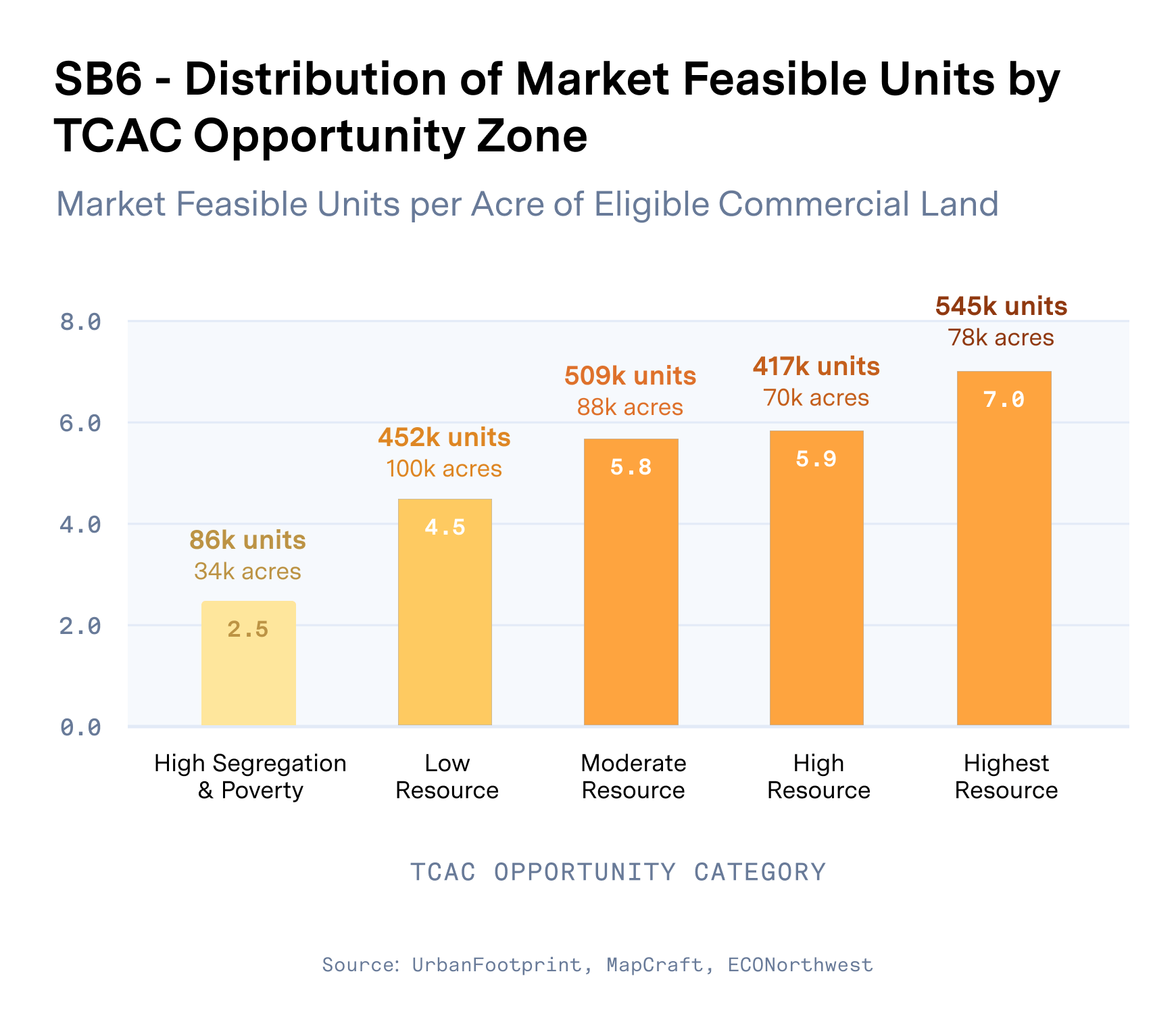

We also assessed eligible parcels and market feasibility based on socio-demographic and urban conditions across the state. In particular, we wanted to understand whether development would be concentrated in lower-income, traditionally disadvantaged areas, where there may be concern that redevelopment could spur gentrification and displacement of existing residents. To evaluate these potential impacts, we assessed SB 6-eligible redevelopment sites based on the California Department of Housing and Community Development Tax Credit Allocation Committee (TCAC) Opportunity Areas, the TCAC areas classify census tracts across the state on a spectrum from ‘highest resource’ to ‘high segregation and poverty.’

