Considering the accuracy in impact projections and the effects from Hurricane Ian on local financial stability

In the aftermath of a major storm like Hurricane Ian, as communities look to put the pieces back together, the first topic discussed is broad-scale impact, public health and safety. Rapidly thereafter, attention turns to the economic strain that local and regional communities will be faced with. Credit analysts and public finance market participants are in critical need for information about impact, long-term credit risk, and short-term losses. But the data to answer these questions is hard to come by. Hurricane Ian is rapidly becoming a test-case for this challenge, however it is not an isolated event for analysis in public finance to lack the adequate data sources necessary to assess climate and other ESG risk. Instead, analysts must rely heavily on financial data and legal covenants.

With the increasing cadence and severity of natural disasters like Hurricane Ian on the horizon, analysts should be better prepared, with the proper data to assess credit risks through ESG lenses for pre-purchase credit underwriting and post event credit triage. That way, the next time a hurricane shocks meteorologists and increases its intensity at one of the fastest rates ever just before making landfall, we believe analysts will have the information they need to respond more rapidly and confidently post-storm.

In the case of Ian, estimates of damage so far are staggering: millions are without power, parts of the electrical grid are entirely destroyed, and countless homes face irreparable damage. UrbanFootprint analysis projects that a geographic area with $293 billion in assessed value is impacted. The unpredictability Ian’s force indicates significant risk in preparing for and understanding future disasters. But just how far off were predicted assessments?

