Naturally, there are strengths and weaknesses of ESG criteria. Critics of the ESG paradigm claim that socially responsible investing detracts from profitable investments. Two sectors with the most potential for sky-high profits are tobacco and defense一areas typically antithetical to ESG.

There is also the argument that moving exclusively towards socially responsible investing decreases the diversity of a company’s portfolio and makes businesses operate less efficiently.

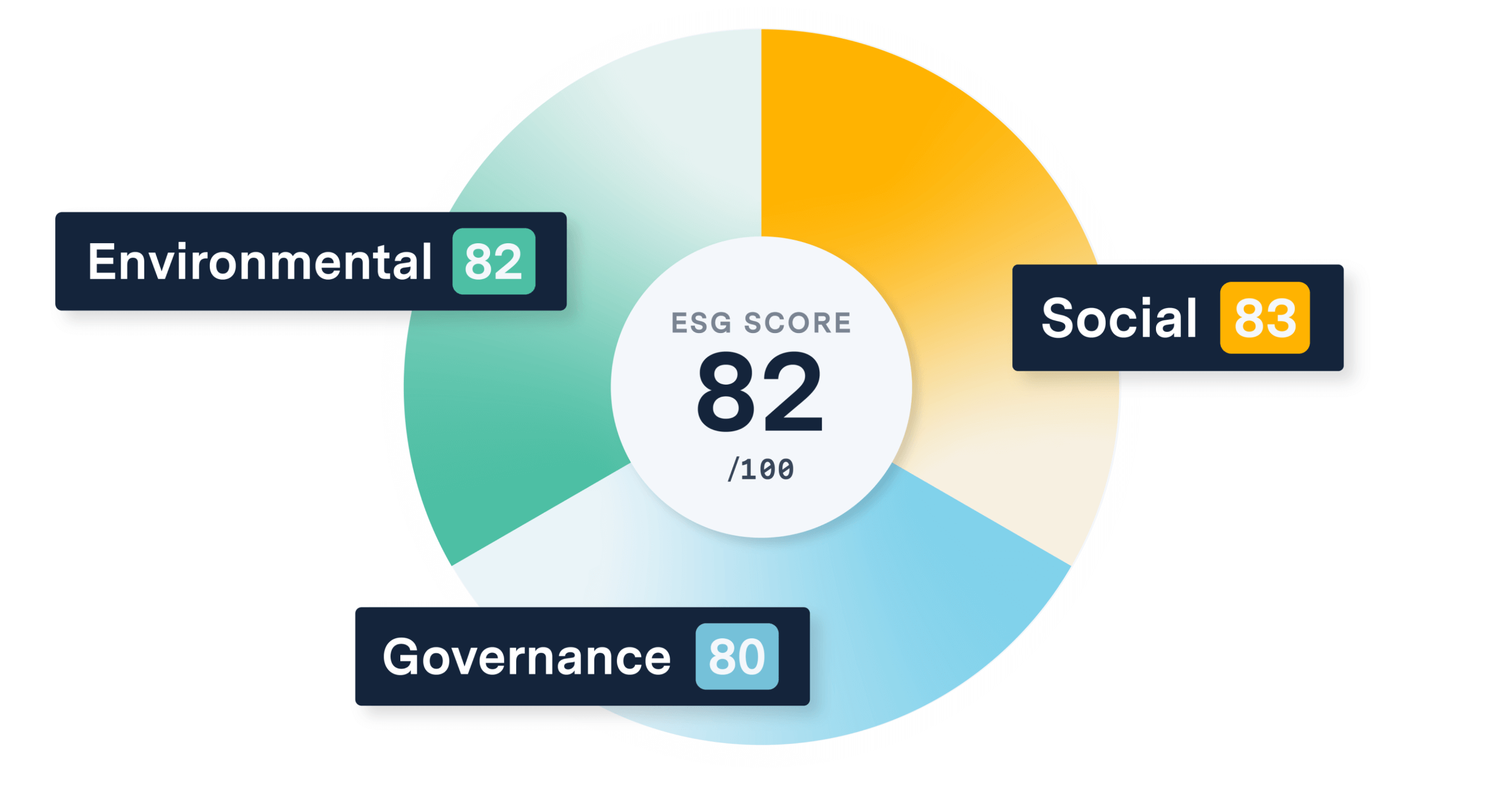

While these theories are up for debate, it is truethat ESG is tough to measure. There’s no formal standardization within ESG criteria, which makes it a challenge to compare scores across companies. For these reasons, analysts that oppose ESG argue that organizations should review a company’s quarterly profits and other financial statements to qualify their investments instead.