We found that higher-resource areas contain approximately double the market-feasible unit capacity of lower-resource areas, despite similar overall acreage. ‘High’ and ‘highest resource’ areas have a combined capacity of 960,000 units across 148,000 acres, whereas ‘low resource’ and ‘high segregation & poverty’ areas have a capacity for 538,000 units over 134,000 acres.

Hazard Risk and Non-Urban Development

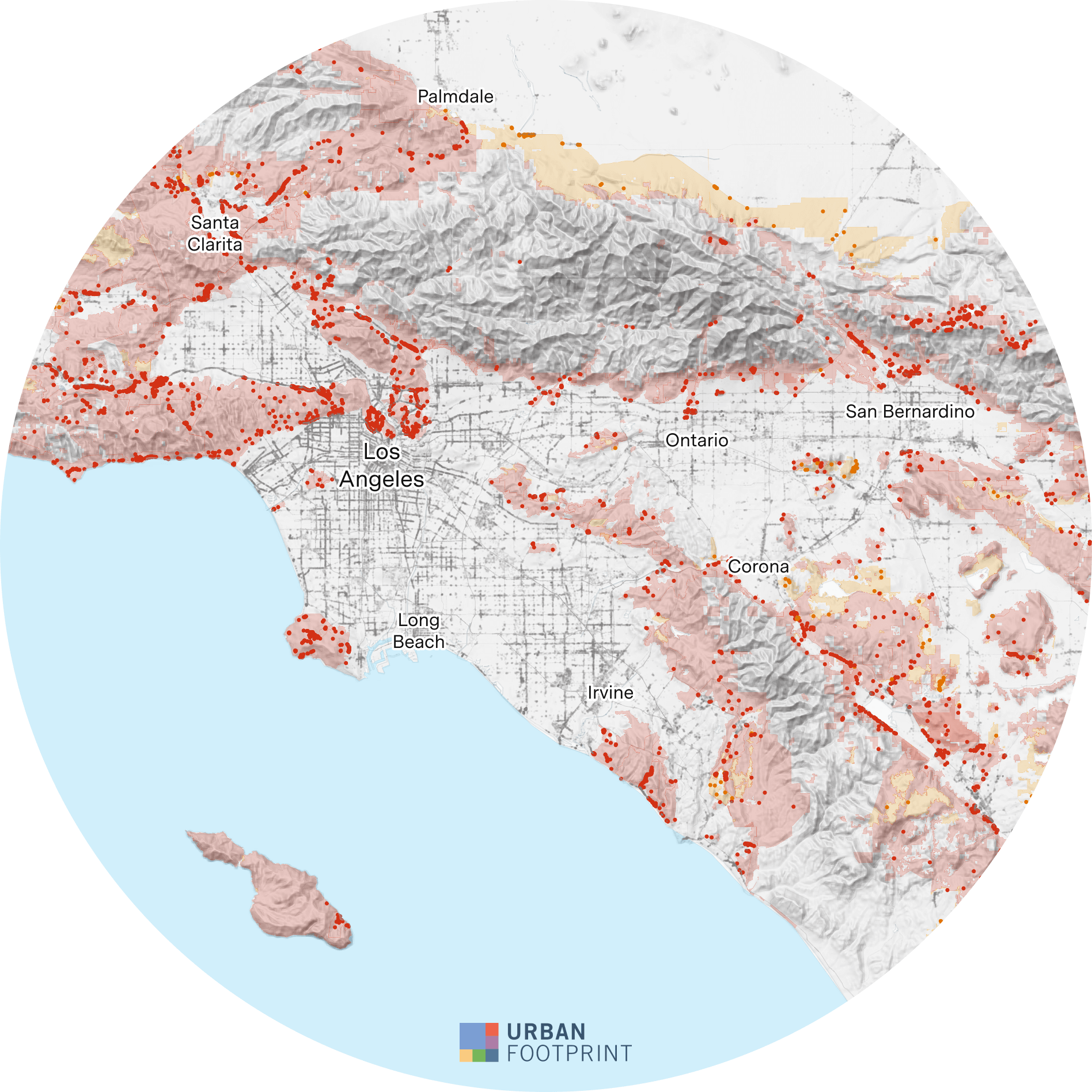

On top of a mounting housing crisis, California and its western neighbors are facing unprecedented drought conditions and extreme fire danger as more housing pushes up against open spaces and the wildland-urban interface. The state has also set the nation’s most aggressive targets to reduce greenhouse gas emissions, with a large proportion of those emissions coming from people driving long distances to commute and meet their daily needs. Will SB 6 push more development out to the edges where homes need more water, people drive further, and fire danger is higher? Or will it incentivize more redevelopment of infill sites? Our analysis shows that in its current form, SB 6 does both, and without additional development criteria could inadvertently run counter to some of the state’s other climate and hazard objectives.

