The Census Bureau estimates that roughly 15% of tenants are currently past due on rent.

Navigating the new housing landscape

The past two years have seen an unprecedented housing shift amidst a global pandemic. On the one hand, an uncertain job market and the shuttering of many businesses put more people at risk of foreclosure and eviction than any time since the 2008 global recession. On the other hand, competitive markets and rising prices have put home equity at an all time high in the U.S., surpassing $27 trillion in June 2022.

All signs point to further housing instability in the near future, which puts added pressure on government agencies and their community partners to reassess their assistance programs.

Ending the emergency rental assistance program

The Census deployed the Household Pulse Survey to collect frequently updated data on changes to meaningful metrics such as household status and employment conditions during the pandemic. But, what can communities do to ensure stability and resilience after that survey expires?

Prior to the pandemic, many people in the United States knew little about housing assistance programs. Unexpected and protracted hardships changed that, as more and more people entered uncertain and risky territory regarding their everyday cost of living expenses and monthly payments. This drove the federal government to act:

- December 2020: Congress passed the Emergency Rental Assistance Program (ERA1), to provide $25 billion to prevent a nationwide flood of evictions.

- March 2021: Congress passed a second package (ERA2) of $21.55 billion.

- September 2025: The funds, which are available to households below 80% area median income (AMI), will expire.

The nearly $47 billion in aid offered states and cities the opportunity to support their communities in need, but distributing those funds was and continues to be a challenge. As of Q4 2021, only an estimated 15% of eligible households had received assistance, meaning there is a significant gap between households in need and households served.

