The impacts of a major natural disaster, like Hurricane Ian, affect different types of entities in many ways. For state and federal agencies, their focus is on providing the financial and labor resources to assist the impacted area in recovering from damage. For more local communities, the top priority is assuring the individual people and businesses have what they need to avoid long-term economic downturn. In between that micro and macro view, are the large financial issuers like counties and states. In Part III of our Hurricane Ian assessment our focus turns to them.

The response to disaster is slightly different for each player within the economy. Yet in all cases, resilience is the ultimate goal. Funneling limited resources to where they are needed most. Each type of organization must have detailed insights and data on impact and damages to inform effective and efficient response efforts.

Assessment of Single Site Risk vs. Government Risk

Even though events like Hurricane Ian can have long term effects on a local community and the related tax base, larger issuers like counties and states are more diversified and therefore better positioned to manage the immediate effects of such events. However, even with multiple municipal bond holdings, some tax exempt bond issuers are regionally concentrated and rely on revenue from one or more physical locations. They will likely experience more immediate effects.

501(c)(3) non-profit business chains such as hospitals, senior living facilities, and schools may face wide-ranging challenges like infrastructure damage and repairs, employees being temporarily relocated, disruption to service, and more, which could impact both revenues and costs. Depending on the geographic distribution of their locations, there could be an unexpected and significant impact to the financial health of an issuer. Unfortunately, in most cases, analysts have not fully assessed the risk of these events or their possible effects in their analysis.

Considering how this may play out for an issuer with assets in Florida

In the weeks following the landfall of Hurricane Ian in Lee County, asset managers need to be able to understand the level of exposure across their portfolio. They will likely pay specific attention to unrated or higher yielding credits which may have experienced adverse impact in comparison to the rest of their portfolio.

To understand this risk, analysts need a solution at their fingertips to quickly locate which of their holdings own or operate facilities within the affected areas, or which provide services to the affected areas. Once they have visualized the path of the storm, they would then pinpoint where their holdings sit within the exposure area to assess what percent of assets or service base have seen direct impact from the Hurricane.

With the enablement of an immediate assessment of risk exposure across a portfolio, a manager then quickly triages their portfolio to prioritize and rank areas of focus and then focus any additional analysis on their holdings with a higher chance of being directly negatively affected.