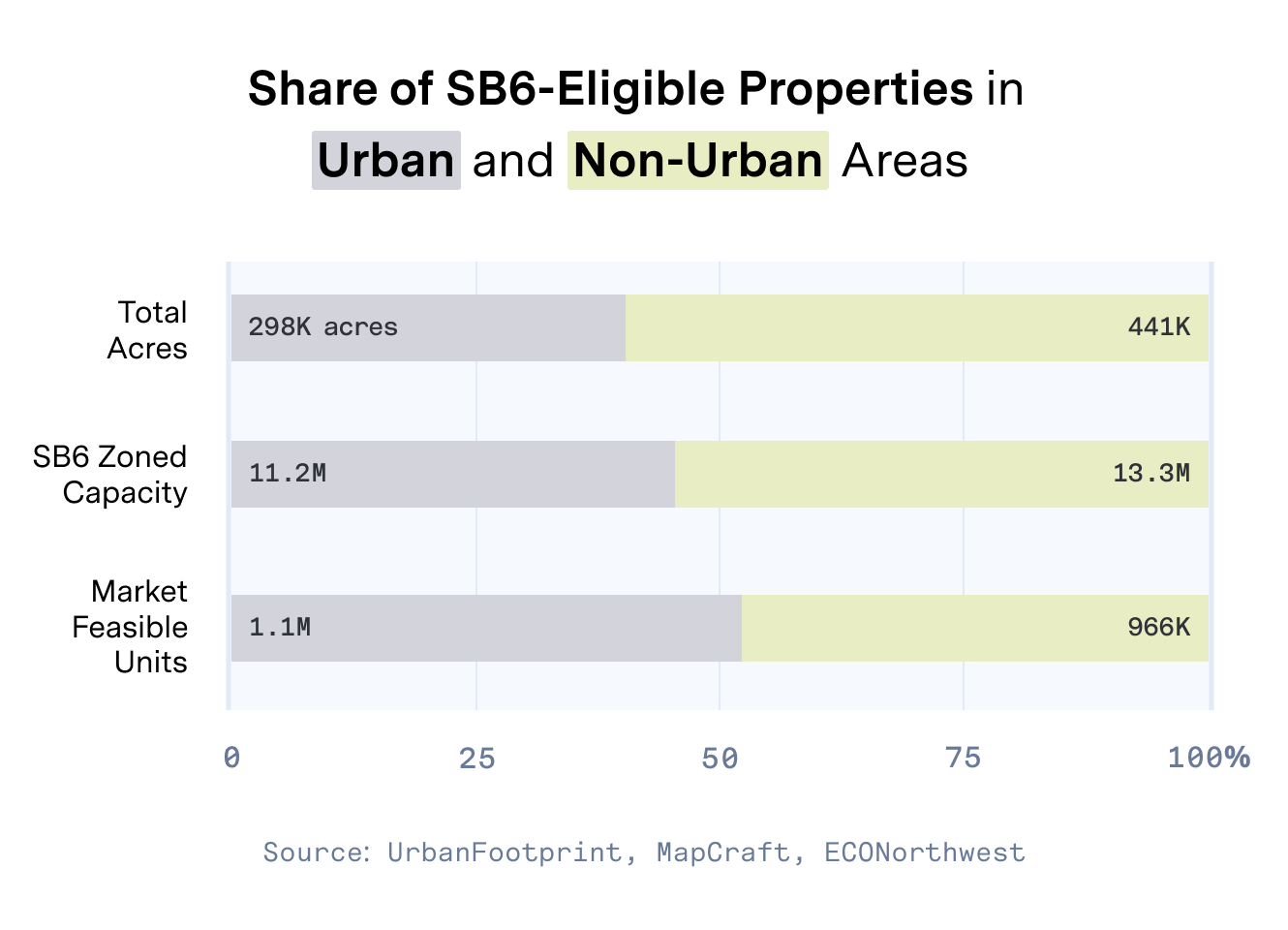

Using California’s own definition of urban development, set by the Farmland Mapping and Monitoring Program (FMMP), we found that 966,000 market-feasible units (nearly half of the statewide total) could be built outside of areas designated as ‘Urban and Built-Up Land’ by the FMMP. This suggests that a significant portion of the market feasibility enabled by the bill would likely take place in less dense areas on large commercial lots with low-value existing uses.