Rents hit all-time high

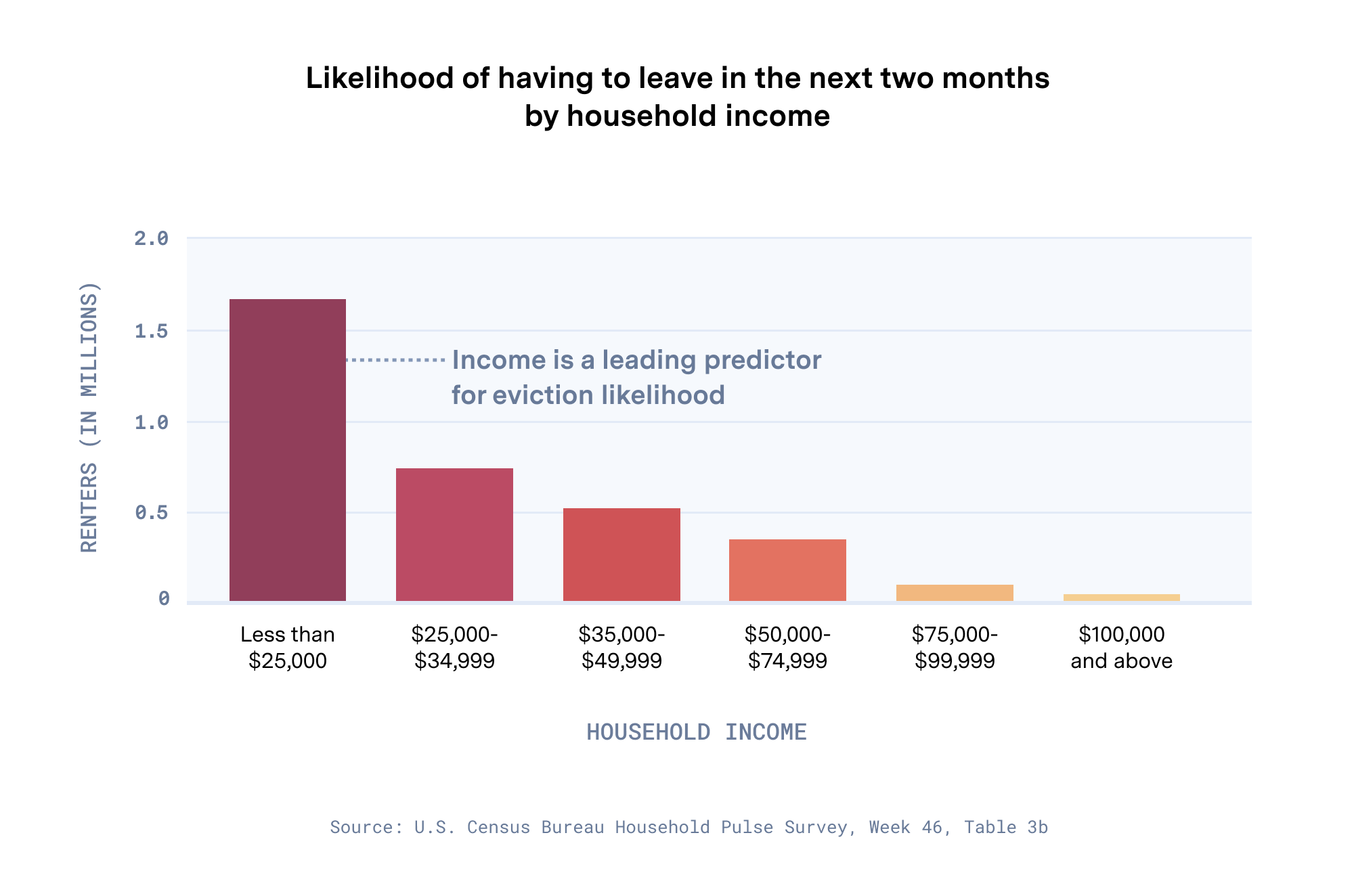

A major hurdle for aid distribution is that at-risk households for eviction are not a static population. Financial hardship, massive layoffs, and other factors can upend seemingly stable homes.

In recent months, bidding wars that defined home purchasing during the pandemic have now entered the rental market, driving up prices and pushing once stable tenants into risky territory and driving some low-income renters into unknown conditions. This is happening at a moment in which rental occupancy has reached an all-time-high—97.6% in the first quarter of 2022. This supply shortage amid rising demand drove median rent prices in June 2022 to surpass $2,000 for the first time in history—that’s an increase of more than 11% from last year.

As the busy summer and fall lease renewal periods approach, many tenants will feel the impact of rent increases which could lead to price-outs and evictions. The Census Bureau estimates that more than eight million tenants are already past due on their payments.

