Today, social and environmental concerns are at the forefront of consumer, employee, and investor decisions. As the concerns surrounding these efforts grow, more and more companies are searching for metrics that accurately measure sustainability. ESG is meant to take “unmeasured criteria” that financial data often omits to get a fuller understanding of a company’s impact on environmental, social, and governance factors.

For instance, 49% of consumers believe it’s more important for a company to “make the world a better place” than to “make money for its shareholders.” Studies also show that 73% of Millennials are willing to pay more for sustainable goods. Additionally, in the United States, investment in funds and businesses that focus on environmental, social, and governance (ESG) risks reached $357 billion in December 2021一a significant increase from $236 billion at the end of 2020. Blackrock has also reported a “tectonic shift” to sustainable investments, sharing that institutional investors expect to double the sustainable assets they’re managing over the next five years.

As the pressure for companies to be more ESG-focused rises, it’s hard to know the true impact of these efforts.

And while many companies use ESG scores to drive investing decisions, it’s difficult to know exactly what ESG scores represent. In this piece, we’re clarifying what an ESG score is, how it’s calculated, why it matters, and how to incorporate it into your company’s strategy.

What is an ESG Score?

Like we mentioned earlier, ESG stands for environmental, social and governance; an ESG score, then, is meant to measure how well a company or business addresses risks tied to these three areas in its day-to-day work. An ESG score is an aggregate assessment of those risks, based on a scale of 0-100. (We’ll talk more about each of these areas and how they’re scored in more detail later.) In other words, if a company wants a good ESG score, it should strive to minimize risks to the environment and society even as it works to maximize profits.

In practice, this means companies tie initiatives to each of the components of ESG. For example, an organization may have projects dedicated to energy efficiency (environmental), worker safety (social), and board of directors diversity (governance).

Investors use ESG scores to form an opinion about a company’s long-term potential; companies that prioritize their scores are seen as capable of mitigating risks. A low ESG score can influence a company’s perceived viability. A poor ESG reputation will eventually hurt a company’s bottom line. That said, ESG scores alone do not determine a company’s potential; financial analysts combine ESG scores with various other measures of success to make decisions and offer guidance.

Who calculates ESG scores?

Typically, ESG scores are determined by third-party vendors specializing in ESG ratings. There are over 140 US firms that provide ESG scores, and each has a slightly different approach to calculating scores. While it can be helpful to have multiple perspectives, the discrepancies among vendor calculations make it difficult to compare one company’s ESG score to another.

How is an ESG score calculated?

Analysts calculate ESG scores via proprietary machine learning algorithms, meaning no two providers will assess the same company in the same way. Each provider’s data can also vary, with sources including (but not limited to):

- Internal metrics like company annual reports or disclosures

- News stories and media about a company’s accomplishments or controversies, processed through Natural Language Processing

- Published research in scientific journals that measures the impact of environmental or social issues, like deforestation or community resiliency

- Information from government databases about topics like climate monitoring, geological surveys, or public health

- NGO (Non-governmental organizations) communications that quantify social issues, like water scarcity

- Social media sentiment on sites like LinkedIn, Twitter, and Facebook that discuss

Each of these data points is weighted differently depending on a firm’s estimated potential impact on the world in a specific timeframe.

Regardless of the differences in data and scoring mechanisms, every ESG score provider gives companies an output of three separate environmental, social, and governance scores that are merged into a cumulative ESG rating.

What do ESG scores measure?

Each ESG factor has its own set of measurable criteria contributing to the overall ESG score. Environmental criteria evaluate a company’s environmental impacts, and their efforts to reduce them. Social criteria measure a company’s relationship with their social environment, like their employees or local communities. Governance criteria gauge corporate responsibility, which could include the responsibilities of executive management or shareholder’s rights. Overall, an ESG score should indicate a company’s dedication to responsible environmental stewardship, their willingness to strengthen existing communities, and their corporate governance accountability. Here are a few examples of criteria that fall under each of the three categories:

Environmental criteria

- Biodiversity and land use

- Carbon footprint

- Climate policies

- Natural resource conservation

- Waste byproducts

Social criteria

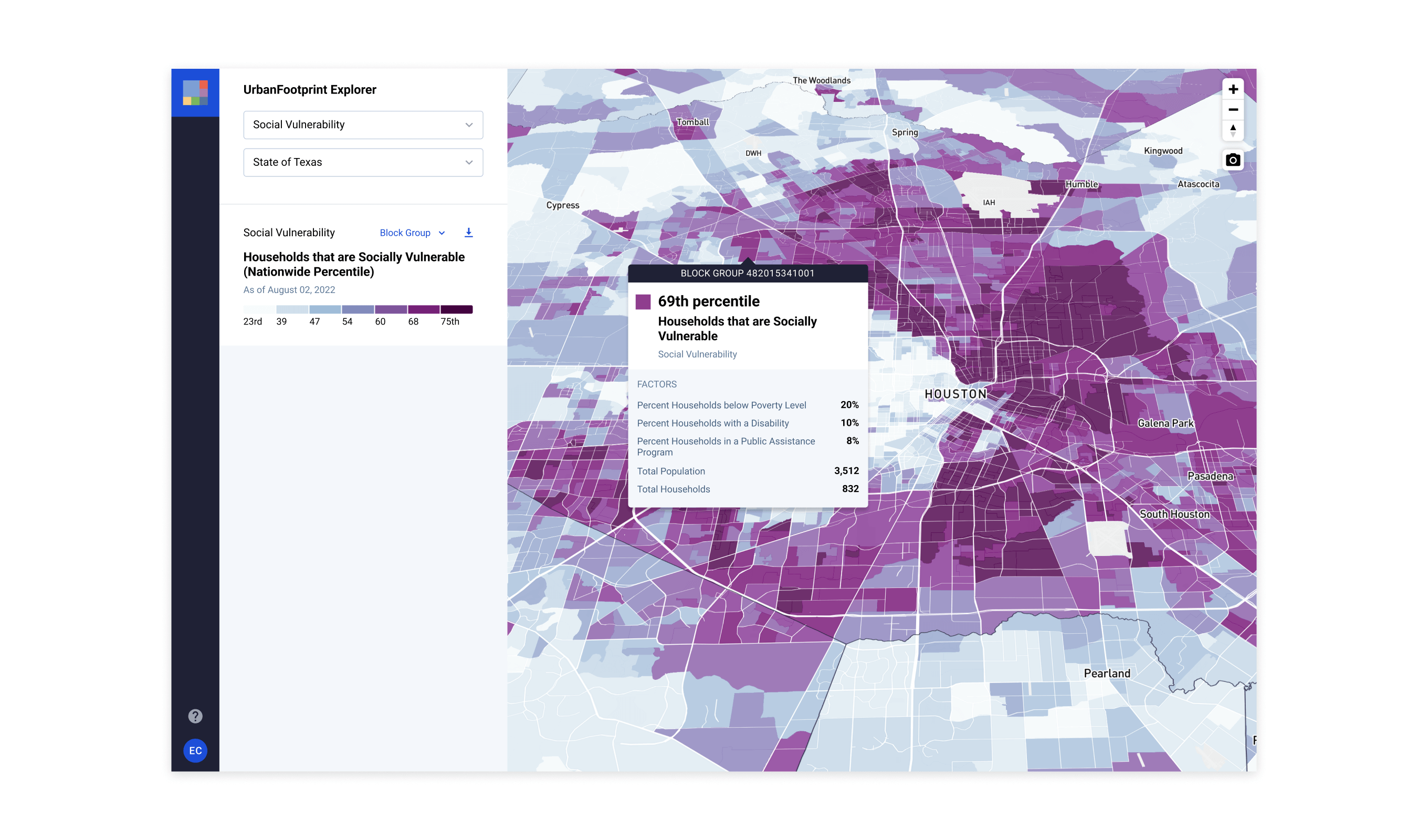

- Social vulnerability

- Consumer protections

- Disadvantaged or priority populations

- Supply chain management

- Health and demographic risk

Governance

- Accounting practices

- Board of Directors diversity

- Business ethics

- Executive compensation

- Pay ratios

While the examples above are delineated into categories, in reality, these criteria are often intertwined. For instance, a poor executive leadership decision could lead to waste byproducts that impact the health and safety of a community. The complex, interconnected nature of ESG criteria is what makes ESG scoring such a challenge. These intersections are often a key aspect to interpreting ESG scores, and the overlap between variables makes it difficult to determine where resources should be allocated. But at the same time, companies that are able to analyze these intersections effectively can make a faster, larger, and more positive ESG impact. That’s why companies often turn to third-party software to get a more holistic picture of their present and future ESG achievements. This way, companies can improve faster with fewer resources.

What is a good ESG score?