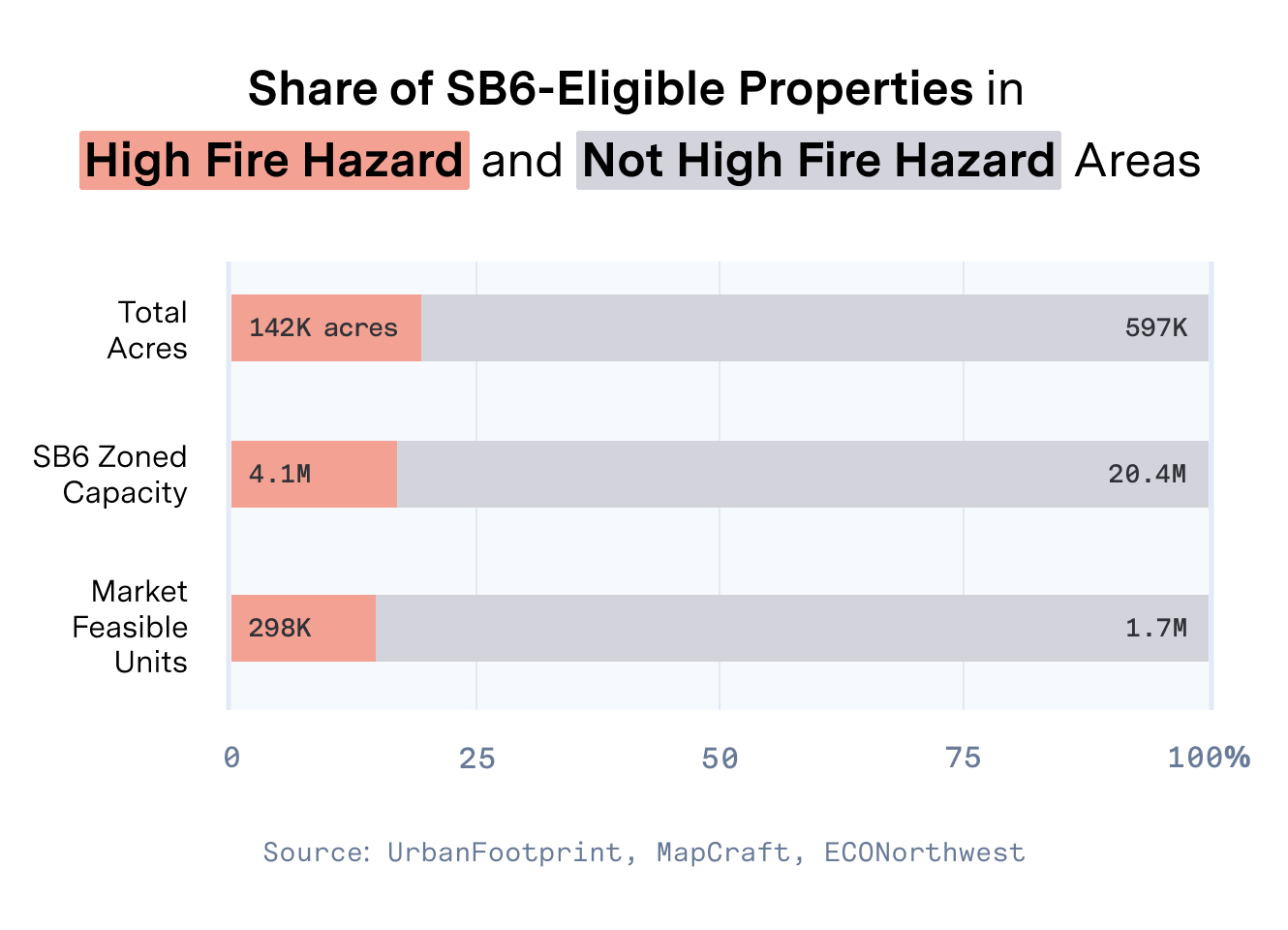

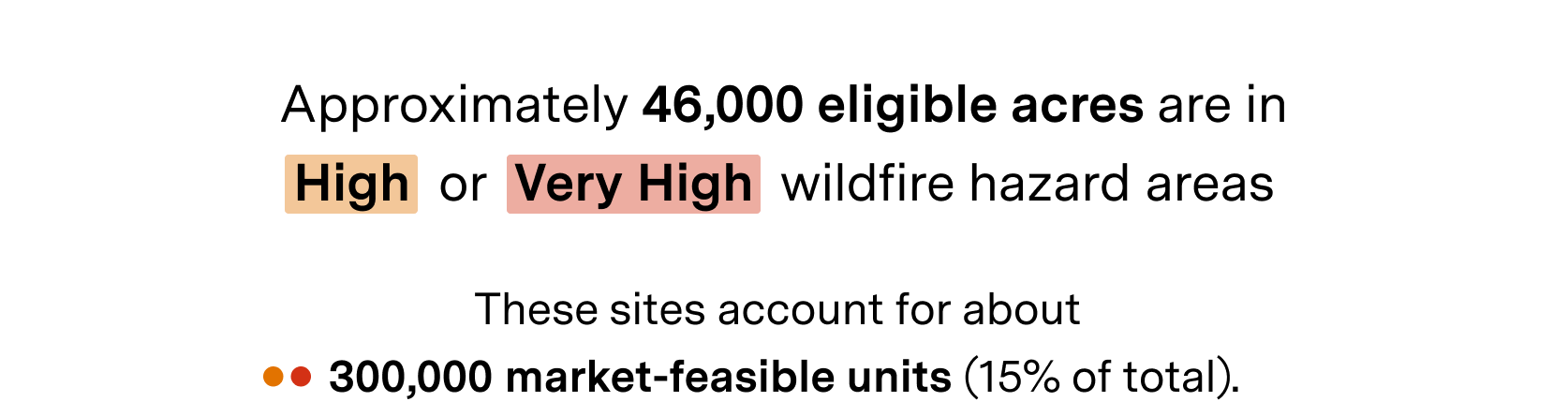

Taking a closer look at fire risk, we found that 46,000 SB 6-eligible parcels are in locations designated by CALFIRE as high or very high fire hazard areas. These locations support 300,000 market-feasible units, or 15% of the statewide market-feasible total. This suggests that excluding high fire hazard areas in the bill could help ensure development is not incentivized in dangerous locations, and would not have an outsize impact on total market-feasible housing capacity.

What are the state-wide tax and revenue implications of SB 6-enabled commercial-to-housing redevelopment?