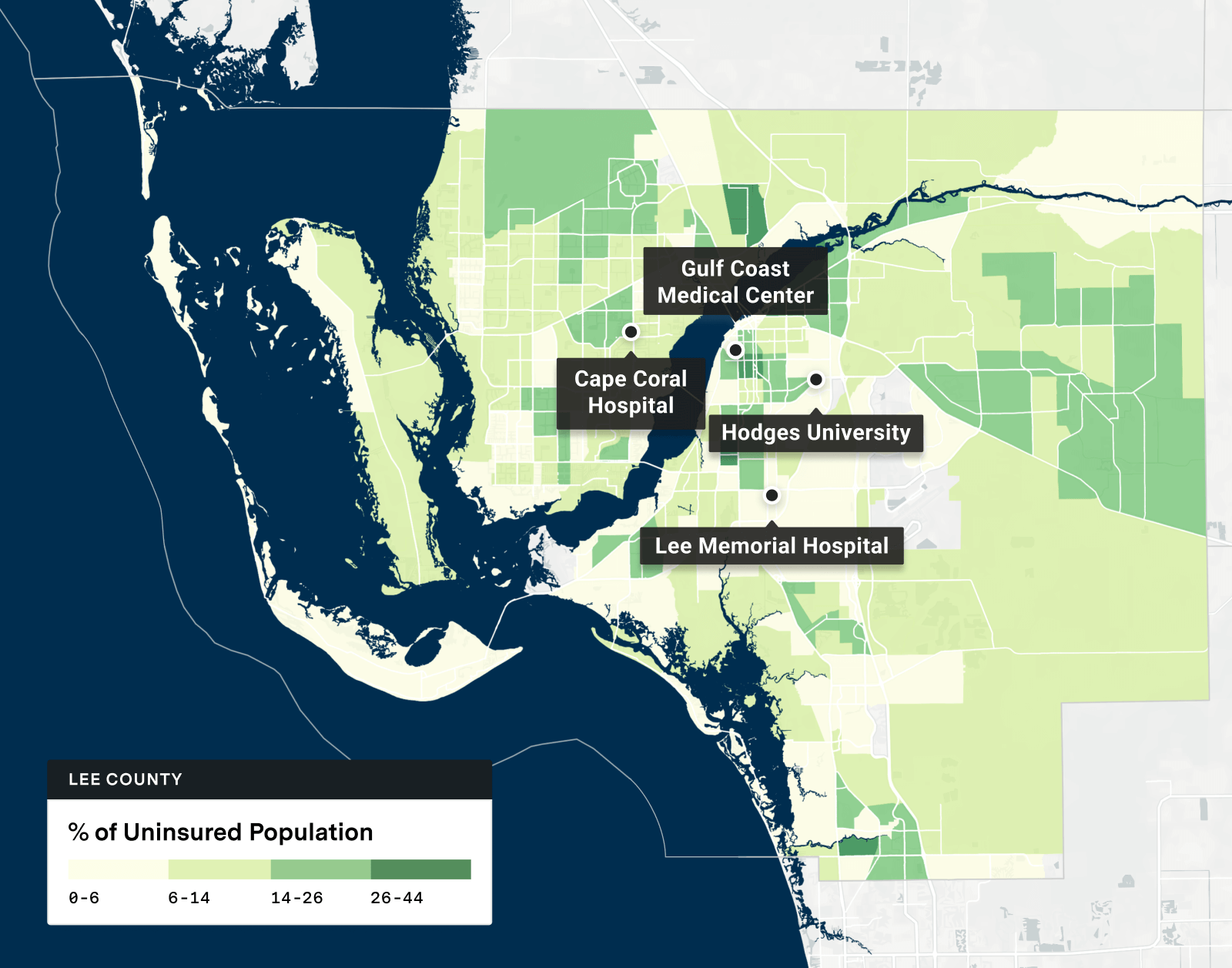

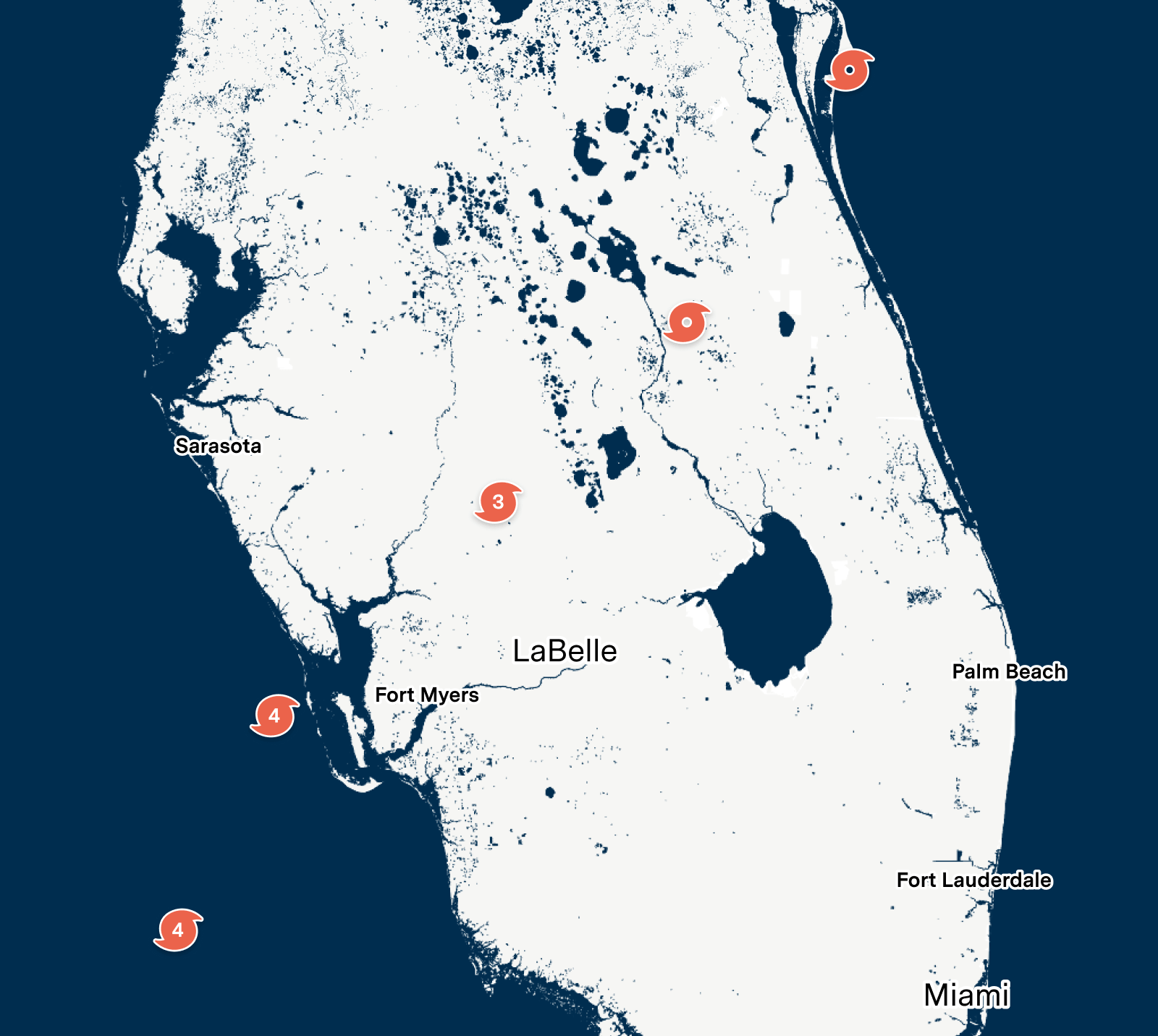

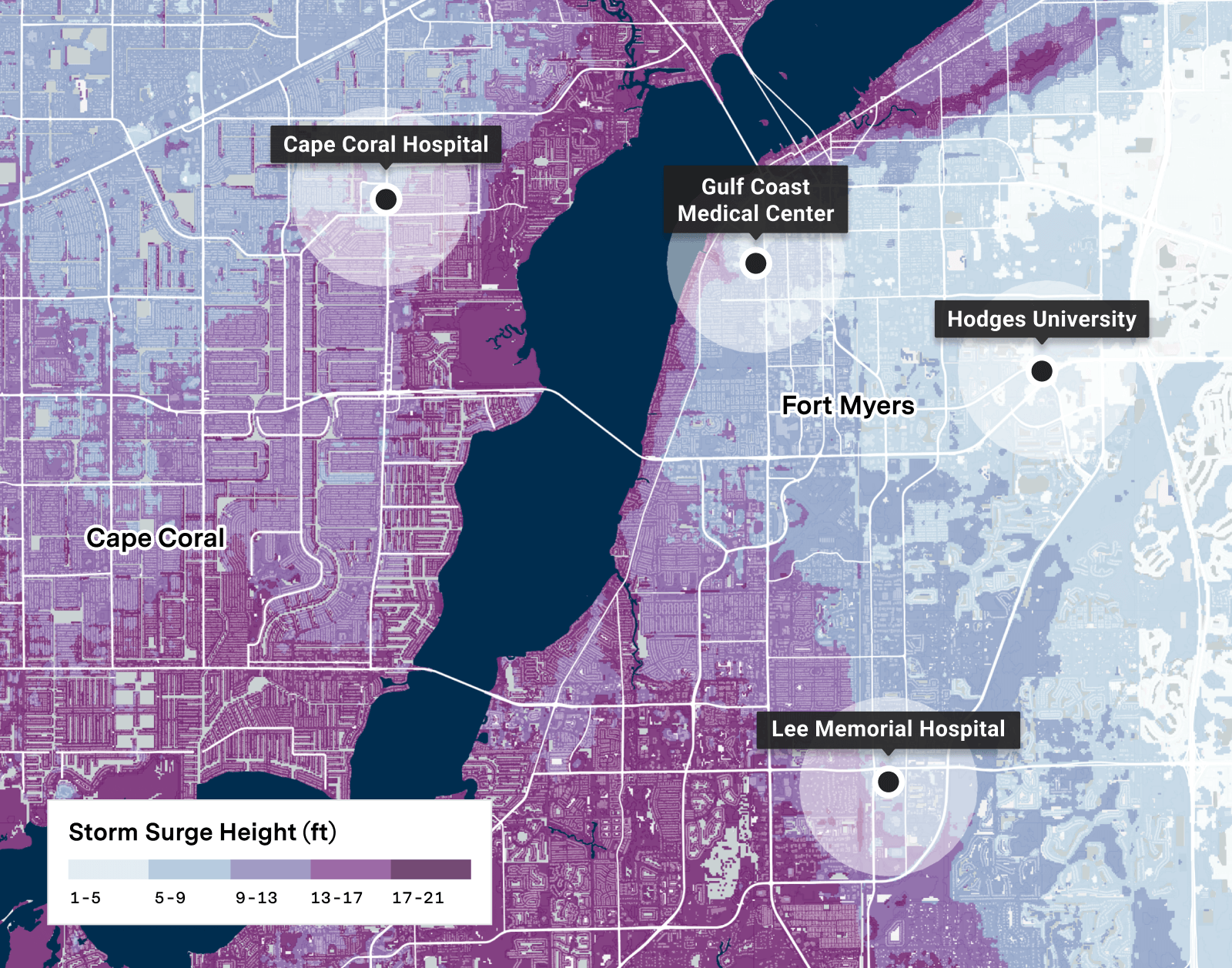

For example, let us take a hypothetical portfolio, where a Manager has located four at-risk holdings within the county. As we see on the map below, they have exposure to three healthcare credits and one Local University credit. However, out of those, only the healthcare credits lie in areas that are likely to be heavily inundated due to the CAT 4 Storm. With that knowledge, they can be prioritized over the university for a deeper analysis.