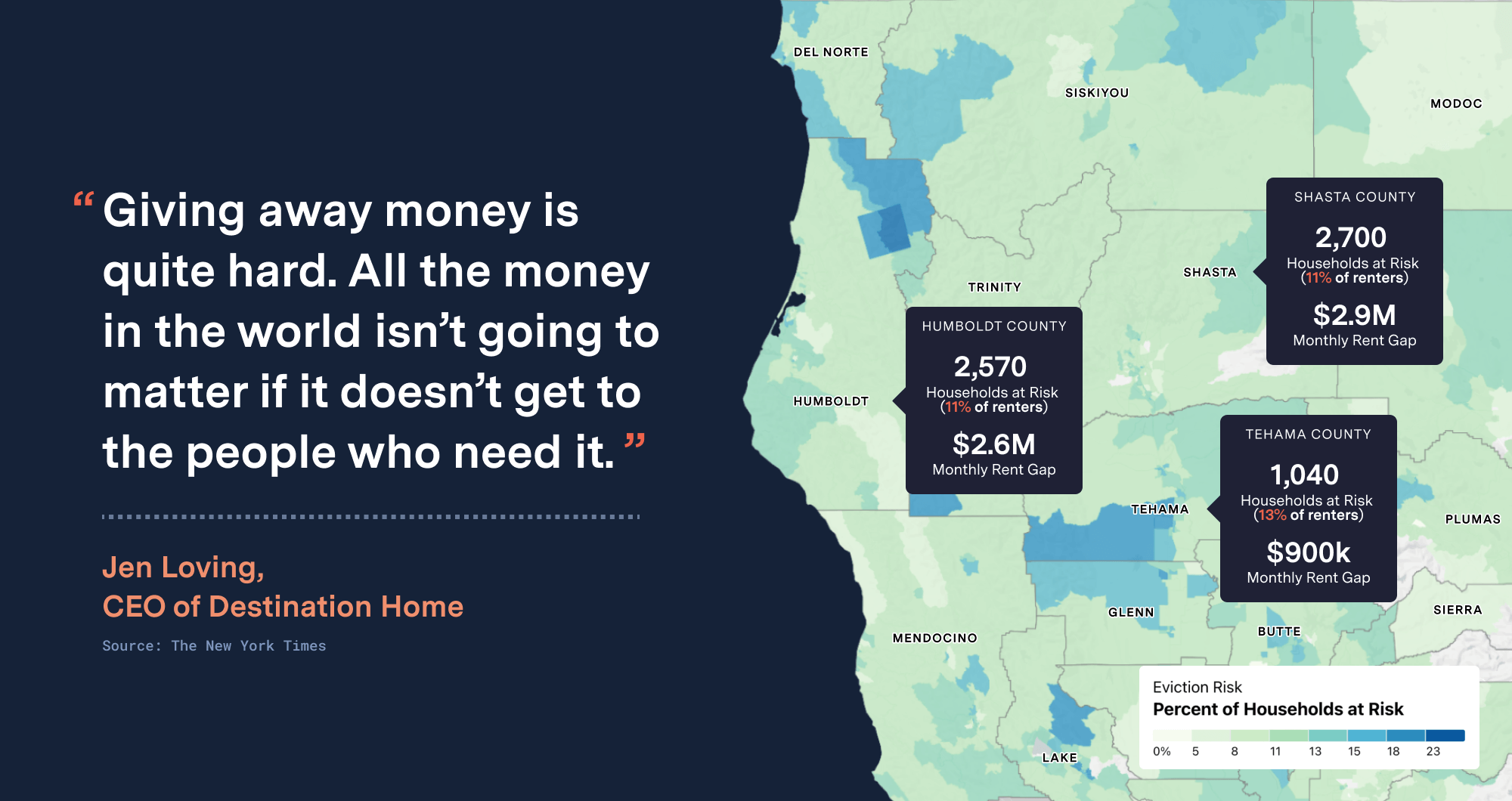

Some communities are hit harder than others

Eviction rates in the U.S. are higher than any peer country. Nearly 1 in 5 people, totaling about 60 million individuals, are renters, but not all face the same eviction risk levels and its long-term effects. Communities of color, for example, have lower rates of homeownership and comprise nearly 60% of rental households, which means they are more likely to experience the negative effects of evictions.

According to the Brookings Institute:

“Low-income tenants who are displaced are generally forced into substandard housing in poorer and higher-crime neighborhoods. Evictions cause psychological trauma, increase the likelihood of suicide, increase emergency room usage, decrease credit access, and lead to homelessness.”

These effects are compounded by the fact that at-risk households are often predictors of additional social and health concerns, and can trigger additional challenges in other sectors of the community.