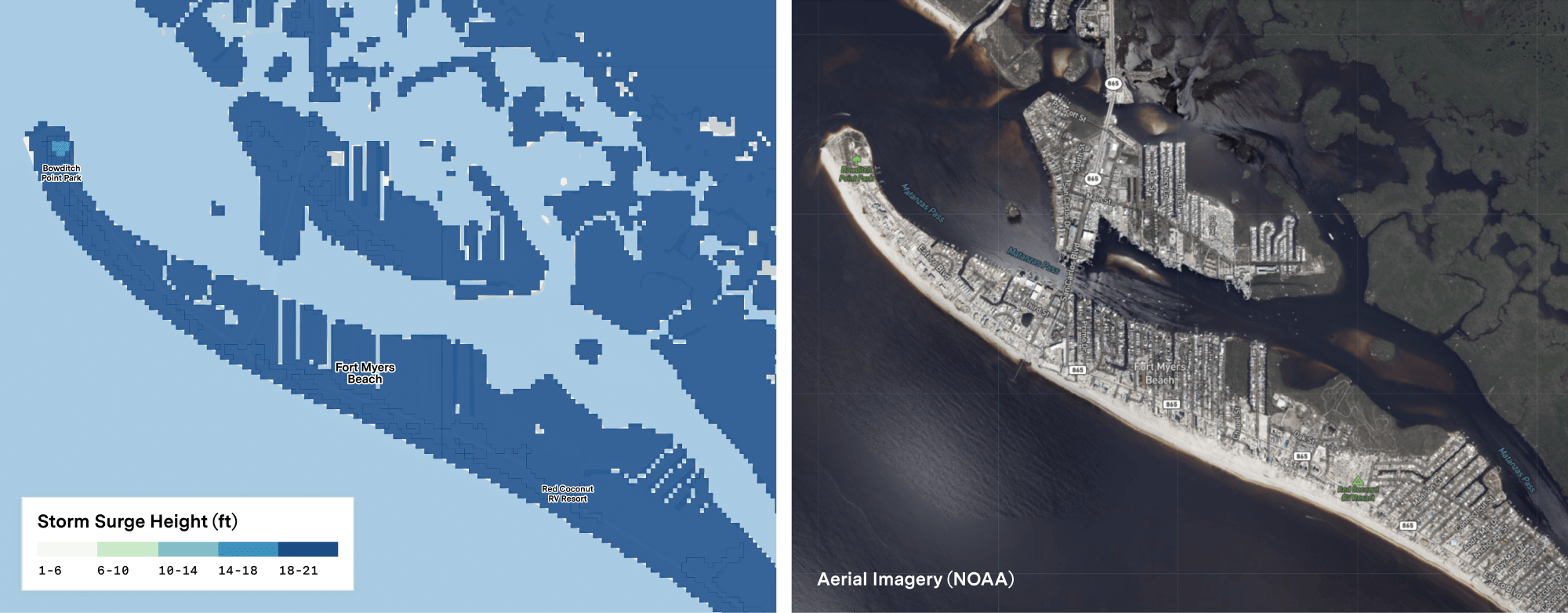

Zooming in to consider the accuracy in predicted impact for Fort Myers

Leveraging UrbanFootprint’s financial solutions, financial managers can see the prediction of storm surge inundation in case of category 4 storm at Fort Myers beach. As we see, nearly the entire city of Fort Myers Beach is predicted to be under 14 ft or higher of storm surge flooding. Based on further analysis, we find that this equals to ~$241M or 100% of the total assessed property value in this city being impacted. The prediction is confirmed by the aerial imagery (right) provided by NOAA to support the post Hurricane Ian emergency response efforts.

Rebuilding the local community

While models and predictions may never be perfect, there is building certainty around the impacts on a local community post-storm. Natural disasters may fundamentally change the makeup of a community, its tax base and its economy. This is especially true when a large portion of homeowners and businesses are under-insured or not insured at all. Rebuilding may be significantly delayed or abandoned when insufficient or no insurance policies are held.

When local communities recover in the wake of disaster, they rarely do so equitably, highlighting an additional threat for immigrants, people of color and low-income Americans who already face increased risks in the face of natural disasters. While many in the white middle class eventually rebounded successfully after Hurricane Katrina, the erosion of the Black middle class in New Orleans accelerated over the same period. The median Black household earned just over $25,000 in 2013, $5,000 less than in 2000, after adjusting for inflation. The median white household made more than $60,000, nearly two and a half times as much.