Community Impact Metrics help bring more relevant context

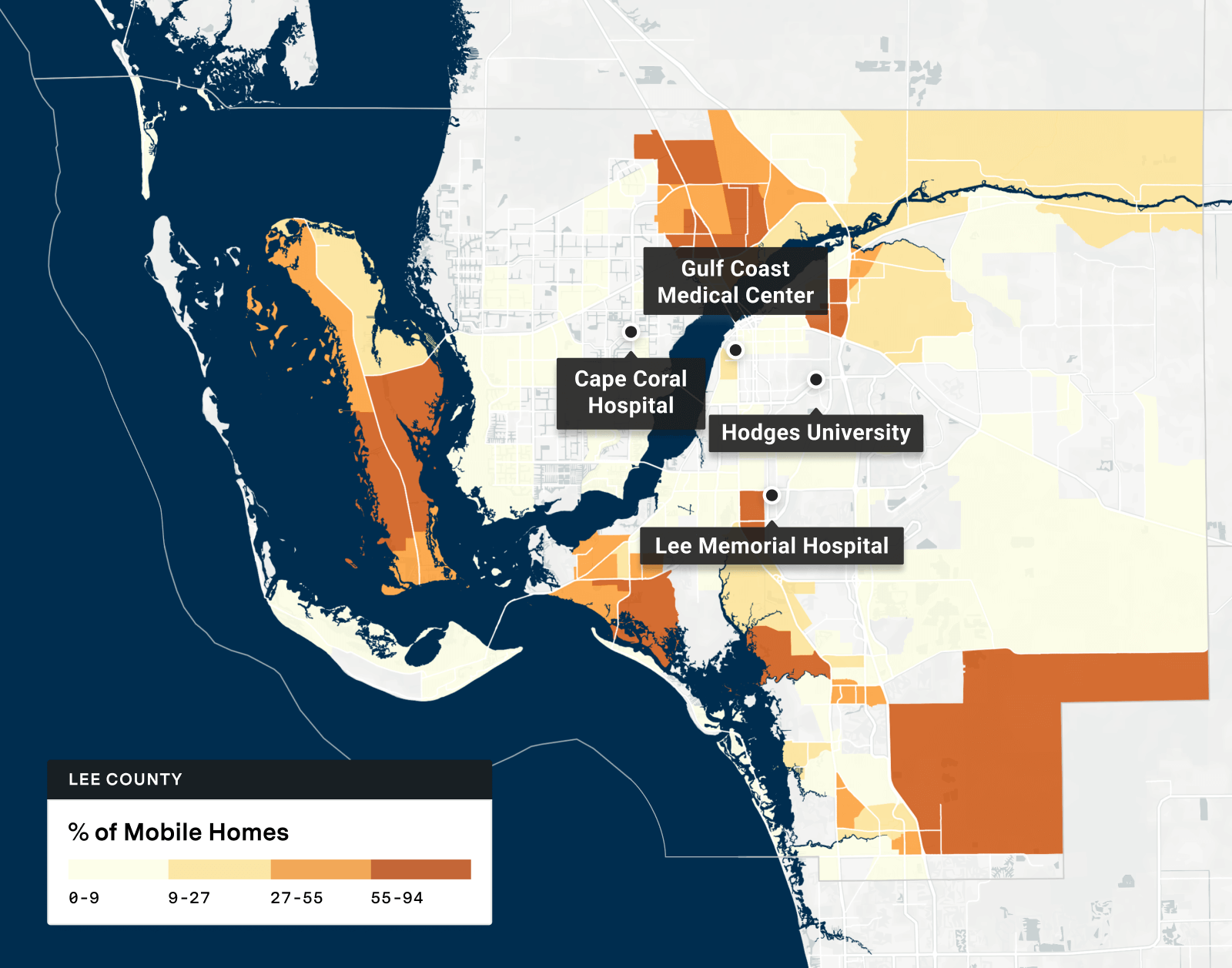

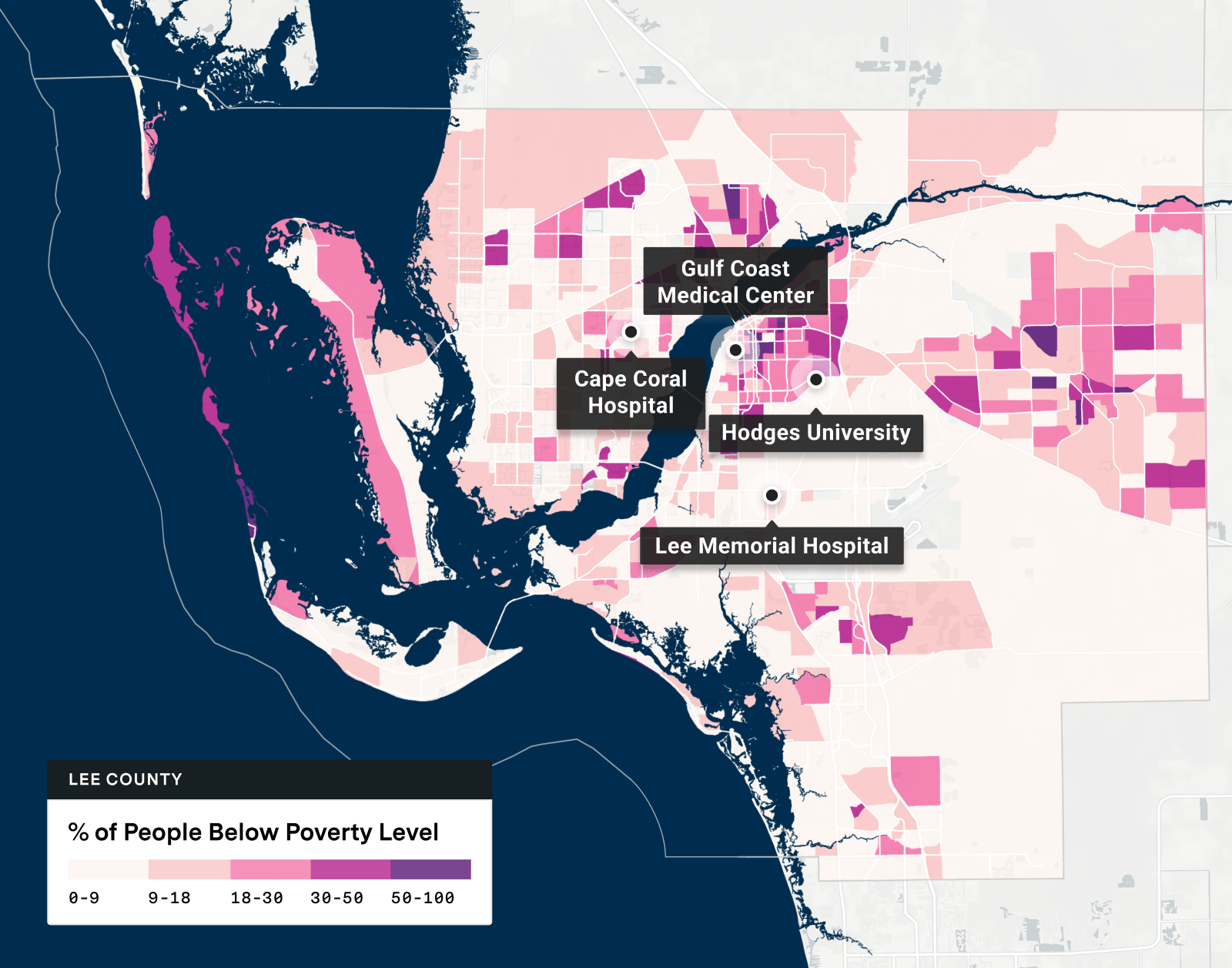

With clear detail on the physical exposure and impact to holdings, a Manager’s attention must take into account the level of resilience or vulnerability in the broader community surrounding the holdings. Analysis of the community demographics help to paint a clear picture of how vulnerable a community served by a facility like a hospital will be to any disruption in service. Community factors like these must be included when evaluating the level of risk associated with each individual holding against portfolio management mandates, such as the likelihood of a rating downgrade and the risk of default by the obligor holding.

As we see in this example, Gulf Coast Medical has a service area with a higher percentage of the community living in Mobile Homes. An analyst might consider this to be highly relevant since they are going to be more susceptible to displacement due to the storm. Furthermore, Lee Memorial has a service area with a higher percentage of population that is both uninsured and below the poverty level. An analyst could find these factors to be material to the long term financial risk of the hospital and could prioritize it for further analysis.

A comprehensive assessment of both physical and community vulnerability is critical to a full understanding of the financial risks posed by dangerous climate events. By providing portfolio managers with the most relevant and most impactful analyses first, the asset manager is better equipped to take full advantage of opportunities to increase, reduce, or maintain their level of exposure to various issuers affected by the storm, depending on what is appropriate for their investment mandates. This approach to portfolio monitoring builds confidence for managers and their ability to withstand the aftermath of the next major climate event on the horizon.