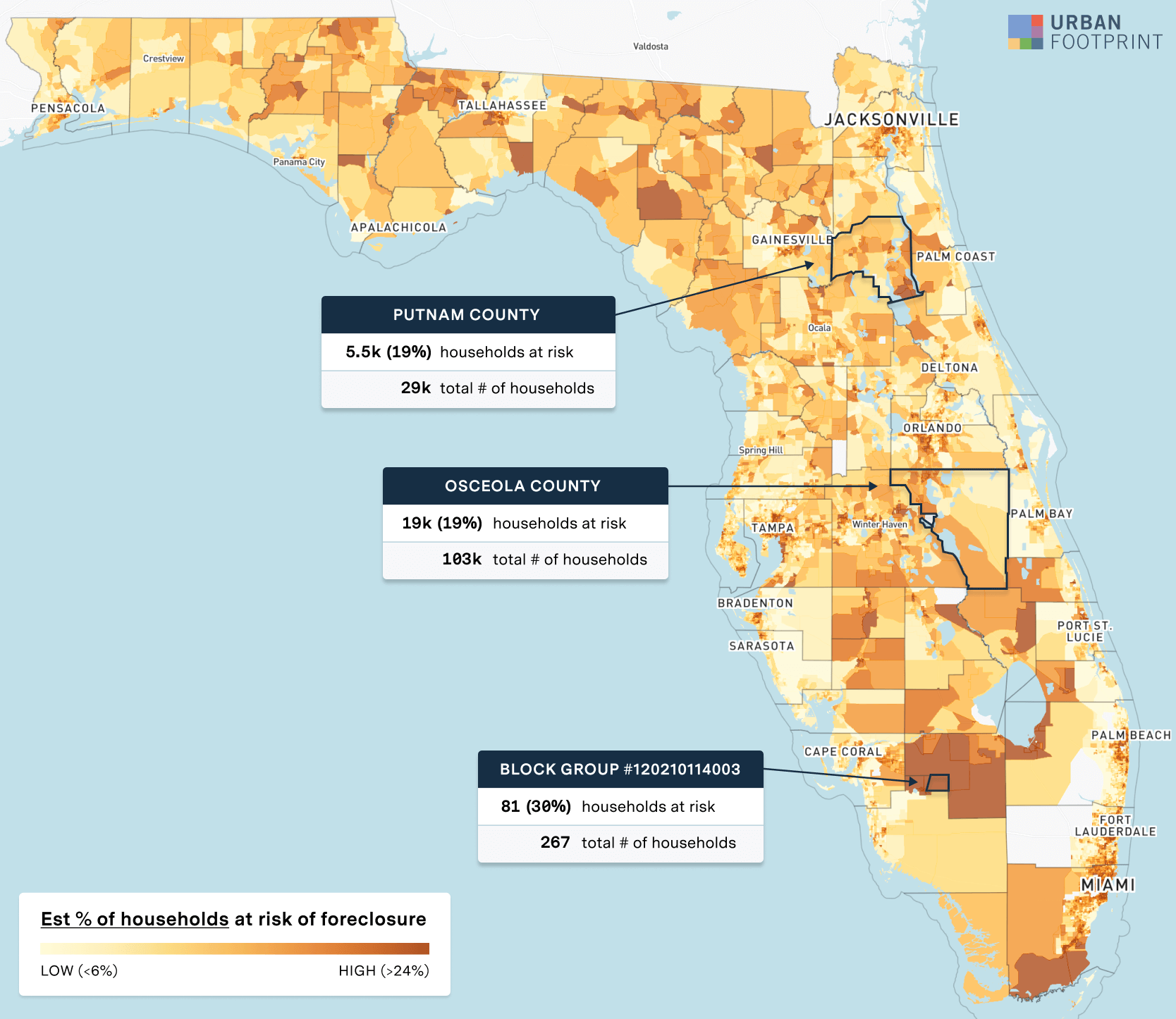

Foreclosure risk on the rise

The pandemic triggered the largest real estate boom of the 21st century, driven in part by investor buyers that priced out first-time and local purchasers, as well as shifts in working environments. In some instances, those investors used mass evictions to drive up rents, while in others high wage workers who moved to rural areas priced out local salary earners.

For those who were able to purchase a home, inflation has since reached its highest point since 1981, which cuts into one’s ability to budget between everyday necessities and their mortgage payment. With the expiration of housing protection measures, and families adjusting to post-pandemic price hikes, mortgage foreclosure rates in Q1 of 2022 were up 132% from the previous year.