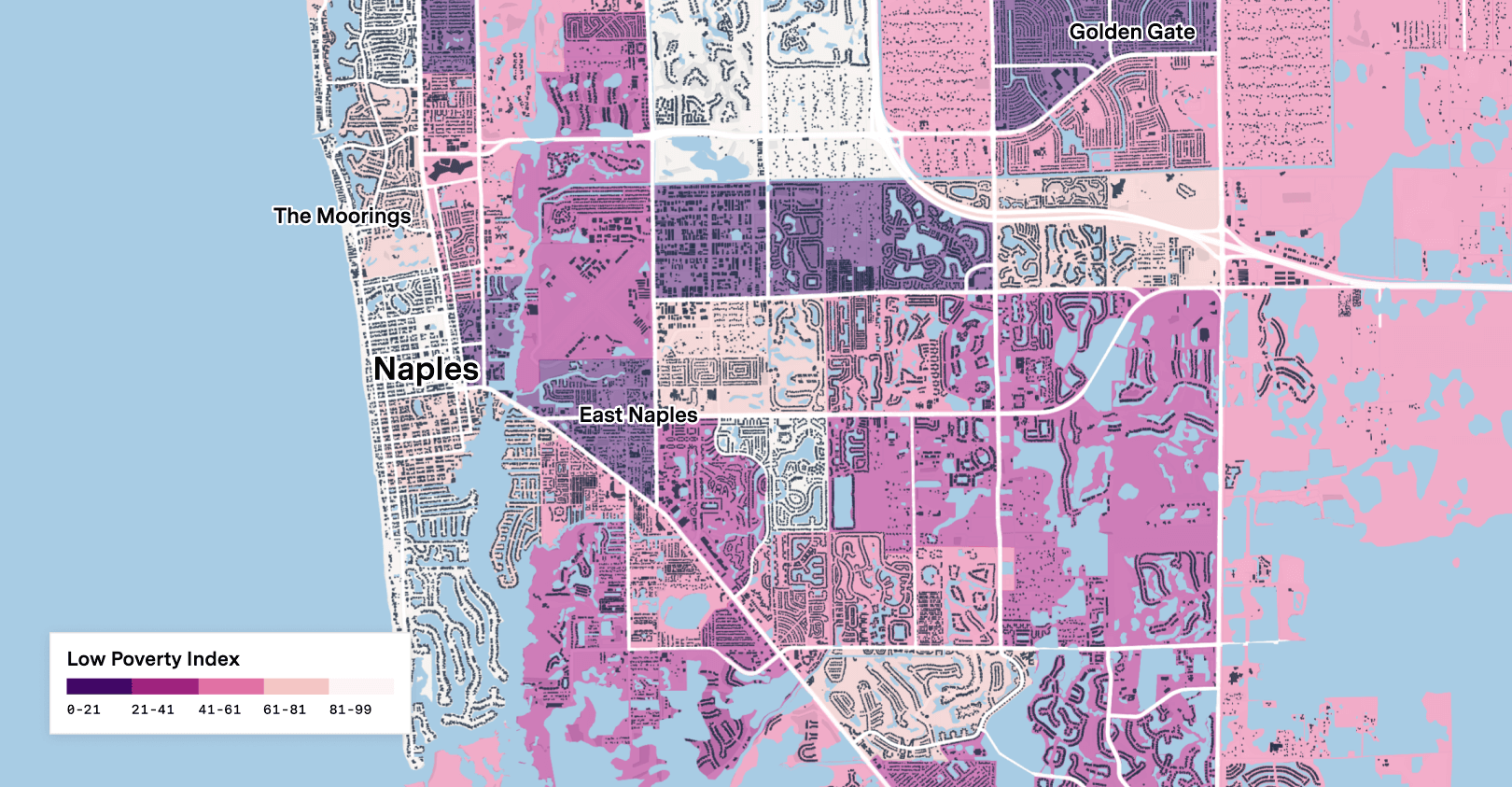

As the City of Naples struggles to help those impacted by the Hurricane to find shelter and access relief services, UrbanFootprint offers a unique social equity lens to solving this problem. Particularly for impact investors looking to invest money into communities of need, UrbanFootprint has significant expertise in identifying barriers that underserved populations may face in the recovery process and estimating the gap in service and need in a community. Uncertainty and increased hazard intensity due to climate change only make these efforts more critical to successful long term recovery.

How long can we rely on the FEMA lifeline?

On top of increasing climate risks and uncertainty that accompany the increasing number of billion dollar disasters federal aid, is also increasingly uncertain.

The national flood insurance program (NFIP) has calculated insurance rates for decades based on static risk measures, but new changes piloted last year as a part of FEMA’s Risk Rating 2.0 are actively reshaping the distribution of flood insurance costs and the cost benefit analysis of paying in to the federal program at all.

Homeowners of high value properties in particular now face rising premiums with the potential to curtail the property values of plots whose climate risk has not previously been adequately accounted for. Further changes proposed by the Biden administration on top of the new NFIP may inhibit new construction projects in some high-risk areas altogether.

In addition to these structural shifts in the insurance market, federal disaster aid distribution, which does not follow a reliable formula, adds another layer of uncertainty for investors and planners, and the continued barrage of costly disasters have raised questions about the degree to which federal dollars aid may be curtailed generally. Today’s dramatically changing landscape demands new levels of risk intelligence and awareness in order to accurately understand and price the resilience and danger a geographic area faces.

Clear insight into the financial risk associated with an individual obligor in the path of future climate events depends on an analyst’s access to better environmental hazard and social data. Asset Managers and Analysts need to incorporate environmental hazard and social considerations to manage risk by analyzing their overall portfolio exposure and keying in on high risk obligors and repricing their internal ratings based on these considerations.