While discrepancies exist within the ESG scoring framework, thankfully, all ESG scores are calculated using the same scale of 0 – 100. As you might imagine, specific ranges represent excellent, good, average, or poor scores. Let’s review each in greater detail:

- Excellent – Excellent ESG scores are at or above 70. These companies have demonstrated outstanding efforts to evangelize ESG throughout their organization, follow ESG best practices, and have proven their dedication through their performance. Organizations with excellent ESG scores have little to no negative impact on people or the environment.

- Good – A good ESG score is between 60-69. Companies that obtain a good ESG rating follow most ESG best practices, and their work does little to harm the environment or society.

- Average – Average ESG scores are between 50-59. The company likely isn’t implementing most ESG best practices, isn’t actively working toward ESG goals, and has adverse environmental, social, or governance effects.

- Poor – A score of 50 or less is considered a poor ESG score. Companies with poor ESG ratings have not adhered to ESG best practices. They currently have a demonstrably negative environmental impact and do not treat their employees well.

While a low or high ESG score may give investors high-level insight into a company’s ESG performance, it doesn’t tell the whole story. For example, despite the notoriety of the oil and gas sector on the environment, companies within this sector could spearhead initiatives to employ low-income or otherwise disadvantaged workers to offset their low environmental score. This means that an ESG score should not be the only metric that companies use to evaluate potential investments. In fact, many companies are turning to third-party ESG providers to get a comprehensive view of the complex interplay between data points.

Why do ESG scores matter?

Unsurprisingly, people prefer to invest in companies that manage their risks better than their competition. Companies with high ESG scores appear sustainable, boast fewer liabilities, build positive brand reputations, and maintain strong relationships with their clients and stakeholders. As a result, these companies have an advantage when attracting talent, impressing consumers, and raising capital.

Recall that statistic we mentioned earlier, that as of December 2021 in the U.S., financial investment in actively managed ESG fund assets totaled $357 billion in December 2021—up 51% from $236 billion in 2020. Clearly, investors are paying attention to and backing ESG-focused companies—and it’s paying off. According to a 2022 report, “between 2013 and 2020, companies with consistently high ESG performance tended to score 2.6x higher on total shareholder return than medium ESG performers.” When companies benefit from investing in one business with an excellent ESG score, they are likely to expand their portfolio and continue this investing strategy.

Limitations of ESG scores

While ESG scores are helpful benchmarks, they shouldn’t be the only metric that a company relies on when making investment decisions, as an ESG score alone isn’t indicative of a company’s long-term prosperity.

To make a fully informed judgment on a company’s future success, organizations must pair ESG scores with extensive financial and operational due diligence. It’s important to remember that the market can also play a role in companies’ success. Investors should be mindful that companies with high ESG scores occasionally underperform in the market, and some companies with low ESG scores post incredible market gains.

Furthermore, ESG disclosures aren’t yet regulated in the United States, and the lack of standardized frameworks makes it challenging to know how a score is determined. There can be serious discrepancies over how companies analyze data and tabulate scores. Third-party ESG ratings providers might use unique metrics, scoring systems, or they might sort criteria differently within the three components of the ESG framework. This means that the same company can have several different ESG scores, despite the fact that ESG ratings companies score the same metrics and criteria. Of course, this lack of standardization makes the impact of ESG scores even more difficult to measure. That being said, there is current mounting legislative pressure to standardize ESG. As ESG moves to the forefront of investors’ strategies, standardization is likely to follow.

Get the full ESG picture

As ESG becomes a bigger focus, there is a greater need for accurate measures of ESG performance. ESG scores serve as a proverbial yardstick, assessing a company’s commitment to ESG best practices. Although there can be discrepancies among ESG scores, they are still valuable predictors of a company’s future success and commitment to their mission.

But ESG scores are just one element of the investing equation, and investors want additional context to justify their decisions.

UrbanFootprint—the world’s first urban intelligence platform—helps you gather the urban, climate, and community resilience data you need to understand markets and assess company risks. Equipped with nationwide data and sector-specific insights, UrbanFootprint highlights key intersections of data that, historically, were difficult to parse without sophisticated data analytics. Using UrbanFootprint, you can make corporate decisions that have a positive and sustainable impact, all while improving your ESG score.

Want to learn more? Talk to a member of our team to discover how you can leverage UrbanFootprint’s data, mapping technology, and analytics tools.

About UrbanFootprint

Never Wonder Where – UrbanFootprint enables companies, utilities, governments, and their community partners to cut through the noise to make high-impact decisions leveraging targeted, actionable data and location analytics. Assess risk, understand markets, close assistance gaps, and make better investment decisions with the most powerful and comprehensive urban, climate, and community resilience data platform available, anywhere.