Housing, the economy, and community resilience

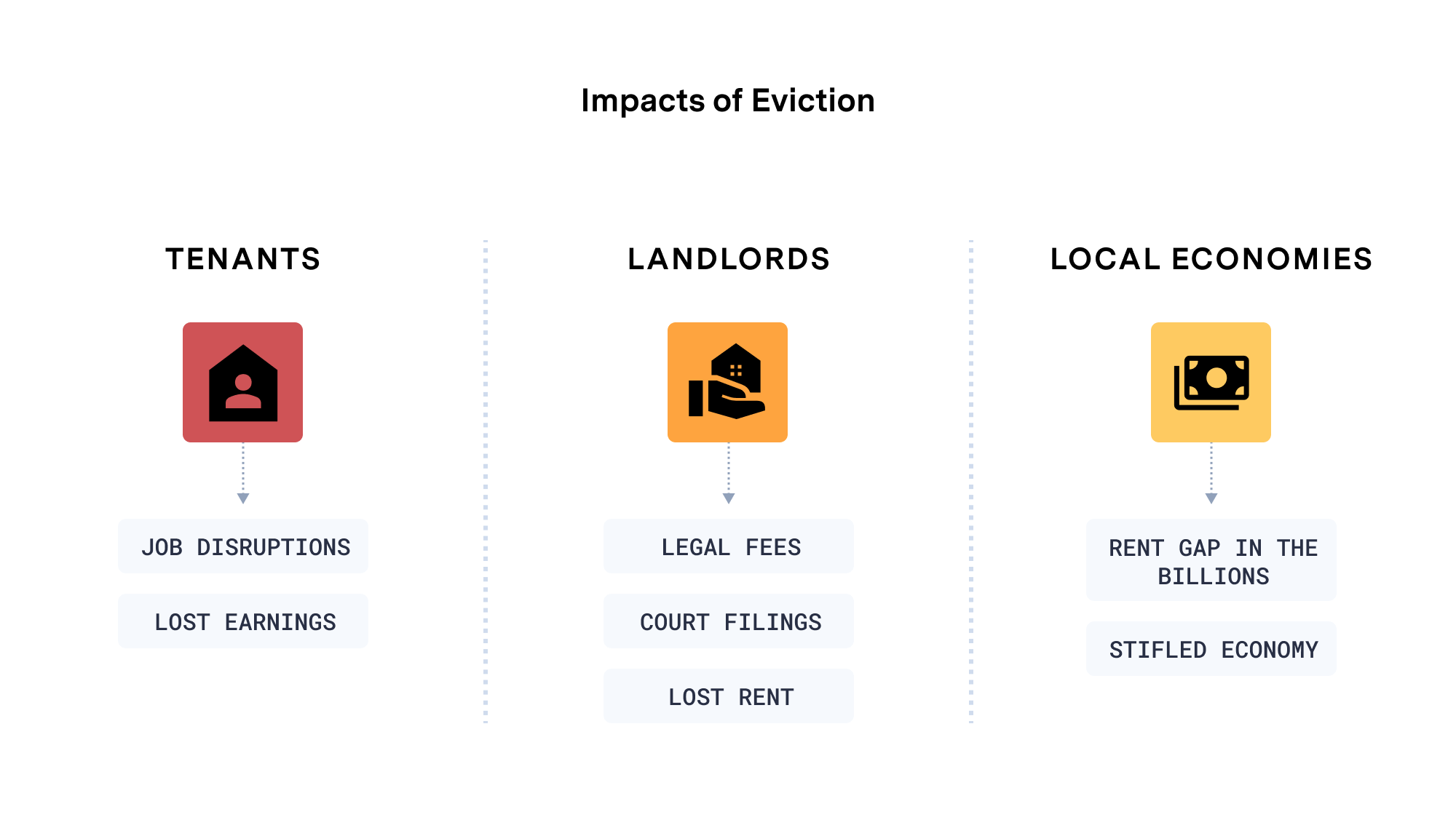

Evictions and foreclosures are deeply personal experiences. The long term effects can include adverse birth outcomes, poorer child health, and depression. Displaced families are also more likely to experience food insecurity and lower educational outcomes.

As a whole, these consequences, especially where eviction and foreclosure rates are concentrated, reverberate throughout a community—costing everyone.

Thus, stopping evictions during the pandemic was a way to protect public health, as well as improve financial health. As we move into a post-pandemic world, this is a valuable reminder that assistance programs preventing evictions ultimately save cities money and bolster local economies.

What can governments and their partners do?

Improving community resilience includes household stability. The question is, how can agencies get resources to people in need in a highly dynamic social environment and changing labor markets?