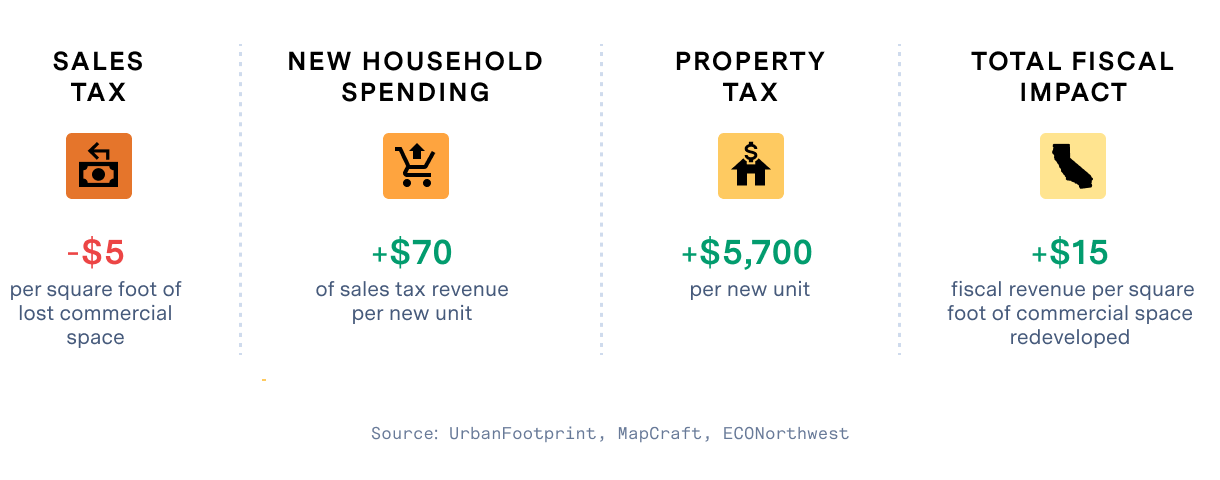

Fiscal analysis performed by ECONorthwest indicates that the commercial redevelopment facilitated by SB 6 would increase net tax revenues statewide, with any lost sales tax revenue offset by increased property tax revenue from residential and mixed-use redevelopment. The approach to fiscal impacts focuses on changes to sales and property tax revenue, but does not factor in impacts to jurisdictional operating budgets, or any impact fee collected. Our approach to fiscal impacts assumes that decreased commercial space would result in a loss of sales tax revenue; this is a conservative approach that is unlikely to occur in aggregate statewide, but may be reflective of impacts to a local jurisdiction as taxable sales might shift to nearby locations. The figure below compares the statewide average sales tax loss of $5 per square foot for lost and redeveloped commercial space with the expected revenues from new residential development.

Any potential losses in sales tax revenue are more than offset by the property tax generated by the residential construction, as well as the induced spending from new households occupying the additional housing units. Statewide, each square foot of commercial space that is redeveloped as a residential use would increase the fiscal revenue by $15. If all 2 million units of market-feasible residential were built over a number of years, it would generate an additional $6 billion in fiscal revenue statewide annually.

The fiscal impacts vary based on local conditions and apportionment, but in almost all circumstances would be expected to result in a positive fiscal impact. Factors influencing the magnitude of the fiscal impacts include:

- Density of the existing commercial use that is redeveloped

- Amount of sales-tax-generating (retail and hospitality) vs. non-sales-tax-generating (office) commercial space lost

- Volume of sales (per square foot) of sales-tax-generating commercial space

- Incomes and disposable spending of new households formed in the housing units developed

- Density and cost of construction for new residential units

Key Takeaways and Considerations for Policymakers

Our analysis shows that California’s commercial lands can accommodate significant housing growth and play an important role in addressing our deepening housing crisis. A bill like SB 6 could enable additional market-feasible capacity in the range of 2 million units, on par with the outcome of upzoning all single family to allow quadruplexes as proposed by 2020’s AB 3040, while stimulating net-positive fiscal benefits to the state and its jurisdictions.

Select refinements to SB 6 and bills like it could help to ensure consistency with other state climate and hazard objectives, and increase market feasibility in target redevelopment locations. Lawmakers might consider excluding high wildfire hazard areas from eligibility, while including other criteria that incentivize more ‘location-efficient’ housing growth within existing urban areas where energy and water use and climate emissions would be reduced.

Further, the analysis found that the bill, as presently written, may result in relatively low-intensity housing outcomes. Lawmakers might consider allowing more intense development in targeted areas by setting higher minimum densities above the minimums already established under SB 6.

Also, as map and data fanatics, we would be remiss if we did not point out that evaluating bills and policies like SB 6 would be infinitely faster and more accurate if there existed a consistent and up-to-date statewide zoning dataset for all 550 jurisdictions in the state. The UrbanFootprint Base Canvas provides such consistency for all existing land uses on every parcel, in every jurisdiction in the state. Having this for zoning as well would net huge benefits and facilitate better policy development driven by rapid and defensible analysis. We’d be very interested in advancing the development of a statewide zoning dataset and look forward to the day when such datasets are available to jurisdictions and policy analysts.