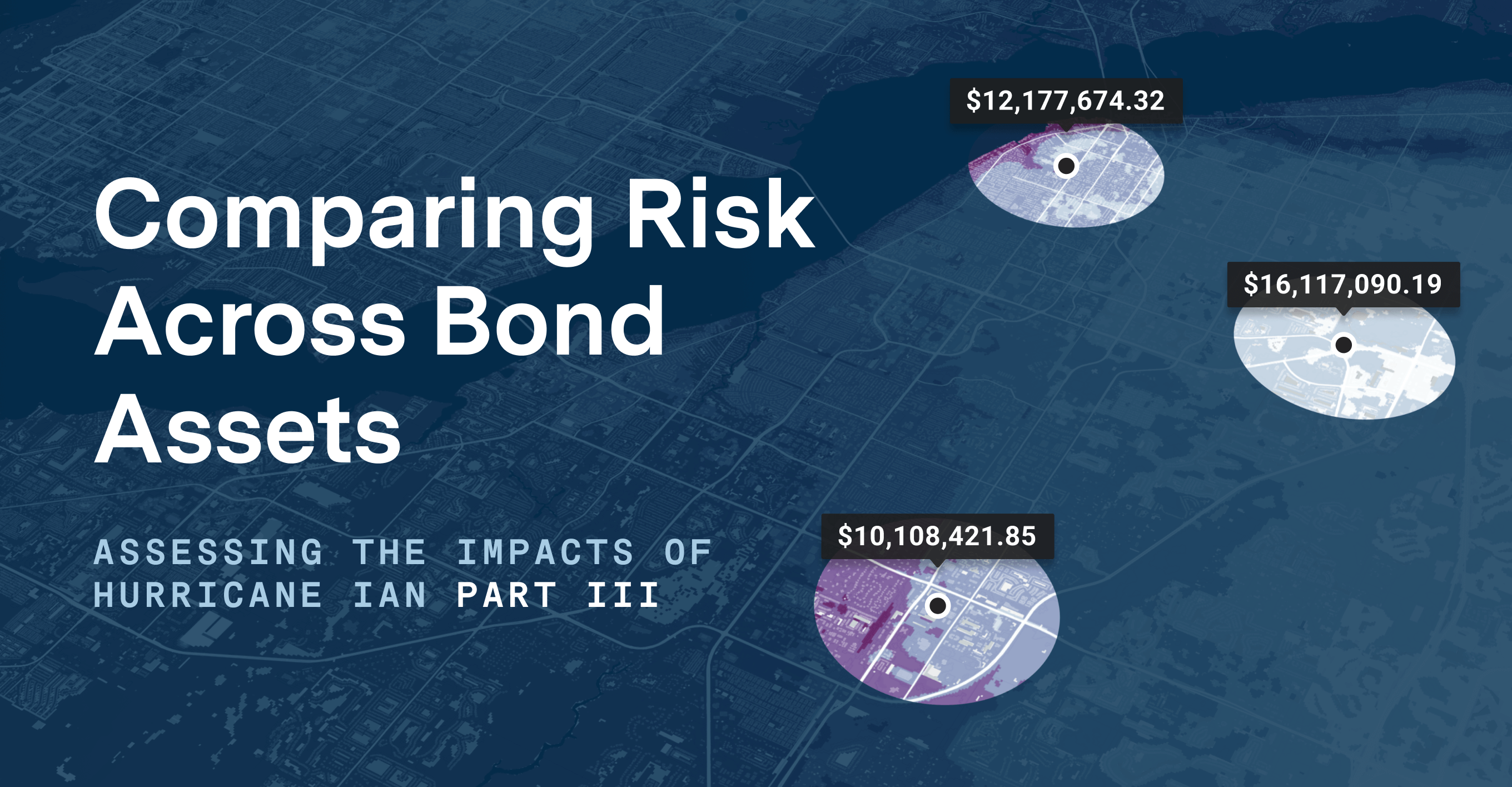

More than a visual

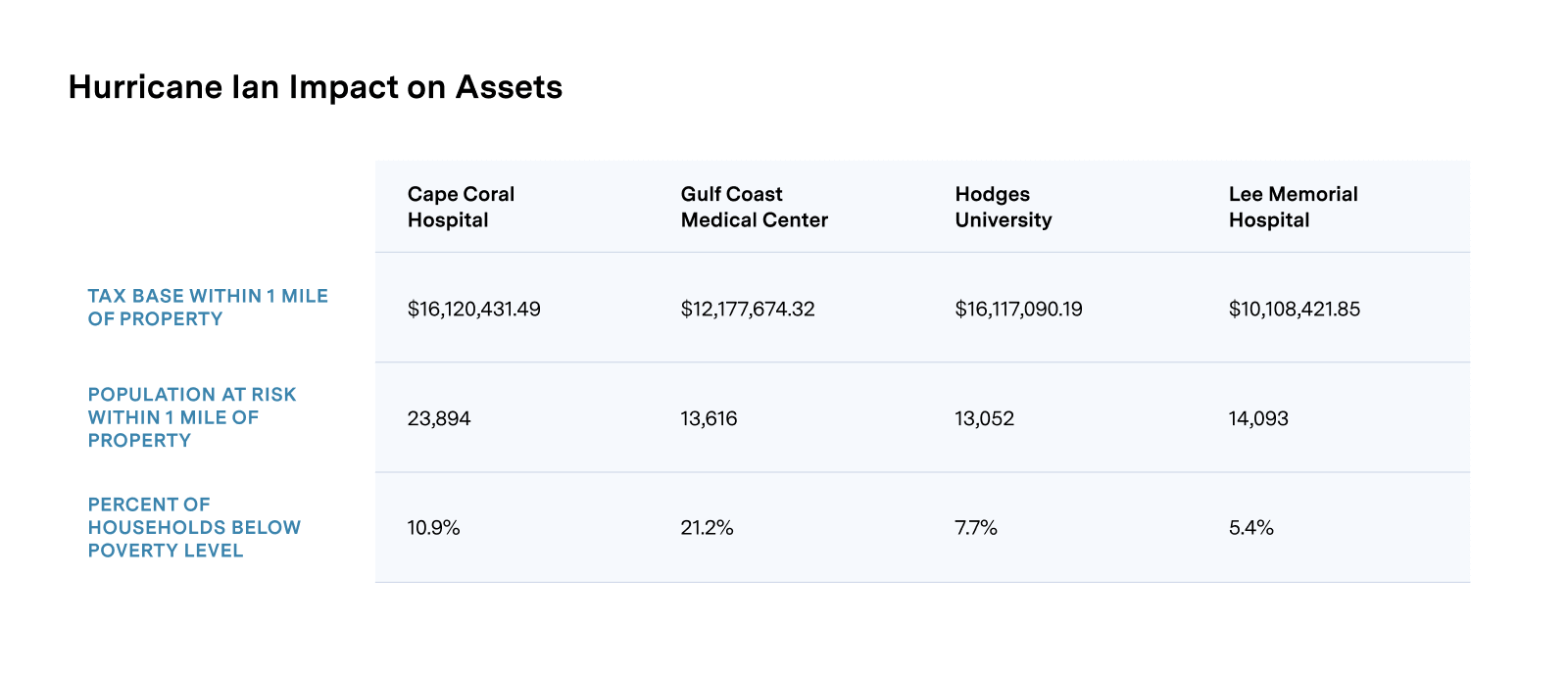

Further exploring the above visuals, analysts can then uncover the quantitative metrics tied to impact. For the four assets discussed above, we then analyzed the associated community, built environment, and financial data to generate estimates of impact. The asset manager will then leverage these metrics to assess material credit impact for their holdings.

Better data can help issuers improve the return on their portfolio

As the number of extreme weather events continues to rise annually, many issuers continue to struggle with assessing where they will face significant impact on their holdings. They need better tools to understand the material risk to their holdings amidst changing dynamics. Better data can help issuers to price, manage, and balance their portfolios for improved long-term return.