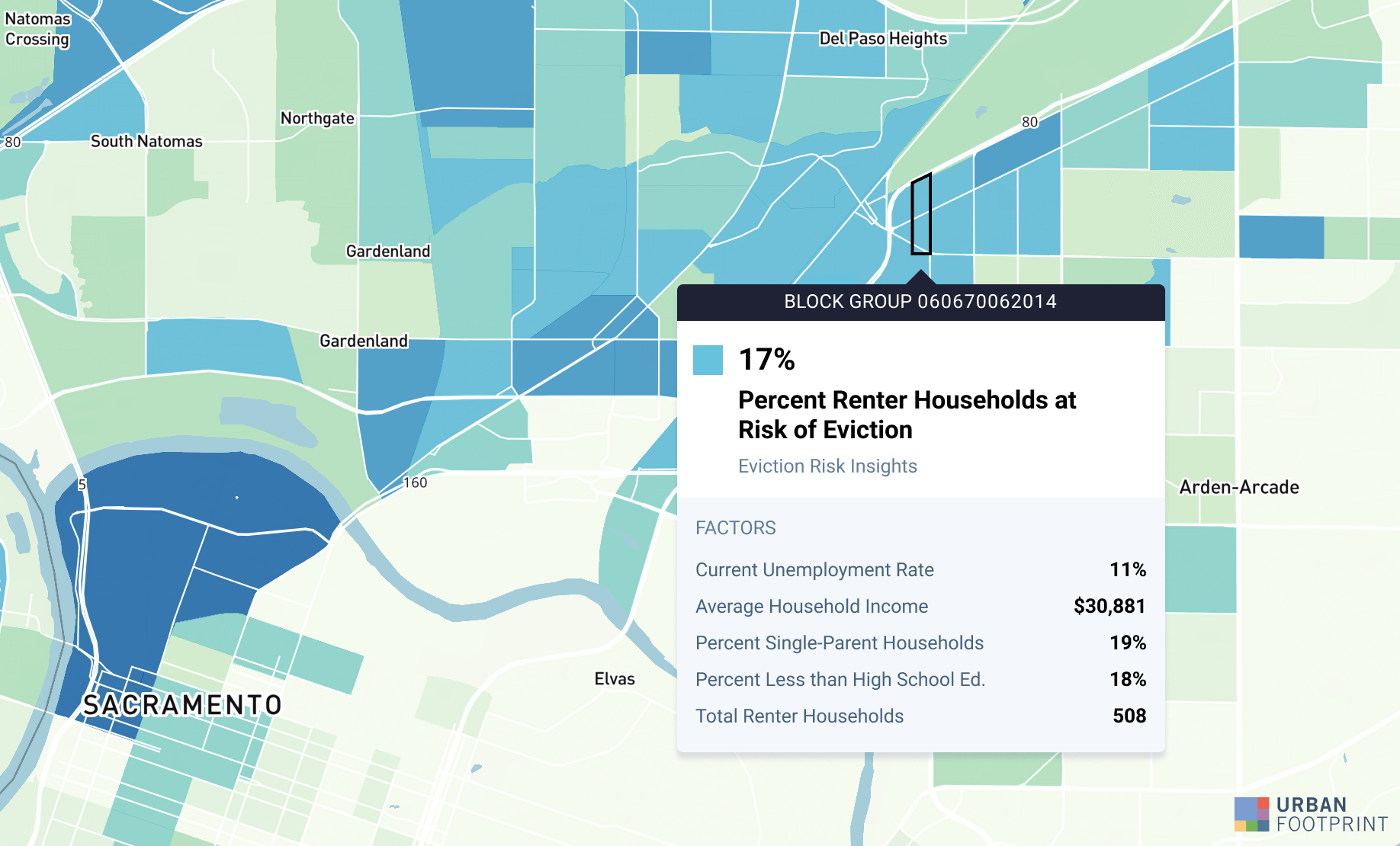

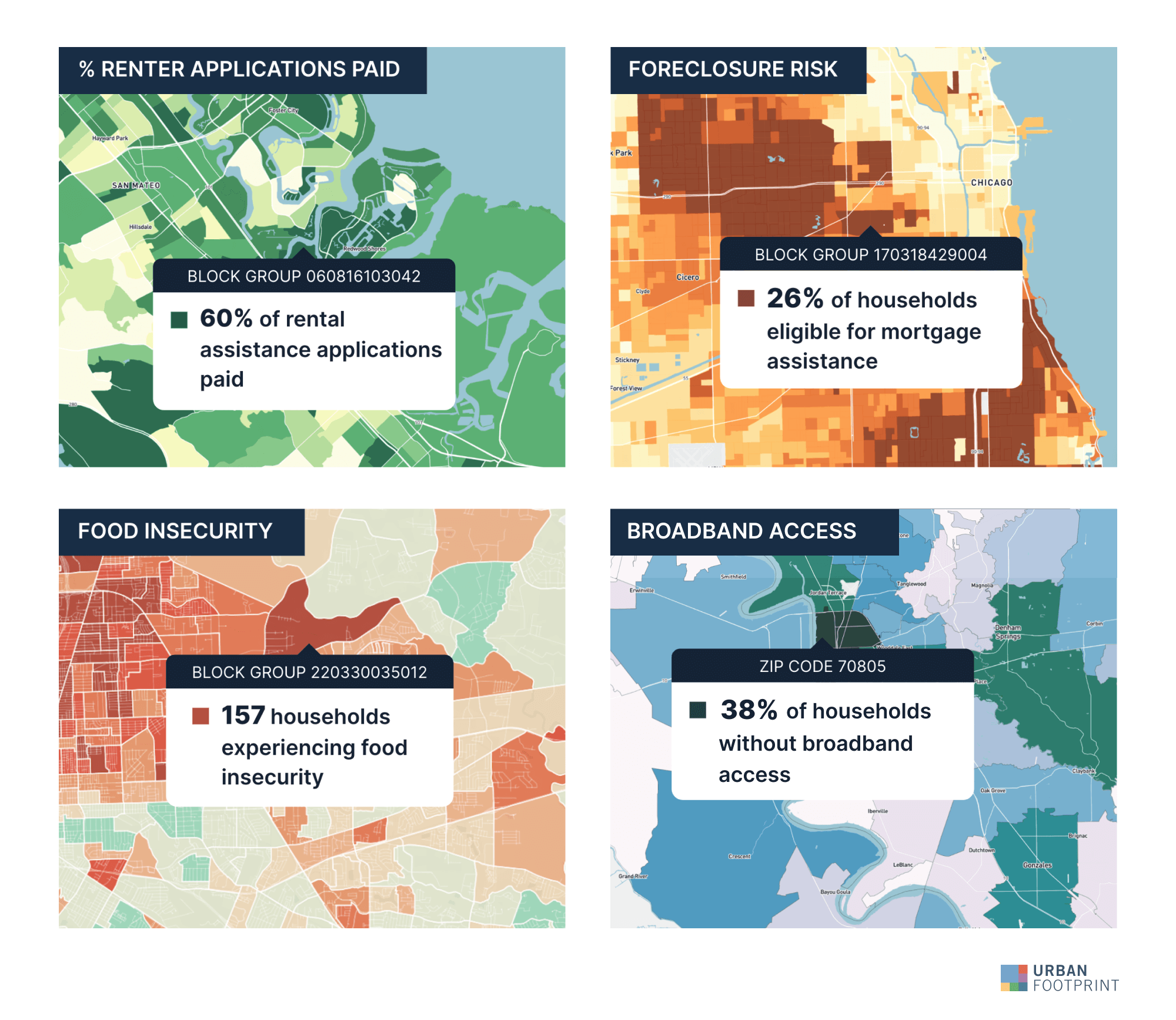

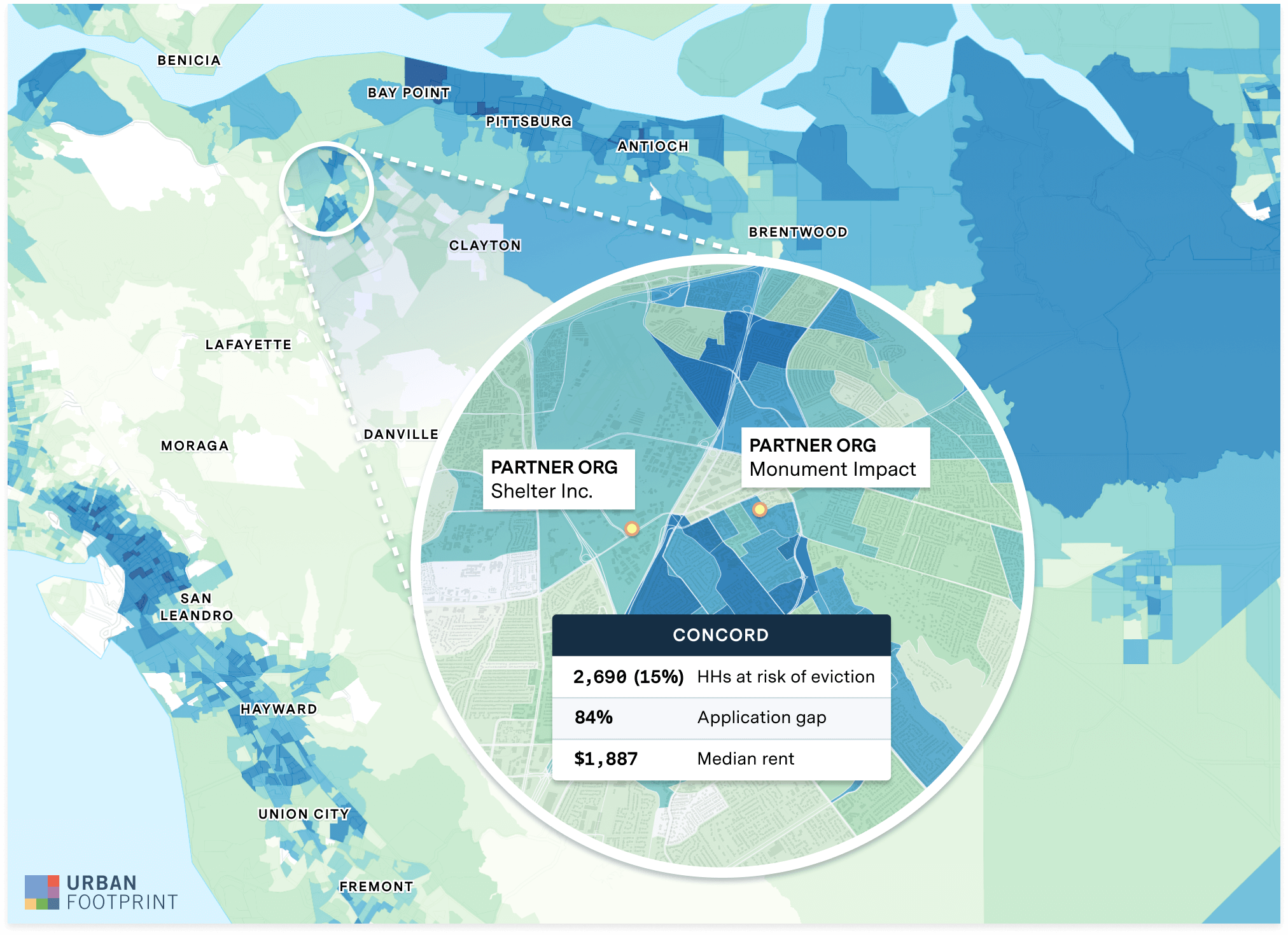

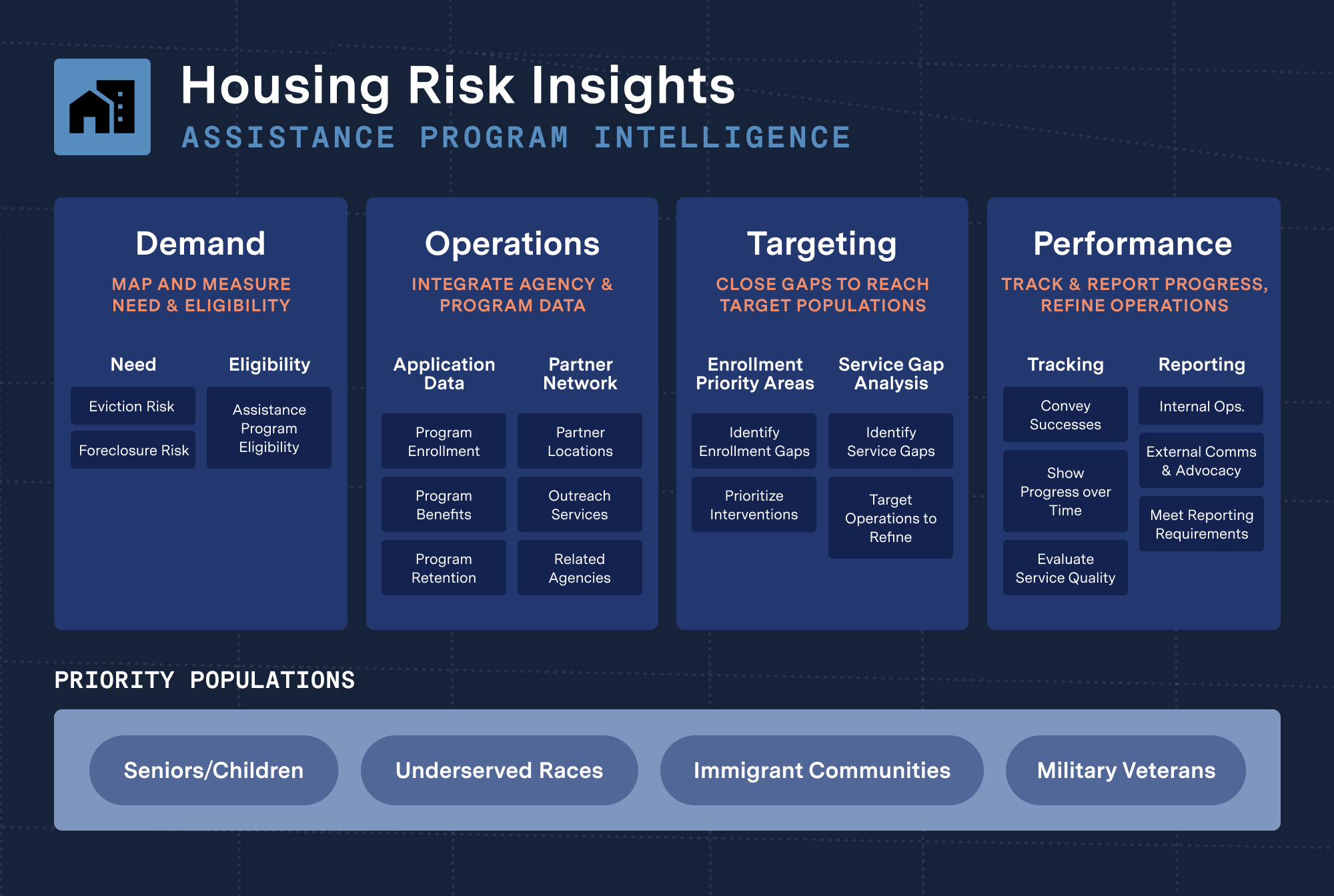

UrbanFootprint provides up-to-date data insights to identify areas with high concentrations of at-risk populations and estimate additional hardships such as possible food insecurity, and partners with other platforms to track public health and environmental metrics such as air quality. The UrbanFootprint platform provides community resilience, economic and demographic data at the census block level to provide stakeholders with granular, actionable insights.

With this curated data from authoritative, yet heterogeneous sources, governments and outreach organizations can:

- Quantify the gap between applications and individuals served by rental and foreclosure assistance programs

- Hyper-target efforts to aid those most in need through frequent data updates

- Chart and convey progress to stakeholders through detailed maps and dashboards

- Accurately report on, assess, and improve operations

After two years of global disruptions, housing is an area where continuity is critical. For governments and their constituents, closing this assistance gap can prevent evictions and foreclosures, and have a net-positive effect for local economies.

About UrbanFootprint

Never Wonder Where – UrbanFootprint enables companies, governments, and their community partners to cut through the noise to make high-impact decisions leveraging targeted, actionable data and location analytics. Assess risk, understand markets, close assistance gaps, and make better decisions with the most powerful and comprehensive urban, climate, and community resilience data platform available, anywhere.