But other analysts disagree. Today’s data analytics providers can accurately process and consolidate ESG metrics to identify top-performing ESG companies. Plus, proponents believe that investing in socially responsible companies is often more beneficial in the long run. If an ESG-related scandal occurs, companies could be hit with heavy fines, lose customers’ trust, and suffer from other adverse effects of a poor brand reputation.

Companies with high ESG scores are also more likely to retain and attract customers who care about ESG. For advocates of ESG, the benefits of achieving ESG criteria outweigh the potential negatives. Ultimately, the goal of ESG is to inspire real change in investing. Companies should make equitable investments for the sake of improving society一not just for positive optics.

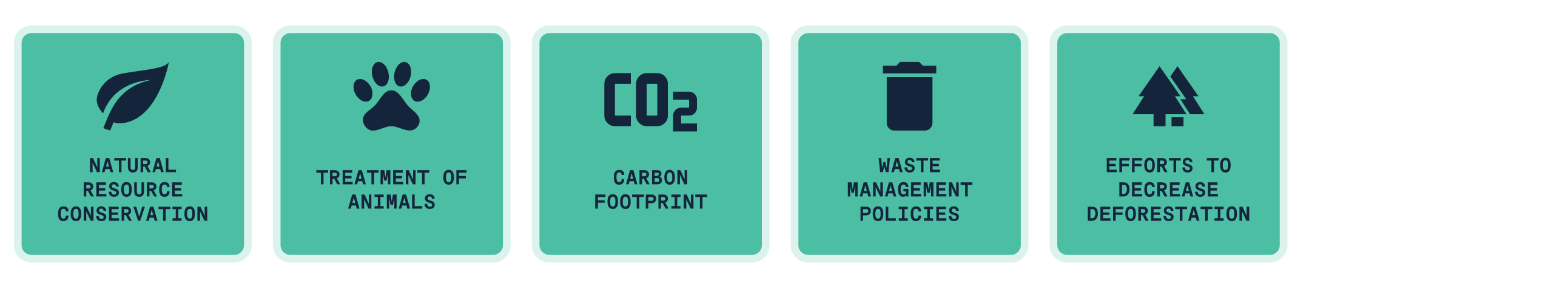

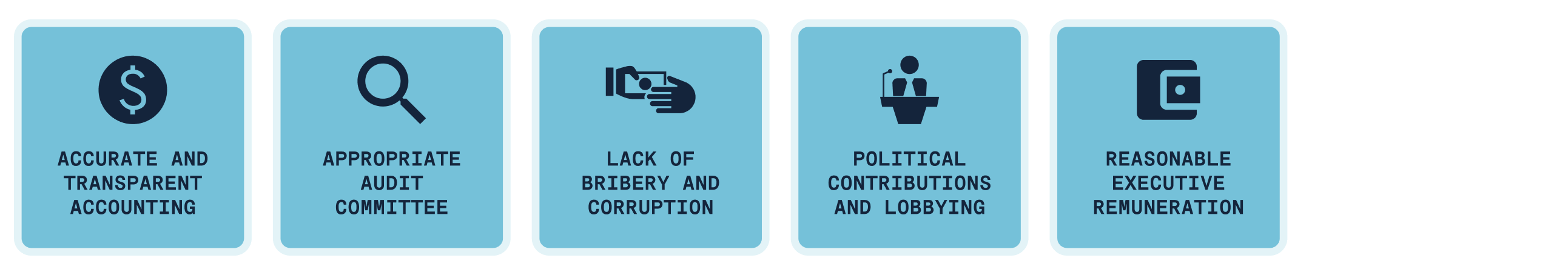

While there are pros and cons to ESG, reducing environmental impact, improving social factors, and instituting honorable practices only boost an organization’s credibility and performance. Organizations that recognize the importance of ESG and are able to adapt to it will have a competitive edge over the rest. As policymakers and consumers continue to push for greater ESG transparency, companies that are unwilling to adapt new practices may be left behind.

As the significance of ESG grows, so does the importance of using advanced analytics tools to help you reach your ESG goals. Since each ESG criteria is inextricably linked, attempting to improve one factor may have unforeseen consequences on another. UrbanFootprint can help you identify the correct path forward: their advanced analytics can run scenarios to help you understand the full context and impact of decisions.

Urban Footprint’s data analytics system parses complex intersections of data, providing a more holistic view of ESG criteria. With UrbanFootprint, users can tie granular urban, environmental, and mobility data to gain unparalleled insight into the potential impact of climate change, policy, and business conduct on local, state, and national communities. Equipped with accurate, relevant data, UrbanFootprint users can make more informed, effective, and equitable decisions.

Eager to try it out for yourself? Contact our sales team to learn more about how UrbanFootprint can empower data-driven ESG decisions.